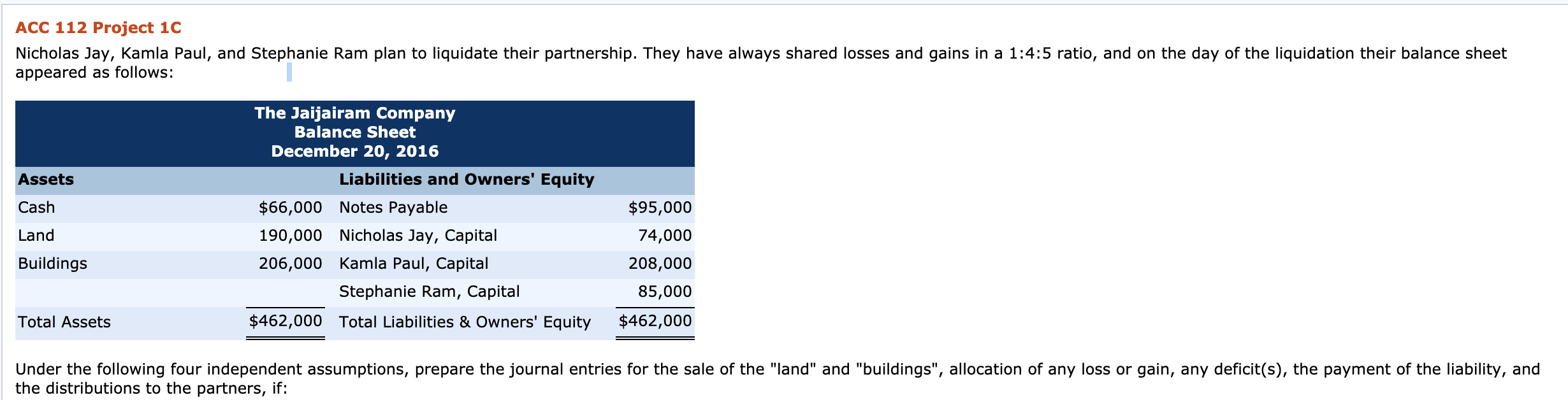

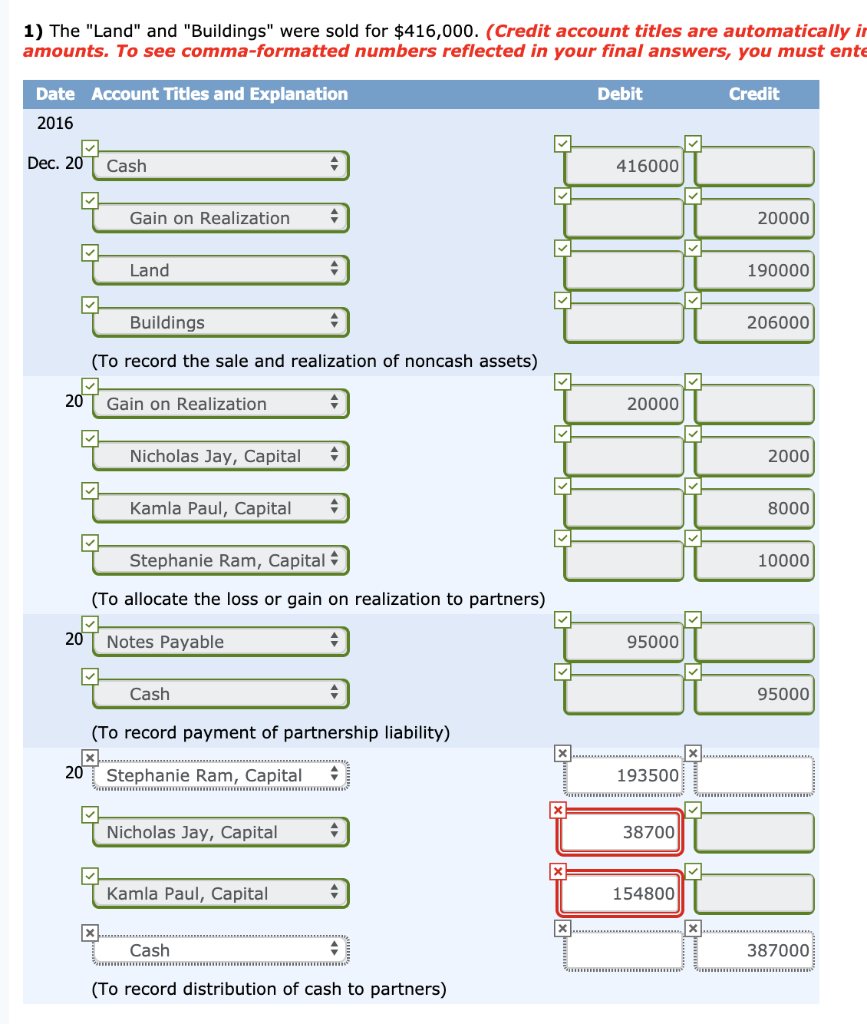

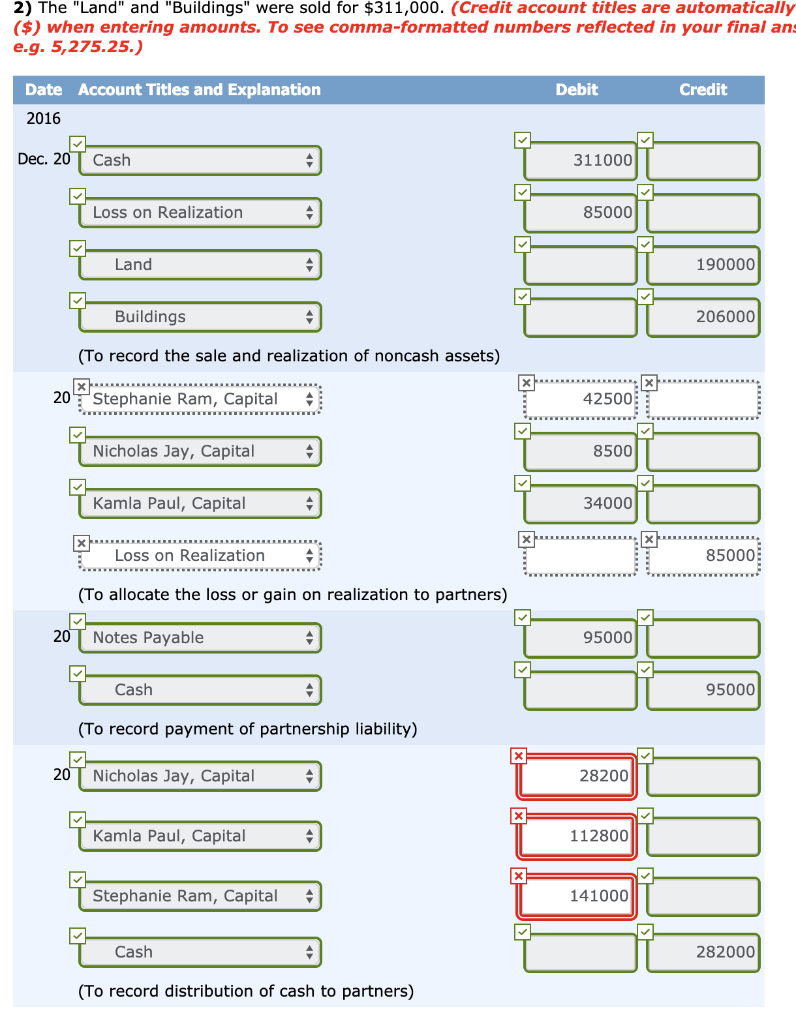

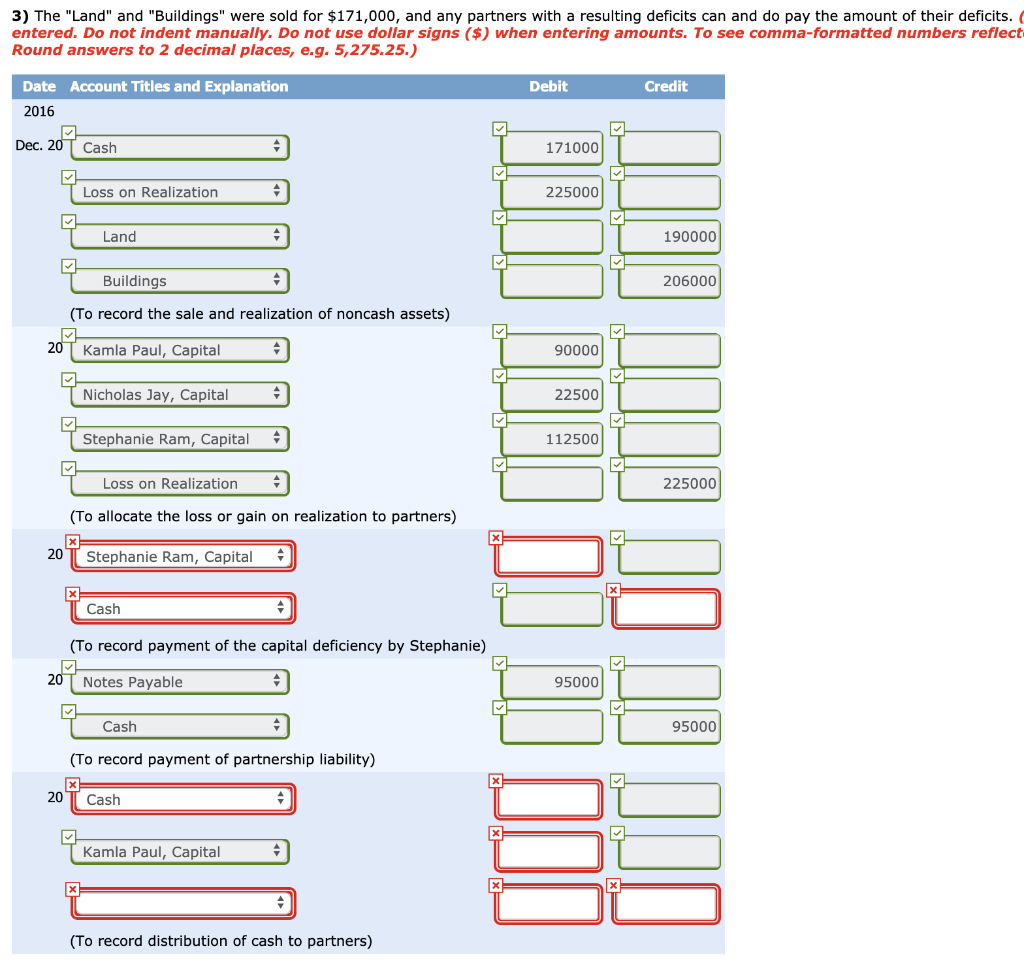

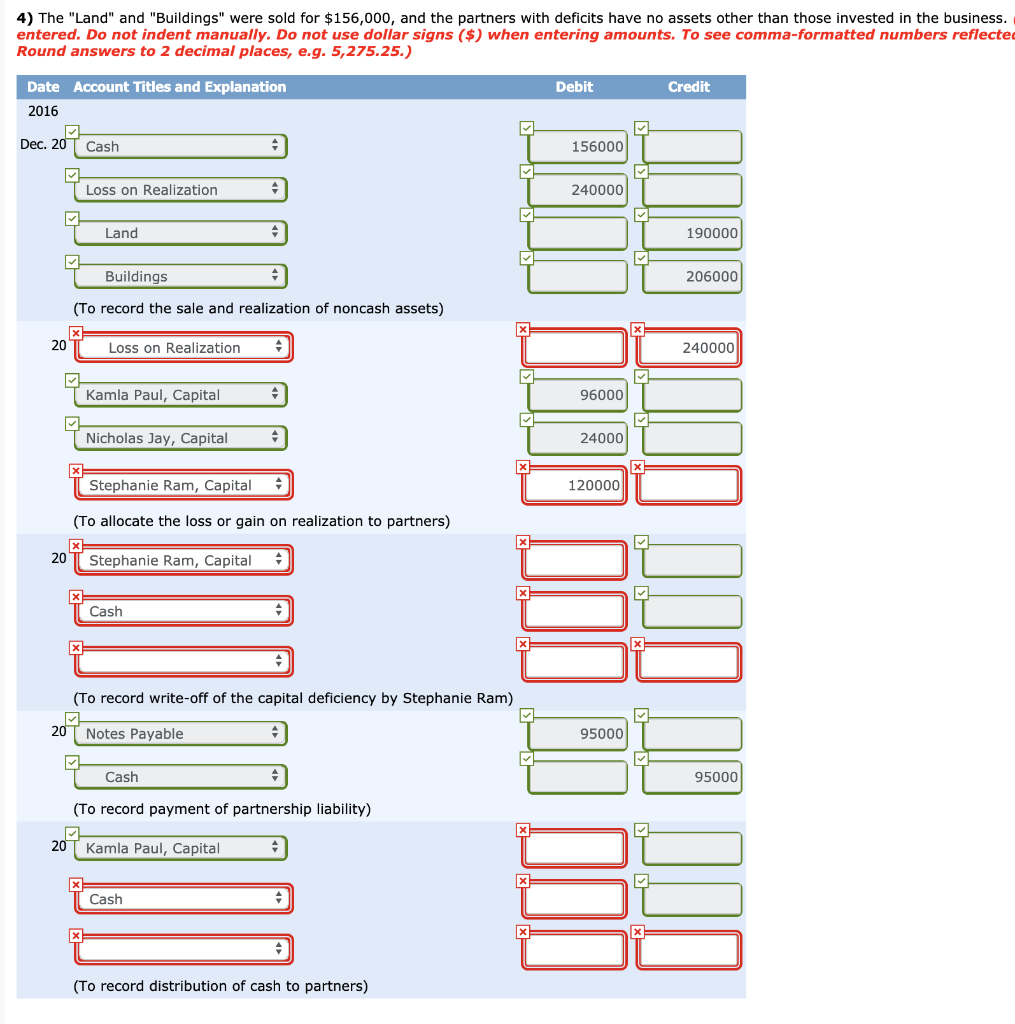

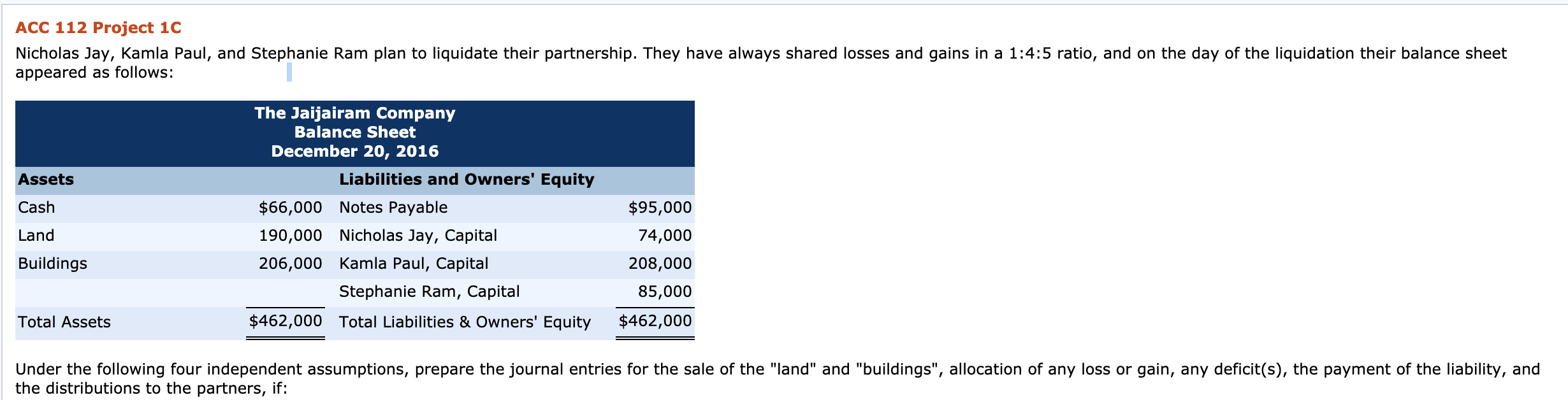

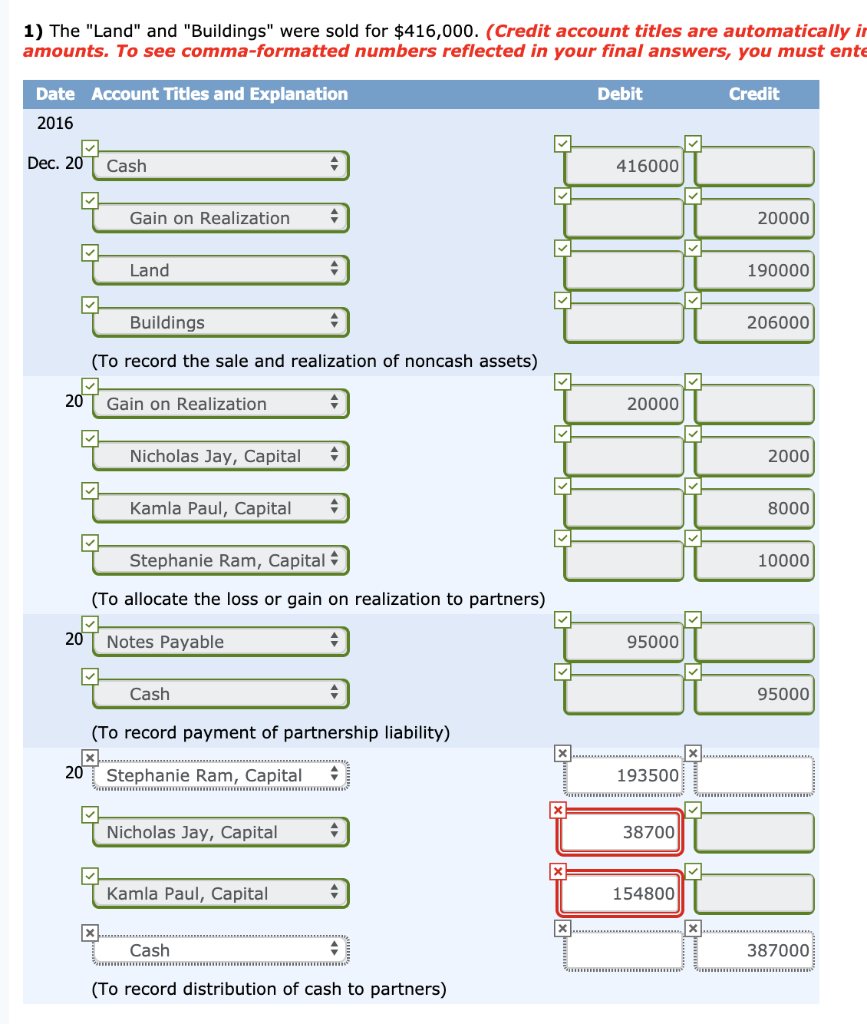

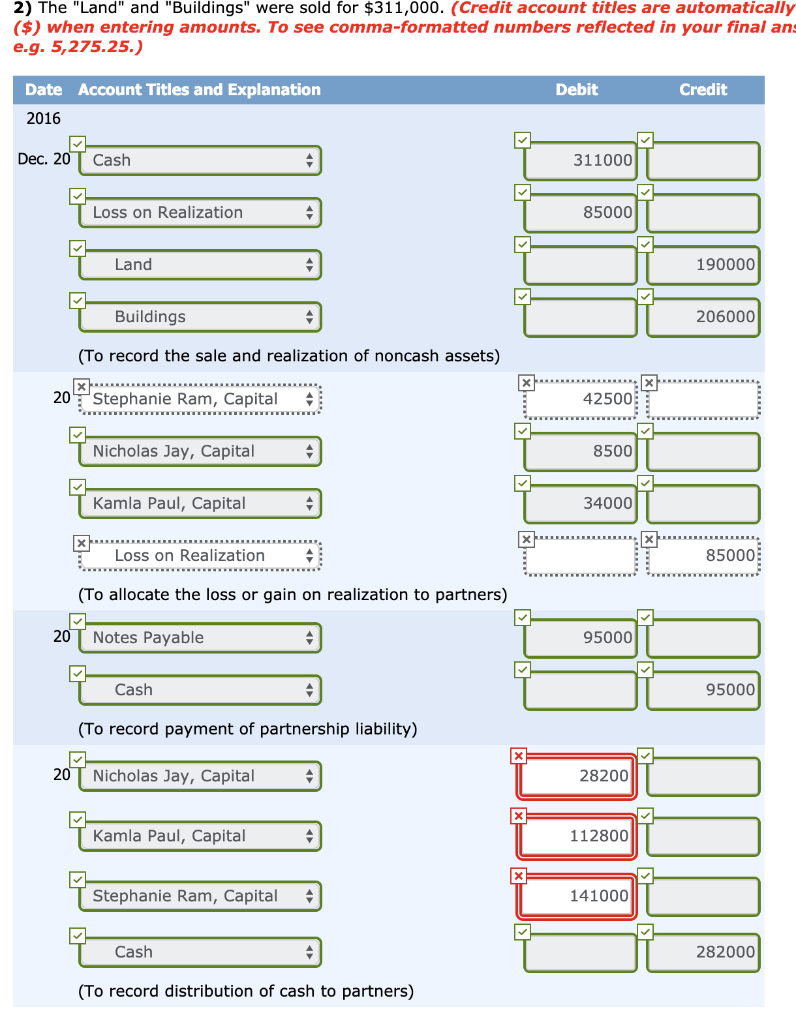

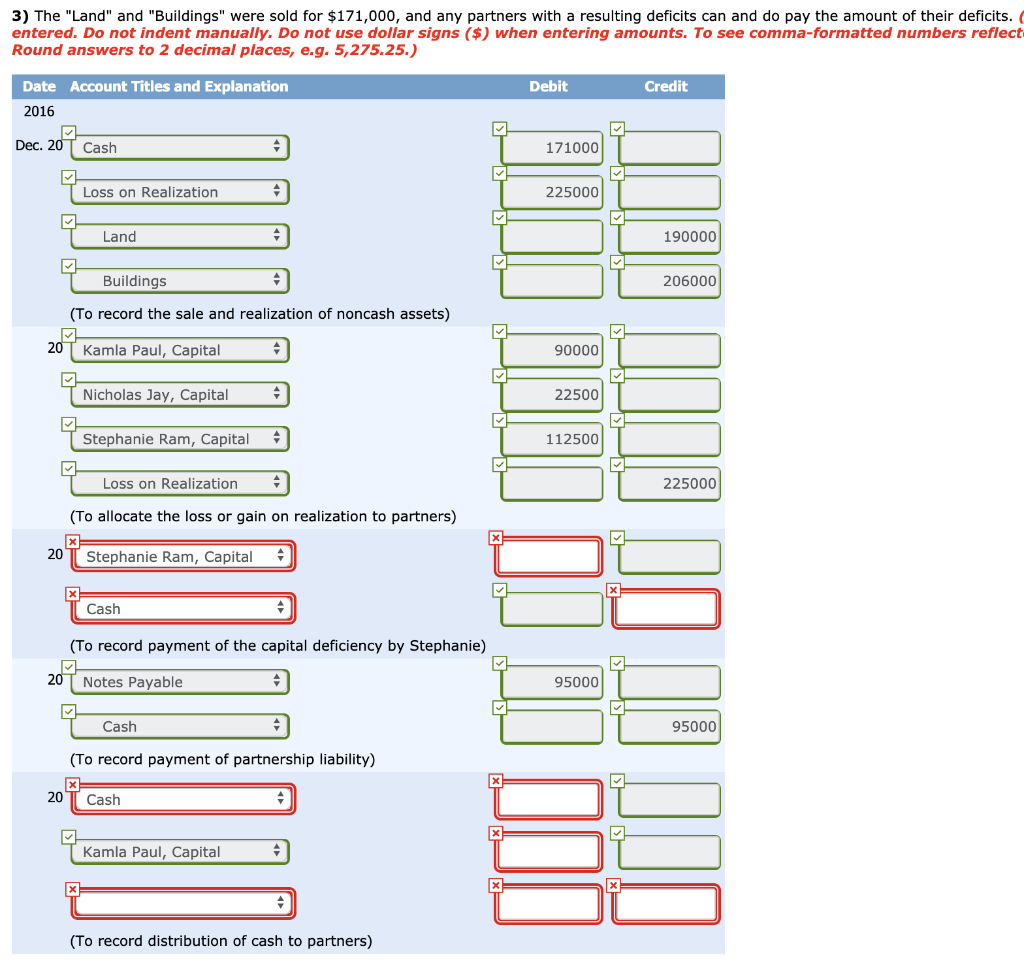

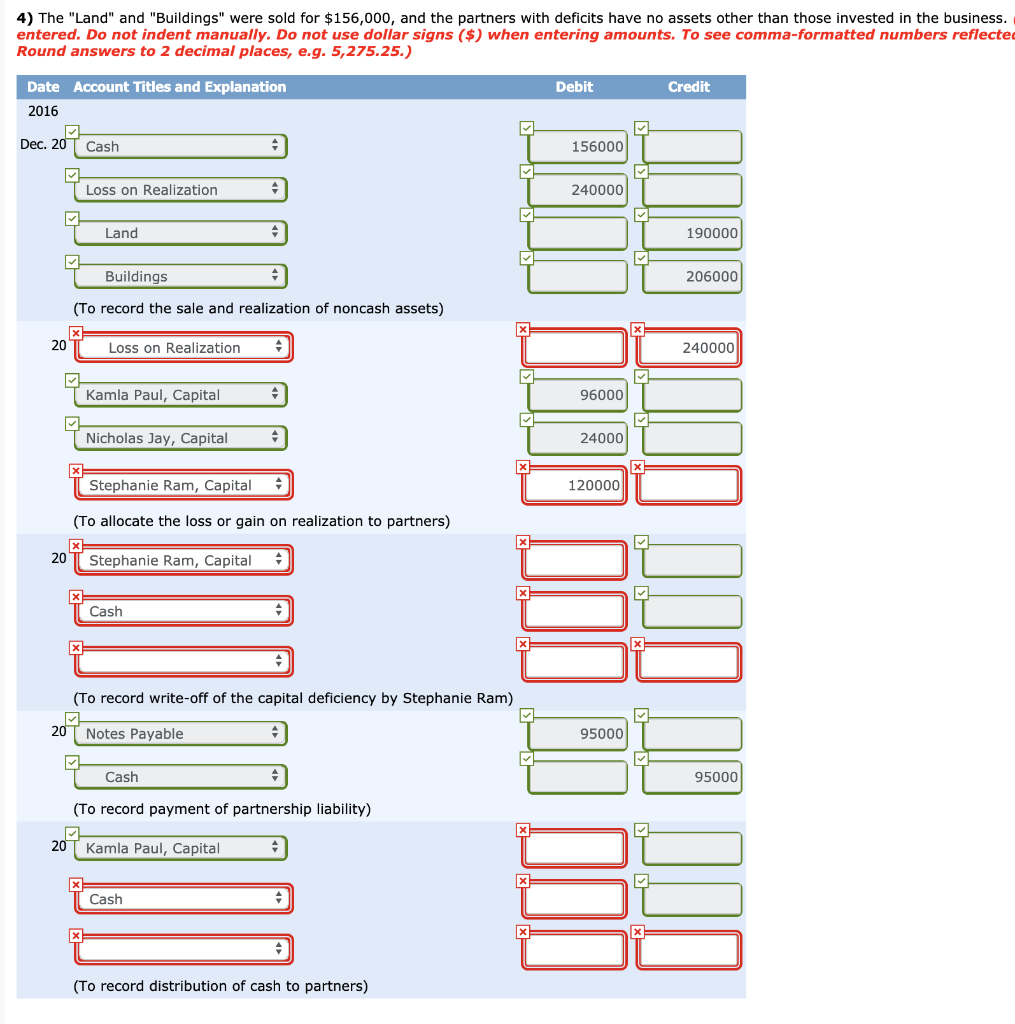

ACC 112 Project 10 Nicholas Jay, Kamla Paul, and Stephanie Ram plan to liquidate their partnership. They have always shared losses and