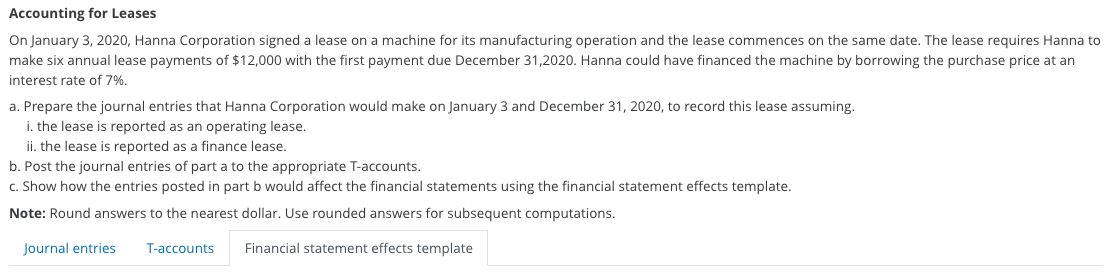

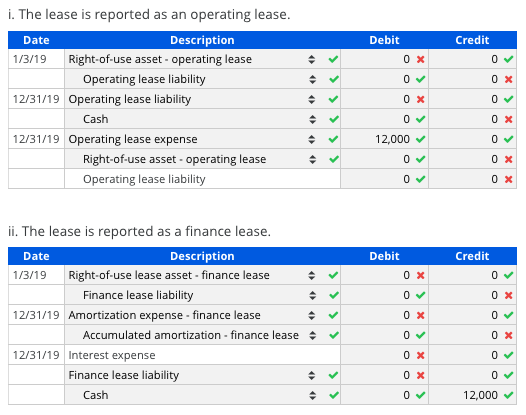

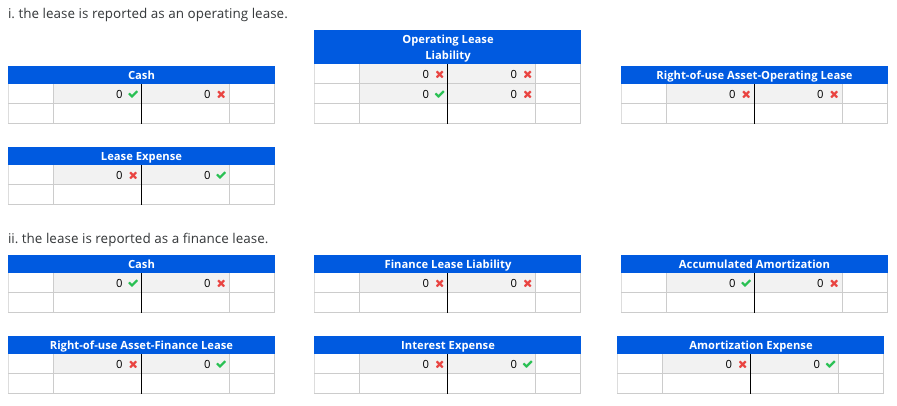

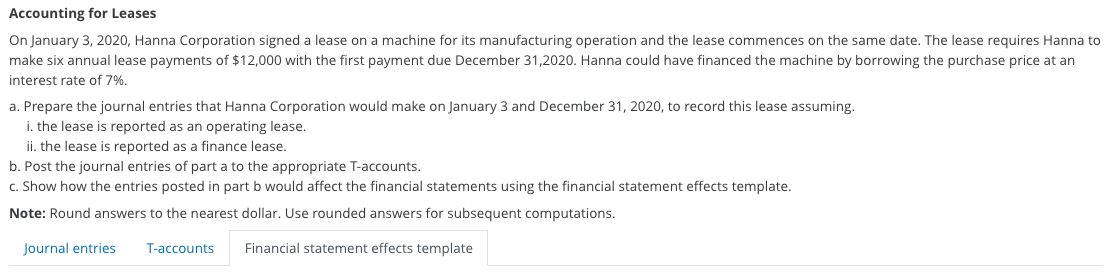

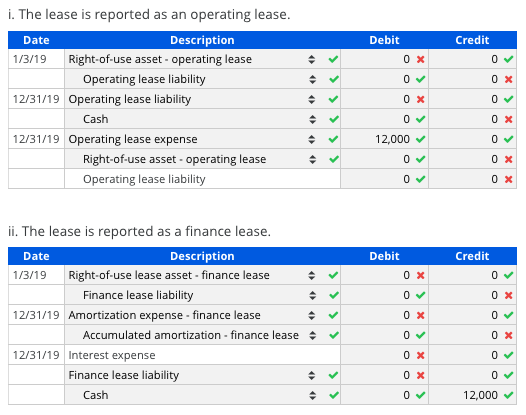

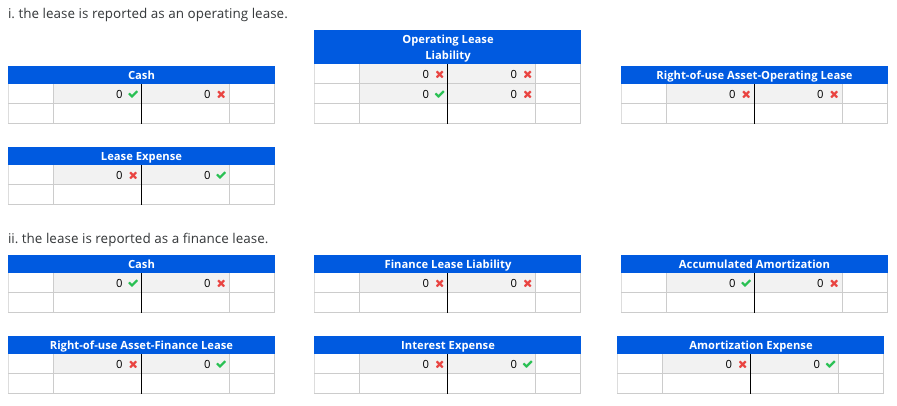

Accounting for Leases On January 3, 2020, Hanna Corporation signed a lease on a machine for its manufacturing operation and the lease commences on the same date. The lease requires Hanna to make six annual lease payments of $12,000 with the first payment due December 31,2020. Hanna could have financed the machine by borrowing the purchase price at an interest rate of 7%. a. Prepare the journal entries that Hanna Corporation would make on January 3 and December 31, 2020, to record this lease assuming. 1. the lease is reported as an operating lease. ii. the lease is reported as a finance lease. b. Post the journal entries of part a to the appropriate T-accounts. C. Show how the entries posted in part b would affect the financial statements using the financial statement effects template. Note: Round answers to the nearest dollar. Use rounded answers for subsequent computations. Journal entries T-accounts Financial statement effects template i. The lease is reported as an operating lease. Debit Credit Date Description 1/3/19 Right-of-use lease asset - finance lease Finance lease liability 12/31/19 Amortization expense - finance lease Accumulated amortization - finance lease 12/31/19 Interest expense Finance lease liability Cash 12,000 i. the lease is reported as an operating lease. Operating Lease Liability 0x Cash Right-of-use Asset-Operating Lease Lease Expense ii. the lease is reported as a finance lease. Cash Finance Lease Liability Accumulated Amortization 0 Amortization Expense Right-of-use Asset-Finance Lease 0X Interest Expense OX Note: Use negative signs with your answers, when appropriate. i. the lease is reported as an operating lease. Income Statement Net Income Cash Asset Earned Capital Liabilities Revenues Expenses Balance Sheet Noncash Contra Assets Assets OX 0 0 OX 07 Transactions Operating leasecommences. Lease payment. Record leaseexpense andchanges to assetand liability. Contributed Capital 0 0 0 0 0x 0 0 OX 0 OX Income Statement ii. the lease is reported as a finance lease. Balance Sheet Noncash Contra Transactions Cash Asset Assets Assets Finance leasecommences. Amortization ofleased asset. 