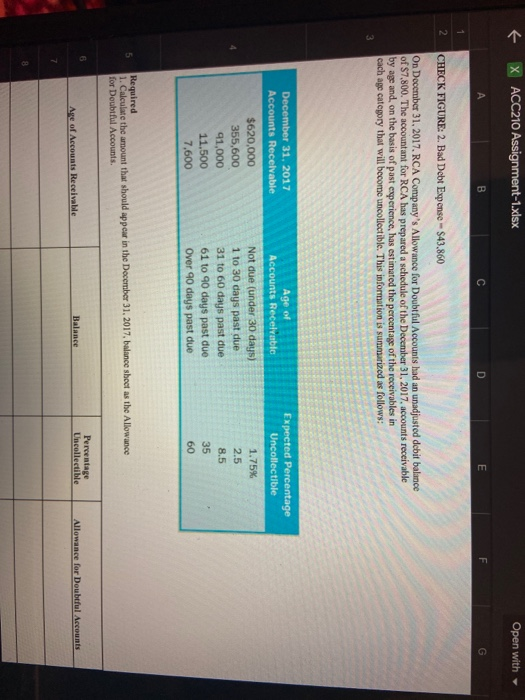

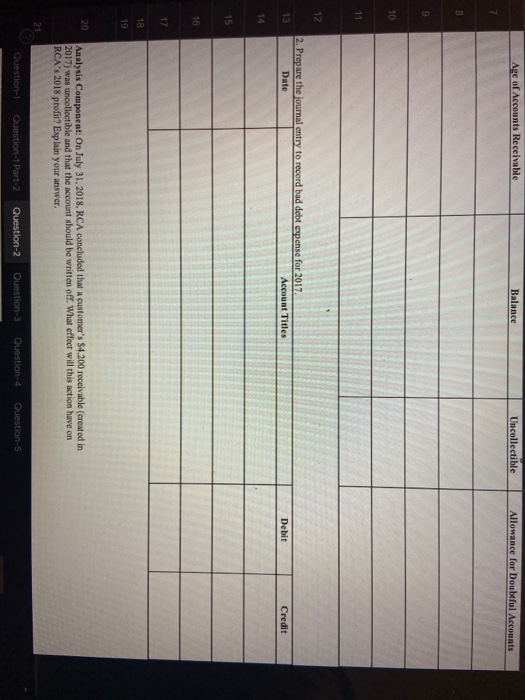

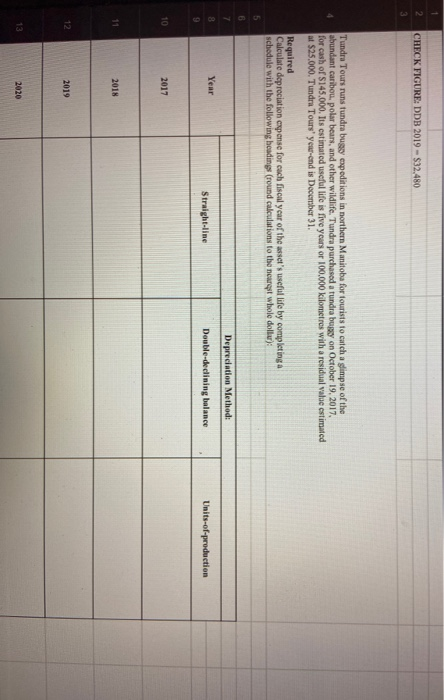

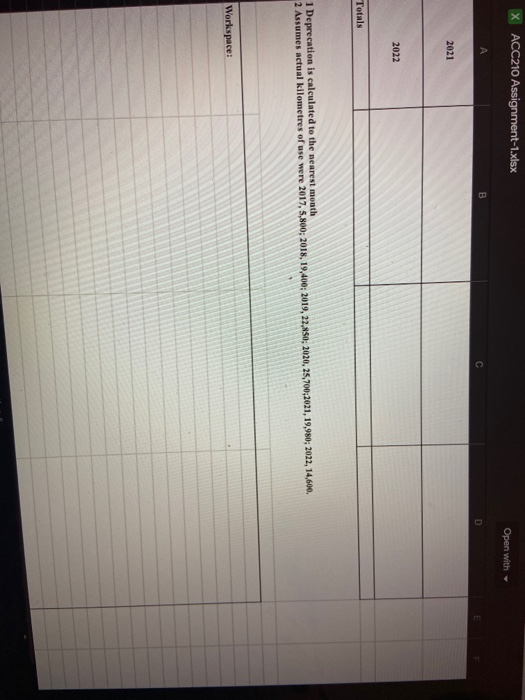

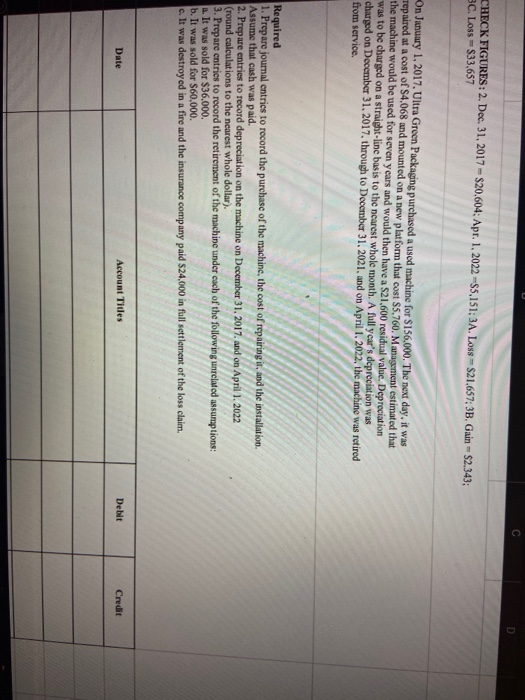

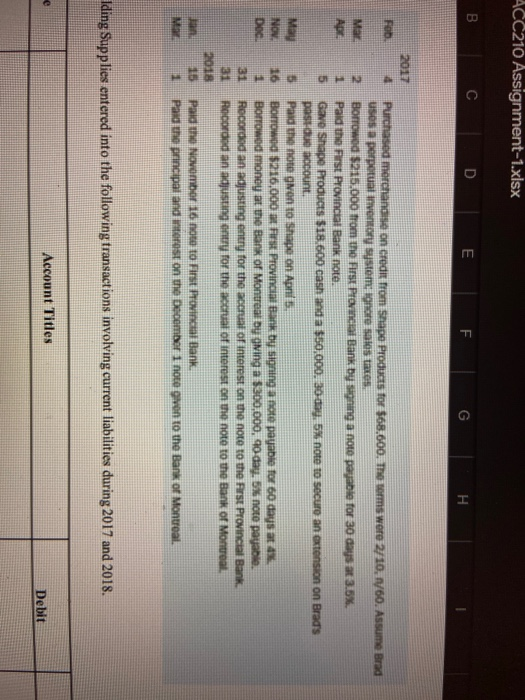

ACC210 Assignment-1.xlsx Open with B D E G 2 CHECK FIGURE: 2. Bad Debt Expense - $43.860 On December 31, 2017. RCA Company's Allowance for Doubtful Accounts had an unadjusted debit balance of $7.800. The accountant for RCA has prepared a schedule of the December 31, 2017, accounts receivable by age and, on the basis of past experience, has estimated the percentage of the receivables in cach age category that will become uncollectible. This information is summarized as follows: December 31, 2017 Accounts Receivable Age of Accounts Recelyable Expected Percentage Uncollectible $620,000 355,600 91,000 11.500 7,600 Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due 1.75% 2.5 8.5 35 60 Required 1. Calculate the amount that should appear in the December 31, 2017, balance sheet as the Allowance for Doubtful Accounts. Percentage Uncollectible Balance Age of Accounts Receivable Allowance for Doubtful Accounts Age of Accounts Receivable Balance Uncollectible Allowance for Doubtful Accounts 7 9 10 11 12 13 2. Prepare the journal entry to record bad debt expense for 2017. Date Account Titles Debit Credit 14 15 16 17 18 19 20 Analysis Component: On July 31, 2018 RCA concluded that a customer's $4,200 receivable (created in 2017) was uncollectible and that the account should be written off. What effect will this action have on RCA's 2018 profit? Explain your answer. 