gains in a 1:4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: The Jaijairam Company Balance Sheet December 20, 2016 Assets Cash Land Liabilities and Owners' Equity $66,000 Notes Payable 190,000 Nicholas Jay, Capital 206,000 Kamla Paul, Capital Stephanie Ram, Capital $462,000 Total Liabilities & Owners' Equity Buildings $95,000 74,000 208,000 85,000 $462,000 Total Assets Under the following four independent assumptions, prepare the journal entries for the sale of the "land" and "buildings", allocation of any loss or gain, any deficit(s), the payment of the liability, and the distributions to the partners, if: 1) The "Land" and "Buildings" were sold for $416,000. (Credit account titles are automatically in amounts. To see comma-formatted numbers reflected in your final answers, you must ente Debit Credit Date Account Titles and Explanation 2016 Dec. 20 T Cash 6000 Gain on Realization - 20000 land 190000 T Buildings 206000 (To record the sale and realization of noncash assets) 20 T Gain on Realization - 20000 1 Nicholas Jay, Capital 2000 Kamla Paul, Capital 8000 Stephanie Ram, Capital 10000 (To allocate the loss or gain on realization to partners) 20T Notes Payable 95000 [ Cash 95000 (To record payment of partnership liability) 20 Stephanie Ram, Capital - 193500 Nicholas Jay, Capital 38700 Kamla Paul, Capital 154800 Cash 387000 TER R IERIIIIIIIIIIIIIIIIIII (To record distribution of cash to partners) 2) The "Land" and "Buildings" were sold for $311,000. (Credit account titles are automatically ($) when entering amounts. To see comma-formatted numbers reflected in your final an e.g. 5,275.25.) Date Account Titles and Explanation 2016 Debit Credit