0 0 OX Contributed Capital 0 Liabilities Earned Capital Net Income Revenues Expenses OX 0 OX 0 OX Made annualpayment. 0 X Accounting for Leases On January 3, 2020, Hanna Corporation signed a lease on a machine for its manufacturing operation and the lease commences on the same date. The lease requires Hanna to make six annual lease payments of $12,000 with the first payment due December 31,2020. Hanna could have financed the machine by borrowing the purchase price at an interest rate of 7%. a. Prepare the journal entries that Hanna Corporation would make on January 3 and December 31, 2020, to record this lease assuming. 1. the lease is reported as an operating lease. ii. the lease is reported as a finance lease. b. Post the journal entries of part a to the appropriate T-accounts. C. Show how the entries posted in part b would affect the financial statements using the financial statement effects template. Note: Round answers to the nearest dollar. Use rounded answers for subsequent computations. Journal entries T-accounts Financial statement effects template i. The lease is reported as an operating lease. Debit Credit Date Description 1/3/19 Right-of-use lease asset - finance lease Finance lease liability 12/31/19 Amortization expense - finance lease Accumulated amortization - finance lease 12/31/19 Interest expense Finance lease liability Cash 12,000 i. the lease is reported as an operating lease. Operating Lease Liability 0x Cash Right-of-use Asset-Operating Lease Lease Expense ii. the lease is reported as a finance lease. Cash Finance Lease Liability Accumulated Amortization 0 Amortization Expense Right-of-use Asset-Finance Lease 0X Interest Expense OX Note: Use negative signs with your answers, when appropriate. i. the lease is reported as an operating lease. Income Statement Net Income Cash Asset Earned Capital Liabilities Revenues Expenses Balance Sheet Noncash Contra Assets Assets OX 0 0 OX 07 Transactions Operating leasecommences. Lease payment. Record leaseexpense andchanges to assetand liability. Contributed Capital 0 0 0 0 0x 0 0 OX 0 OX Income Statement ii. the lease is reported as a finance lease. Balance Sheet Noncash Contra Transactions Cash Asset Assets Assets Finance leasecommences. Amortization ofleased asset. 0 0 OX Contributed Capital 0 Liabilities Earned Capital Net Income Revenues Expenses OX 0 OX 0 OX Made annualpayment. 0 X