Answered step by step

Verified Expert Solution

Question

1 Approved Answer

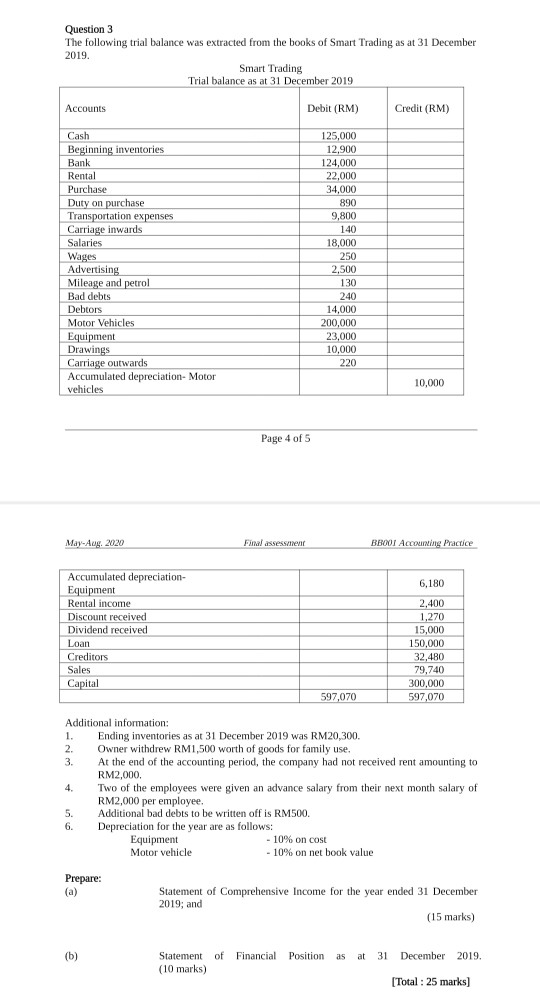

Accounting foundation Question 3 The following trial balance was extracted from the books of Smart Trading as at 31 December 2019. Smart Trading Trial balance

Accounting foundation

Question 3 The following trial balance was extracted from the books of Smart Trading as at 31 December 2019. Smart Trading Trial balance as at 31 December 2019 Accounts Debit (RM) Credit (RM) Cash Beginning inventories Bank Rental Purchase Duty on purchase Transportation expenses Carriage inwards Salaries Wages Advertising Mileage and petrol Bad debts Debtors Motor Vehicles Equipment Drawings Carriage outwards Accumulated depreciation- Motor vehicles 125,000 12,900 124,000 22,000 34.000 890 9,800 140 18,000 250 2,500 130 240 14,000 200,000 23,000 10,000 220 10,000 Page 4 of 5 May-Aug. 20.00 Final assessment BBOOT Accounting Practice 6,180 Accumulated depreciation- Equipment Rental income Discount received Dividend received Loan Creditors Sales Capital 2,400 1,270 15,000 150,000 32,480 79,740 300,000 597,070 597,070 Additional information: 1. Ending inventories as at 31 December 2019 was RM20,300. 2. Owner withdrew RM1,500 worth of goods for family use. 3. At the end of the accounting period, the company had not received rent amounting to RM2,000. 4. Two of the employees were given an advance salary from their next month salary of RM2,000 per employee. 5. Additional bad debts to be written off is RM500. 6. Depreciation for the year are as follows: Equipment - 10% on cost Motor vehicle - 10% on net book value Prepare: (a) Statement of Comprehensive Income for the year ended 31 December 2019; and (15 marks) (b) Financial Position as at 31 December 2019. Statement of (10 marks) [Total: 25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started