Dec. 20 T Cash 311000 TLoss on Realization 85000 * Land 190000 Buildings 206000 (To record the sale and realization of noncash assets) 20 Stephanie Ram, Capital - 42500 T Nicholas Jay, Capital 8500 Kamla Paul, Capital 34000 Loss on Realization 85000 (To allocate the loss or gain on realization to partners) 1 95000 20 Notes Payable o cash 95000 (To record payment of partnership liability) 20T N ( Nicholas Jay, Capital 28200 Kamla Paul, Capital 112800 Stephanie Ram, Capital A 141000 Cash 282000 (To record distribution of cash to partners) 3) The "Land" and "Buildings" were sold for $171,000, and any partners with a resulting deficits can and do pay the amount of their deficits. entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflect Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 Dec. 20 T Cash 171000 Loss on Realization 225000 Land 190000 T Buildings 206000 (To record the sale and realization of noncash assets) 20 T Kamla Paul, Capital 90000 Nicholas Jay, Capital 22500 Stephanie Ram, Capital 112500 I Loss on Realization , 225000 (To allocate the loss or gain on realization to partners) 20 Stephanie Ram, Capital 9 cash (To record payment of the capital deficiency by Stephanie) 20 Notes Payable 95000 Cash 95000 (To record payment of partnership liability) x 20 Cash Kamla Paul, Capital (To record distribution of cash to partners) 4) The "Land" and "Buildings" were sold for $156,000, and the partners with deficits have no assets other than those invested in the business. entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected Round answers to 2 decimal places, e.g. 5,275.25.) Debit Credit Date Account Titles and Explanation 2016 Dec. 2017 Cash 156000 TLoss on Realization 240000 Land 190000 Buildings 206000 (To record the sale and realization of noncash assets) 20 1 Loss on Realization 240000 | Kamla Paul, Capital 96000 Nicholas Jay, Capital 24000 Stephanie Ram, Capital 120000 (To allocate the loss or gain on realization to partners) Stephanie Ram, Capital * Cash (To record write-off of the capital deficiency by Stephanie Ram) 20 Notes Payable A 95000 T Cash 95000 (To record payment of partnership liability) 20 T Kamla Paul, Capital Cash (To record distribution of cash to partners)