Answered step by step

Verified Expert Solution

Question

1 Approved Answer

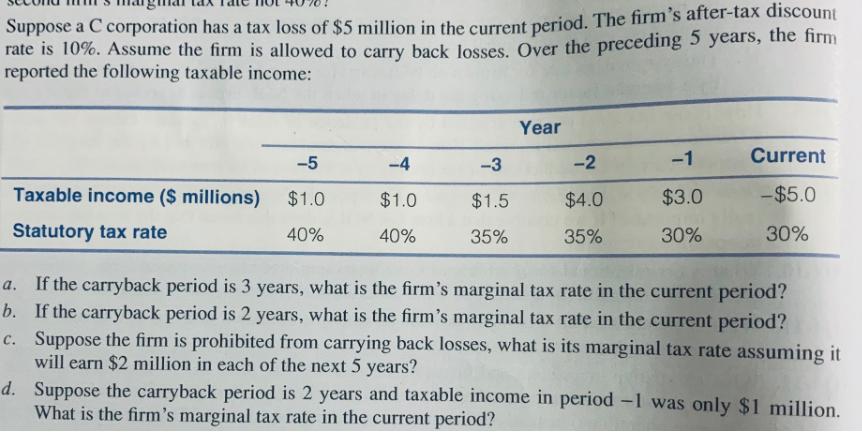

Suppose a C corporation has a tax loss of $5 million in the current period. The firm's after-tax discount rate is 10%. Assume the

Suppose a C corporation has a tax loss of $5 million in the current period. The firm's after-tax discount rate is 10%. Assume the firm is allowed to carry back losses Over the preceding 5 years, the firm reported the following taxable income: Year -5 -4 -3 -2 -1 Current Taxable income ($ millions) $1.0 $1.0 $1.5 $4.0 $3.0 -$5.0 Statutory tax rate 40% 40% 35% 35% 30% 30% a. If the carryback period is 3 years, what is the firm's marginal tax rate in the current period? b. If the carryback period is 2 years, what is the firm's marginal tax rate in the current period? c. Suppose the firm is prohibited from carrying back losses, what is its marginal tax rate assuming it will earn $2 million in each of the next 5 years? d. Suppose the carryback period is 2 years and taxable income in period -1 was only $1 million. What is the firm's marginal tax rate in the current period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CORMICT EVEN GO TO DISP TAX TAX 8 4 1 AC 00 Netes a Curcent yeat lass If Carey Back Pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started