Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corporation is an equity-financed company without debt. The number of its shares is 10,000. You own 1,000 shares of the company. In one

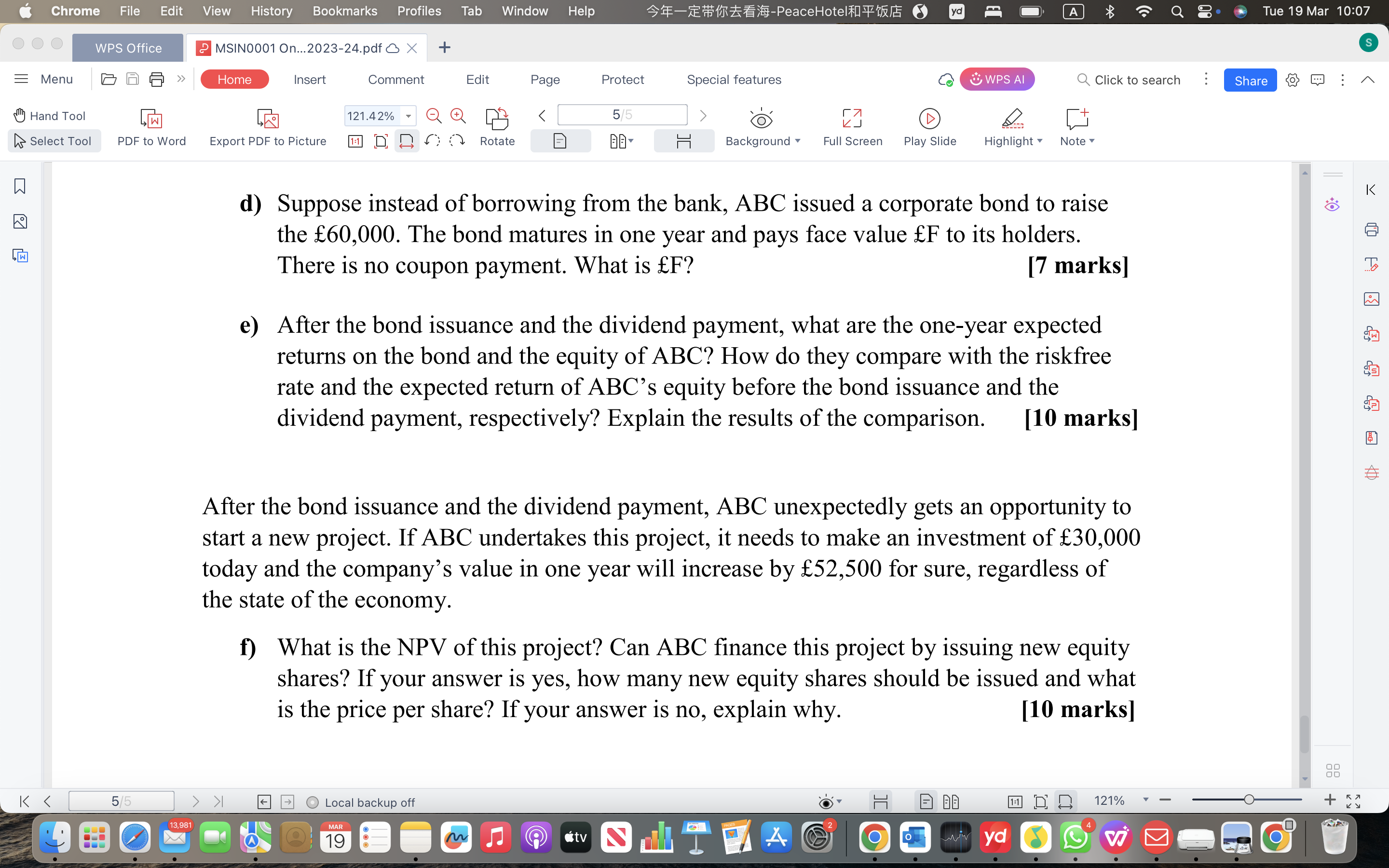

ABC Corporation is an equity-financed company without debt. The number of its shares is 10,000. You own 1,000 shares of the company. In one year, the economy can be Good or Bad for equal probabilities, 50%. The business will be worth 160,000 in the Good economy and 40,000 in the Bad economy. The risk-free interest rate is 5%. The risk premium of the business is 20%. The financial market is competitive and there is no tax. a) Suppose you have no cash in hand today but needs to spend 6,400 to pay a bill today. You are considering selling some of your shares to pay the 6,400 bill. How many shares do you need to sell? [5 marks] b) Calculate the prices of the Arrow securities of the Good economy and the Bad economy. [6 marks] Suppose you haven't sold your shares to raise the 6,400. ABC announces that it just borrowed 60.000 from a bank and paid the 60.000 to shareholders as dividend today. Note Tue 19 Mar 10:07 Chrome File Edit View History Bookmarks Profiles Tab Window Help -PeaceHotel yd A WPS Office PMSIN0001 On...2023-24.pdf + = Menu Home Insert Comment Edit Page Protect Special features * WPS AI QClick to search Share Hand Tool 121.42% 4/5 W KJ ( Select Tool PDF to Word Export PDF to Picture 1:1 D SECTION D. Rotate Background Full Screen Play Slide Highlight Note K < This section consists of ONE (1) compulsory question. Candidates should attempt ALL parts of the question. This section is worth TWENTY-FOUR (24) marks. XYZ Corporation has 100 million shares outstanding and no debt. The current market price of the shares is 5 per share. The market believes that XYZ's assets are generating stable earnings for ever. The corporate tax rate is 30%. XYZ just made an announcement of borrowing 200 million by issuing perpetual bonds and using the 200 million to repurchase the shares. Both the bond issuance and share repurchase occur today. Assume that the bonds are riskfree and the capital markets are competitive. 4/5 13,981 a) What is the market price of XYZ's shares right after the announcement but before the issuance of the bonds? [7 marks] b) What is the value of XYZ's equity right after the repurchase of the shares? [5 marks] c) How many shares are repurchased? [12 marks] > > Local backup off MAR 19 tv N A I 11 D D 121% 4 BB yd Vi S K T A 00 + Chrome File Edit View History Bookmarks Profiles Tab Window Help -PeaceHotel yd A Tue 19 Mar 10:07 = Menu WPS Office MSIN0001 On...2023-24.pdf x + Home Insert Comment Edit Page Protect Special features * WPS AI QClick to search Share Hand Tool 121.42% 5/5 W KJ ( Select Tool PDF to Word Export PDF to Picture 1:1 D Rotate Background Full Screen Play Slide Highlight Note SECTION C: This section consists of ONE (1) compulsory question. Candidates should attempt ALL parts of the question. This section is worth FORTY-FOUR (44) marks. ABC Corporation is an equity-financed company without debt. The number of its shares is 10,000. You own 1,000 shares of the company. In one year, the economy can be Good or Bad for equal probabilities, 50%. The business will be worth 160,000 in the Good economy and 40,000 in the Bad economy. The risk-free interest rate is 5%. The risk premium of the business is 20%. The financial market is competitive and there is no tax. a) Suppose you have no cash in hand today but needs to spend 6,400 to pay a bill today. You are considering selling some