21 Question-1 Question-1 Part 2 Question-2 Question-3 Question-4 Question-5 2 CHECK FIGURE: DDB 2019 - $32.480 Tundra Tours runs tundra bugy expeditions in northern Manitoba for tourists to catch a glimpse of the abundant caribou, polar bears, and other wildlife. Tundra purchased a tundra buy on October 19, 2017 for cash of $145.000. Its estimated useful life is five years or 100.000 kilometros with a residual value estimated at $25.000. Tundra Tours' year-end is December 31. Required Calculate depreciation expense for cach fiscal year of the asset's useful life by completinga schedule with the following headings (round calculations to the nearest whole dolu): Depreciation Method: Year Straight-line Double-declining balance Units-of-production 10 2017 2018 12 2019 2020 ACC210 Assignment-1.xlsx Open with D 2021 2022 Totals 1 Deprecation is calculated to the nearest month 2 Assumes actual kilometres of use were 2017, 5,800; 2018, 19,400; 2019, 22,850, 2020, 25,700,2021, 19,980; 2022, 14,600. Workspace: D CHECK FIGURES: 2. Dec 31, 2017 = $20.604: Apr. 1, 2022 -$5,151: 3A. Loss $21.657; 3B. Gain = $2.343; BC. Loss = $33.657 On January 1, 2017. Ultra Green Packaging purchased a used machine for $156,000. The next day, it was repaired at a cost of $4.068 and mounted on a new platform that cost $5,760. Management estimated that the machine would be used for seven years and would then have a $21,600 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year's depreciation was charged on December 31, 2017, through to December 31, 2021, and on April 1.2022, the machine was retired from service. Required 1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid. 2. Prepare entries to record depreciation on the machine on December 31, 2017, and on April 1.2022 (round calculations to the nearest whole dollar). 