Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTING 2302 Question Can somebody please help me answer the questions at the very bottom? I have some answers but I need help with the

ACCOUNTING 2302 Question Can somebody please help me answer the questions at the very bottom? I have some answers but I need help with the rest. Please and Thank you!

| Work in Process = Job #1 Work in Process 2 = Job #2

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

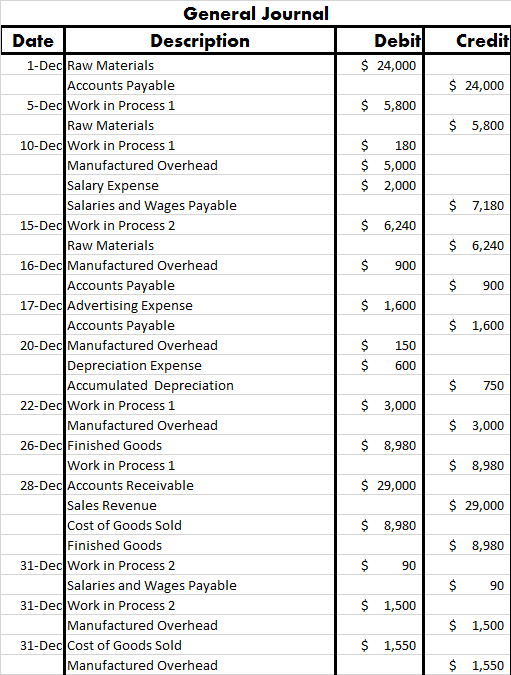

General Journal Date Description Debit Credit 24,000 1-Dec Raw Materials 24,000 Accounts Payable 5,800 5-Dec Work in Process 1 Raw Materials 5,800 10-Dec Work in Process 1 180 5,000 Manufactured Overhead 2,000 Salary Expense Salaries and wages payable 7,180 6,240 15-Dec Work in Process 2 Raw Materials 6,240 16-Dec Manufactured Overhead 900 Accounts Payable 900 1,600 17-Dec Advertising Expense 1,600 Accounts Payable 20 Dec Manufactured Overhead Depreciation Expense 00 Accumulated Depreciation 750 3,000 22-Dec Work in Process 1 3,000 Manufactured Overhead 8,980 Finished Goods 26-Dec 8,980 Work in Process 1 29,000 28-Dec Accounts Receivable 29,000 Sales Revenue Cost of Goods Sold 8,980 8,980 Finished Goods 31-Dec Work in Process 2 90 90 Salaries and wages payable 1,500 31-Dec Work in Process 2 1,500 Manufactured Overhead 1.550 31-Dec Cost of Goods Sold 1.550 Manufactured Overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started