Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. a) Suppose that the nominal exchange rate between Canada and China is: 1 CAD = 5.35 CNY The price of a big mac

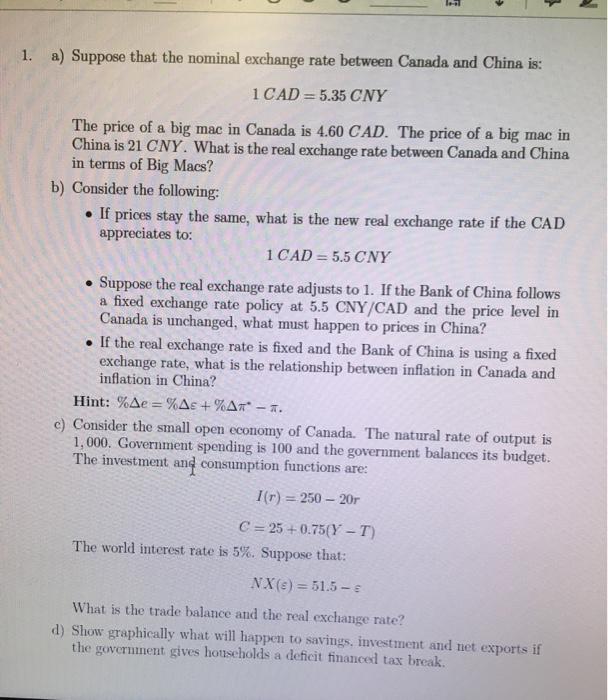

1. a) Suppose that the nominal exchange rate between Canada and China is: 1 CAD = 5.35 CNY The price of a big mac in Canada is 4.60 CAD. The price of a big mac in China is 21 CNY. What is the real exchange rate between Canada and China in terms of Big Macs? b) Consider the following: If prices stay the same, what is the new real exchange rate if the CAD appreciates to: 1 CAD = 5.5 CNY Suppose the real exchange rate adjusts to 1. If the Bank of China follows a fixed exchange rate policy at 5.5 CNY/CAD and the price level in Canada is unchanged, what must happen to prices in China? If the real exchange rate is fixed and the Bank of China is using a fixed exchange rate, what is the relationship between inflation in Canada and inflation in China? Hint: %Ae = %As +%An* - a. c) Consider the small open economy of Canada. The natural rate of output is 1,000. Government spending is 100 and the government balances its budget. The investment and consumption functions are: I(r) = 250 20r C = 25 + 0.75(Y T) The world interest rate is 5%. Suppose that: NX(s) = 51.5 E What is the trade balance and the real exchange rate? d) Show graphically what will happen to savings, investment and net exports if the government gives households a deficit financed tax break.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started