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $36.000. b. It was sold for $60,000. c. It was destroyed in a fire and the insurance company paid $24,000 in full settlement of the loss claim. Date Account Titles Debit Credit ACC210 Assignment-1.xlsx B D E F. 2017 4 FOD, 2 Mar Apr. 1 5 Purchased merchandise on Credit from shape Products for $68.600. The terms were 2/10, 1/60. Assume Brad Usos perpetual inventory system: ignore sales taxes Borrowed $215.000 from the First Provincial Bank by signing a noto payable for 30 days at 3.5%. Pald the first Provincial Banknote. Gave Shape Products $18.600 cash and a $50,000. 30 day, 5% not to secure an extension on Brad's pastu account Paid the nove oven to Shape on Apni 5. Borrowed $216.000 m First Provincial Bank by signing a note payable for 60 days at 4% Borrowed money at the Bank of Montreal by aving a $300,000, 90 day, 5% noto payable Recorded an adjusting entry for the accruat of interest on the note to the First Provincial Bank Recorded an adjusting entry for the acciat of interest on the note to the Bank of Montreal May NOW DOC 5 16 1 31 31 2018 15 1 Paid Nomor 16 teto First Provincial Bank Paid the principal and interest on the December 1 note given to the Bank of Montreal. M Iding Supplies entered into the following transactions involving current liabilities during 2017 and 2018. Account Titles Debit A B c D umaiddinmaana Date Account Titles Debit Credit M Gmail YouTube Maps Ranjodh singh - Fin... k X ACC210 Assignment-1.xlsx A B Open with C D E 37 F H 38 Date Account Titles 39 Debit Credit 40 41 42 43 45 46 47 48 49 50