Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Properties Limited helps prospective homeowners of substantial means to find low-cost financing and assists existing homeowners in refinancing their current loans at lower interest

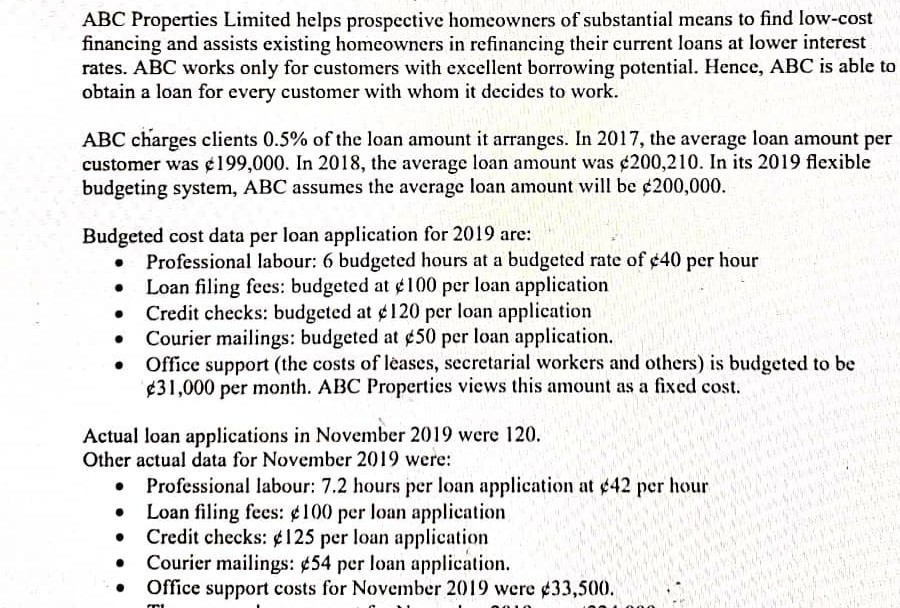

ABC Properties Limited helps prospective homeowners of substantial means to find low-cost financing and assists existing homeowners in refinancing their current loans at lower interest rates. ABC works only for customers with excellent borrowing potential. Hence, ABC is able to obtain a loan for every customer with whom it decides to work. ABC charges clients 0.5% of the loan amount it arranges. In 2017, the average loan amount per customer was 199,000. In 2018, the average loan amount was $200,210. In its 2019 flexible budgeting system, ABC assumes the average loan amount will be 200,000. Budgeted cost data per loan application for 2019 are: Professional labour: 6 budgeted hours at a budgeted rate of $40 per hour Loan filing fees: budgeted at $100 per loan application Credit checks: budgeted at 120 per loan application Courier mailings: budgeted at 50 per loan application. Office support (the costs of leases, secretarial workers and others) is budgeted to be 31,000 per month. ABC Properties views this amount as a fixed cost. Actual loan applications in November 2019 were 120. Other actual data for November 2019 were: Professional labour: 7.2 hours per loan application at 442 per hour Loan filing fees: 100 per loan application Credit checks: 125 per loan application Courier mailings: 454 per loan application. Office support costs for November 2019 were $33,500. ABC Properties Limited helps prospective homeowners of substantial means to find low-cost financing and assists existing homeowners in refinancing their current loans at lower interest rates. ABC works only for customers with excellent borrowing potential. Hence, ABC is able to obtain a loan for every customer with whom it decides to work. ABC charges clients 0.5% of the loan amount it arranges. In 2017, the average loan amount per customer was 199,000. In 2018, the average loan amount was $200,210. In its 2019 flexible budgeting system, ABC assumes the average loan amount will be 200,000. Budgeted cost data per loan application for 2019 are: Professional labour: 6 budgeted hours at a budgeted rate of $40 per hour Loan filing fees: budgeted at $100 per loan application Credit checks: budgeted at 120 per loan application Courier mailings: budgeted at 50 per loan application. Office support (the costs of leases, secretarial workers and others) is budgeted to be 31,000 per month. ABC Properties views this amount as a fixed cost. Actual loan applications in November 2019 were 120. Other actual data for November 2019 were: Professional labour: 7.2 hours per loan application at 442 per hour Loan filing fees: 100 per loan application Credit checks: 125 per loan application Courier mailings: 454 per loan application. Office support costs for November 2019 were $33,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started