of your shares to pay the 6,400 bill. How many shares do you need to sell? K < 5/5 [5 marks] b) Calculate the prices of the Arrow securities of the Good economy and the Bad economy. [6 marks] B BB 11 D D yd 121% 4 Vi Suppose you haven't sold your shares to raise the 6,400. ABC announces that it just borrowed 60,000 from a bank and paid the 60,000 to shareholders as dividend today. Note > > 13,981 Local backup off MAR 19 tv N A S K T A 00 + Chrome File Edit View History Bookmarks Profiles Tab Window Help -PeaceHotel yd A Tue 19 Mar 10:07 = Menu WPS Office MSIN0001 On...2023-24.pdf x + Home Insert Comment Edit Page Protect Special features * WPS AI QClick to search Share Hand Tool 121.42% 5/5 W KJ ( Select Tool PDF to Word Export PDF to Picture 1:1 D Rotate Background Full Screen Play Slide Highlight Note economy. S [6 marks] Suppose you haven't sold your shares to raise the 6,400. ABC announces that it just borrowed 60,000 from a bank and paid the 60,000 to shareholders as dividend today. Note that your dividend = * ABC's total dividend payment. number of your shares number of total shares c) How much dividend do you receive? Is it enough to pay your 6,400 bill? If not, how many ABC's shares do you need to sell so that you just have enough cash to pay the bill? [6 marks] d) Suppose instead of borrowing from the bank, ABC issued a corporate bond to raise the 60,000. The bond matures in one year and pays face value F to its holders. There is no coupon payment. What is F? [7 marks] e) After the bond issuance and the dividend payment, what are the one-year expected returns on the bond and the equity of ABC? How do they compare with the riskfree rate and the expected return of ABC's equity before the bond issuance and the dividend payment, respectively? Explain the results of the comparison. [10 marks] K T A K < 5/5 13,981 After the bond issuance and the dividend navment ABC unexpectedly gets an opportunity to > > Local backup off MAR 19 tv N A OD 00 1:1 DB 121% + yd Vi 4 Tue 19 Mar 10:07 Chrome File Edit View History Bookmarks Profiles Tab Window Help -PeaceHotel yd A WPS Office MSIN0001 On...2023-24.pdf x + = Menu Home Insert Comment Edit Page Protect Special features * WPS AI QClick to search Share Hand Tool 121.42% W Select Tool PDF to Word Export PDF to Picture 1:1 5/5 KJ ( Rotate Background Full Screen Play Slide Highlight Note K < d) Suppose instead of borrowing from the bank, ABC issued a corporate bond to raise the 60,000. The bond matures in one year and pays face value F to its holders. There is no coupon payment. What is F? [7 marks] e) After the bond issuance and the dividend payment, what are the one-year expected returns on the bond and the equity of ABC? How do they compare with the riskfree rate and the expected return of ABC's equity before the bond issuance and the dividend payment, respectively? Explain the results of the comparison. [10 marks] After the bond issuance and the dividend payment, ABC unexpectedly gets an opportunity to start a new project. If ABC undertakes this project, it needs to make an investment of 30,000 today and the company's value in one year will increase by 52,500 for sure, regardless of the state of the economy. f) What is the NPV of this project? Can ABC finance this project by issuing new equity shares? If your answer is yes, how many new equity shares should be issued and what is the price per share? If your answer is no, explain why. [10 marks] 5/5 13,981 > > Local backup off MAR 19 tv A S K T A 00 11 D D 121% + 4 Vi BB yd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started