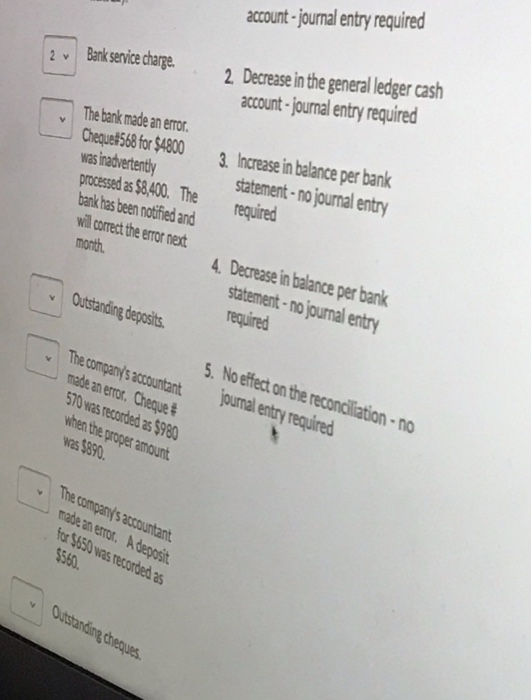

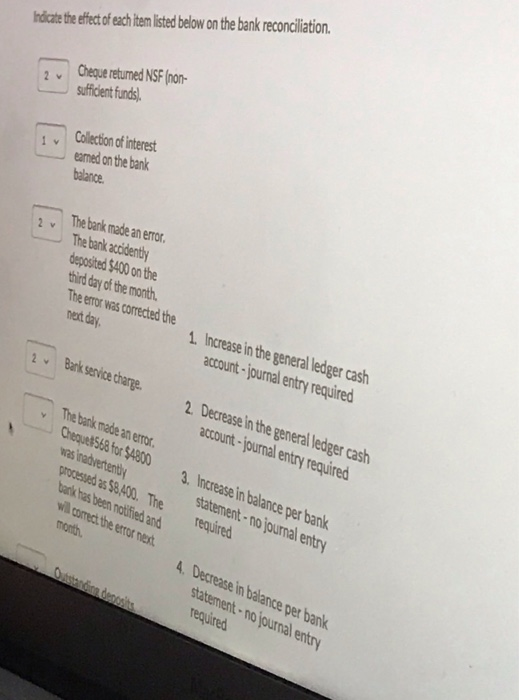

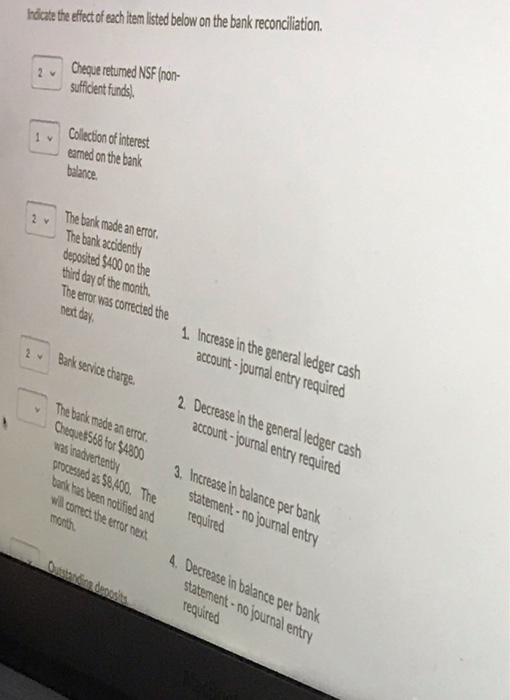

account - journal entry required 2 Bank service charge. 2. Decrease in the general ledger cash account - journal entry required The bank made an error Cheque#568 for $4800 was inadvertently processed as $8,400. The bank has been notified and will correct the error next month 3. Increase in balance per bank statement - no journal entry required 4. Decrease in balance per bank statement - no journal entry required Outstanding deposits. 5. No effect on the reconciliation - no The company's accountant journal entry required made an error. Chequet 570 was recorded as $980 when the proper amount was $890. The company's accountant made an emr. A deposit for $650 was recorded as $568. Outstanding cheques. Indicate the effect of each item listed below on the bank reconciliation. 2 Cheque returned NSF (non- sufficient funds). 1 Collection of interest eamed on the bank balance. 2 The bank made an error The bank accidently deposited $400 on the third day of the month. The error was corrected the next day 1. Increase in the general ledger cash account - journal entry required 2 Bark service charge 2. Decrease in the general ledger cash account - journal entry required The bank made an error Cheguet568 for $4800 3. Increase in balance per bank was inadvertently statement - no journal entry proud as 58200. The bank has been notified and required will come the mother month. ourabiandensis 4. Decrease in balance per bank statement - no journal entry required Indicate the effect of each item listed below on the bank reconciliation. Cheque returned NSF (non- sufficient funds) 1 Collection of interest eamed on the bank balance. 2 v The bank made an error The bank accidently deposited $400 on the third day of the month. The error was corrected the next day, 1. Increase in the general ledger cash account - journal entry required Bark service charge 2. Decrease in the general ledger cash account - journal entry required The bank made an error Cheque 568 for $4800 3. Increase in balance per bank was inadvertently statement- no journal entry processed 2 58400. The tank has been notified and wil.com. be totes month 4. Decrease in balance per bank statement - no journal entry required required henda