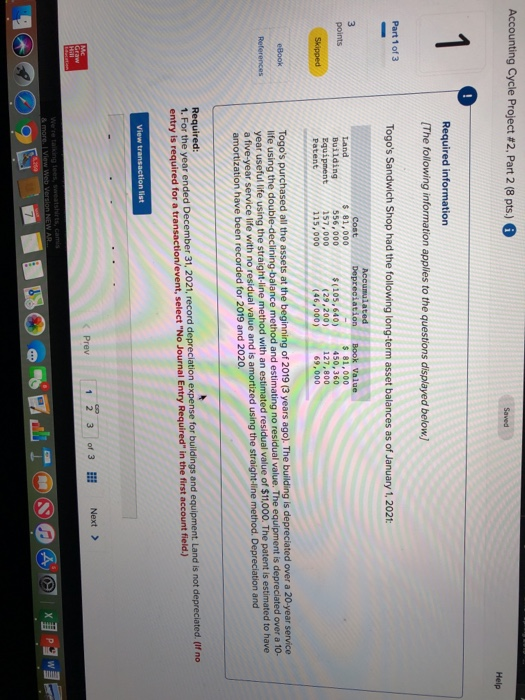

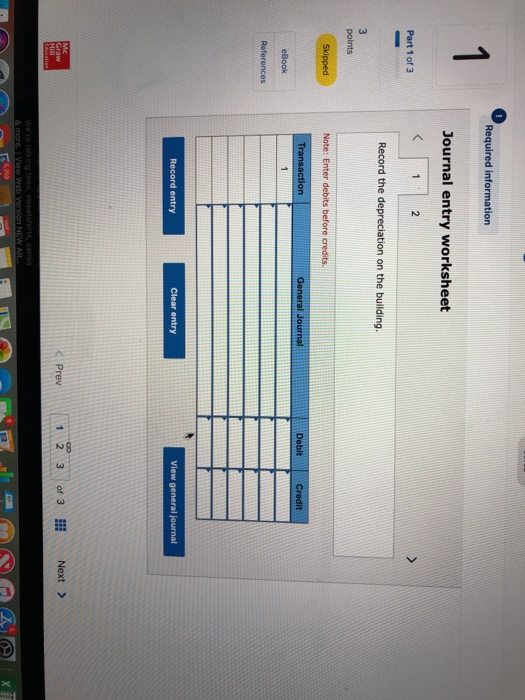

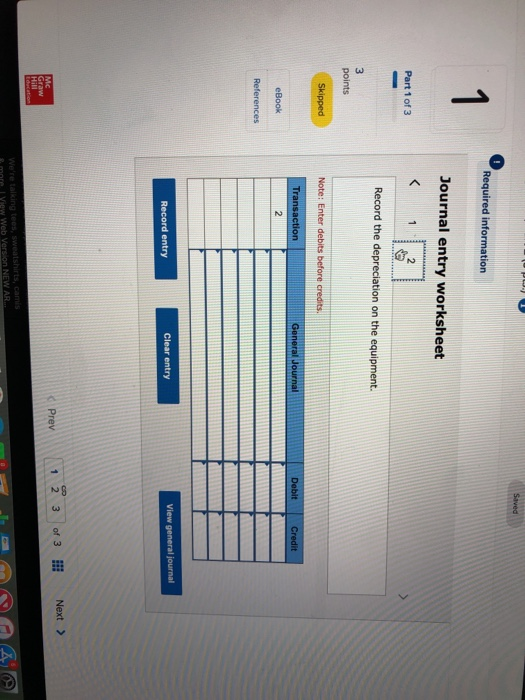

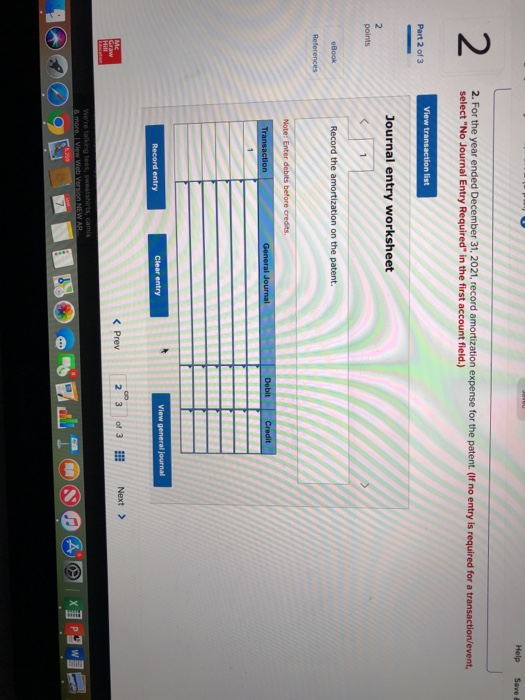

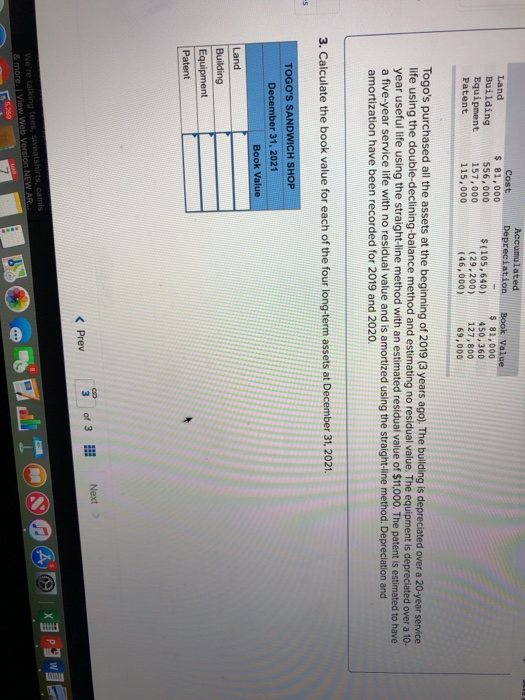

Accounting Cycle Project #2, Part 2 (8 pts ) Help Required information (The following information applies to the questions displayed below.] Part 1 of 3 Togo's Sandwich Shop had the following long-term asset balances as of January 1, 2021 Land Building $ 81,000 556,000 Equipment/157,000 115,000 points $ 81,000 (105,640450,360 127,800 69,000 (46,000) Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 20-year service life using the year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2019 and 2020. no I value. The equipment is depreciated over a 10- Required 1. For the year ended December 31, 2021, record depreciation expense for buildings and entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) equipment. Land is not depreciated. (If no list 1 2 3 of 3 Next Required information 1 Journal entry worksheet Part 1 of 3 Record the depreciation on the building. points General Journal Clear entry View general journal Prev1 2or Next 3 : of 3 Next > Journal entry worksheet Part 1 of3 Record the depreciation on the equipment. points Clear entry tll Depreciation Land Building Equipment Patent s 81,000 556,000 157,000 115,000 s 81,00 (105,640)450,360 127,800 69,000 (29,200) (46,000) Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 20-year service life using the double-declining-balance method and estimating no residual value. The equipment is year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation antd amortization have been recorded for 2019 and 2020. depreciated over a 10- 3. Calculate the book value for each of the four long-term assets at December 31, 2021 TOGO'S SANDWICH SHOP December 31, 2021 Book Value Land Building Equipment 3 of 3 Next Prev