Answered step by step

Verified Expert Solution

Question

1 Approved Answer

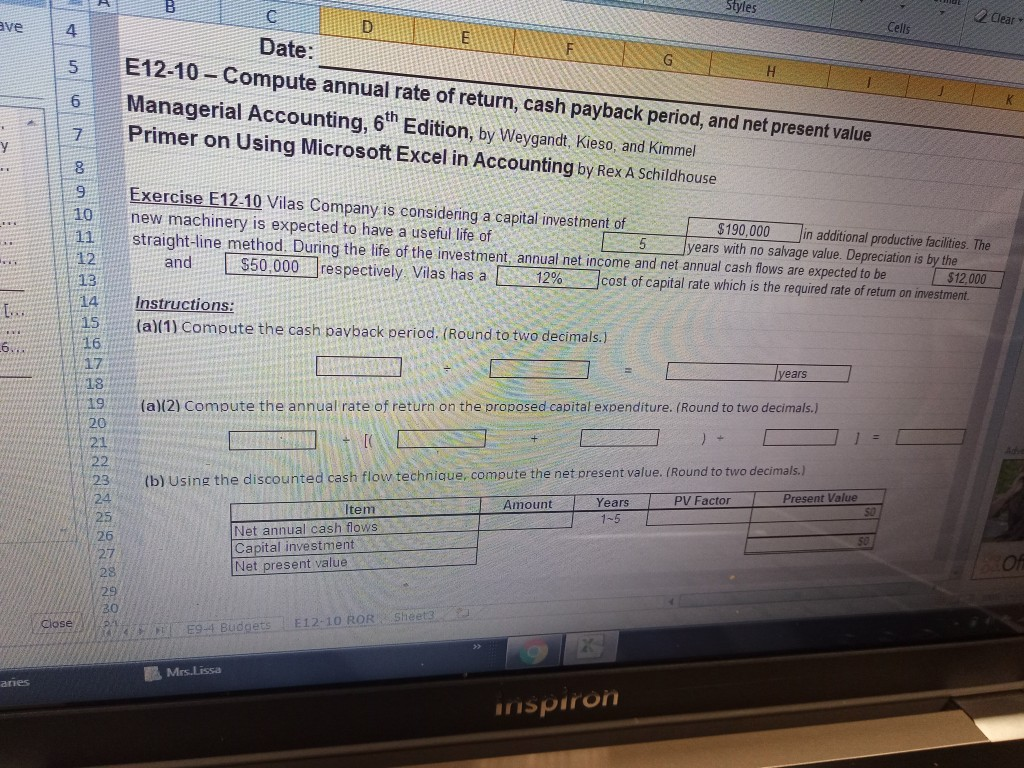

Acc217 home work Clear ave Cells Date: G E12-10-Compute annual rate of return, cash payback period, and net present value H J Managerial Accounting, 6

Acc217

home work

Clear ave Cells Date: G E12-10-Compute annual rate of return, cash payback period, and net present value H J Managerial Accounting, 6 Edition, by Weygandt. Kieso, and Kimmel Primer on Using Microsoft Excel in Accounting by Rex A Schildhouse 7 Exercise E12-10 Vilas Company is considering a capital investment of new machinery is expected to have a useful life of straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be 10 $190,000 years with no salvage value. Depreciation is by the in additional productive facilities. The 11 12 $50,000 and respectively Vilas has a 12% $12,000 cost of capital rate which is the required rate of return on investment 13 14 Instructions: (a)(1) Compute the cash pavback period. (Round to two decimals.) 15 16 6. 17 years 18 19 (a)(2) Compute the annual rate of return on the proposed capital expenditure. (Round to two decimals.) 20 1 = 21 22 (b) Using the discounted cash flow technique, compute the net present value. (Round to two decimals.) 23 Present Value 24 PV Factor Years Amount Item 25 1-5 Net annual cash flows Capital investment Net present value 26 27 28 29 30 E12-10 ROR Sheet3 Close E9-4 Budgets Mrs.Lissa aries nspironStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started