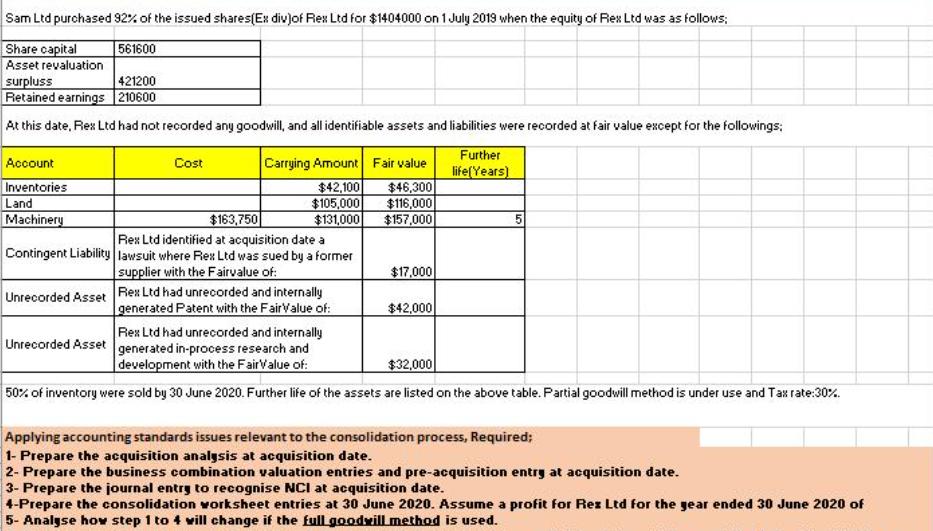

Question: Sam Ltd purchased 92% of the issued shares(Ex div)of Rex Ltd for $1404000 on 1 July 2019 when the equity of Rex Ltd was

Sam Ltd purchased 92% of the issued shares(Ex div)of Rex Ltd for $1404000 on 1 July 2019 when the equity of Rex Ltd was as follows; Share capital Asset revaluation surpluss Retained earnings 210600 561600 421200 At this date, Rex Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings: Further Account Inventories Land Machinery Carrying Amount Fair value $46,300 $116,000 $157,000 Cost life(Years) $42,100 $105,000 $131,000 Rex Ltd identified at acquisition date a Contingent Liability lawsuit where Rex Ltd was sued by a former $163,750 supplier with the Fairvalue of: $17,000 Unrecorded Asset Rex Ltd had unrecorded and internally generated Patent with the FairValue of: $42,000 Rex Ltd had unrecorded and internally Unrecorded Asset generated in-process research and development with the FairValue of: $32,000 50% of inventory were sold by 30 June 2020. Further life of the assets are listed on the above table. Partial goodwill method is under use and Taxrate:30%. Applying accounting standards issues relevant to the consolidation process, Required; 1- Prepare the acquisition analysis at acquisition date. 2- Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 3- Prepare the journal entry to recognise NCI at acquisition date. 4-Prepare the consolidation vorksheet entries at 30 June 2020. Assume a profit for Rez Ltd for the gear ended 30 June 2020 of 5- Analyse hov step 1 to 4 will change if the full goodyill method is used.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Sheet1 Sheet2 Exit Full Screen A C E Journal entries for NCI at acquisition date Dr identifiable ass... View full answer

Get step-by-step solutions from verified subject matter experts