Accounting help

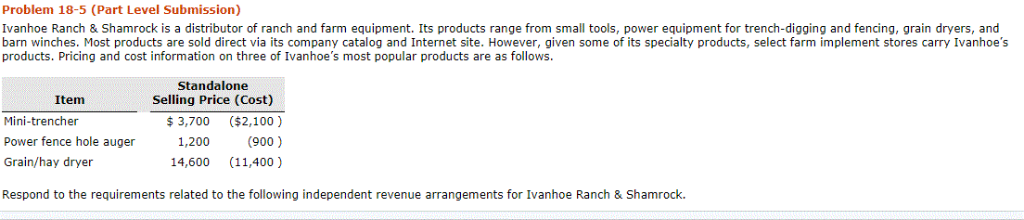

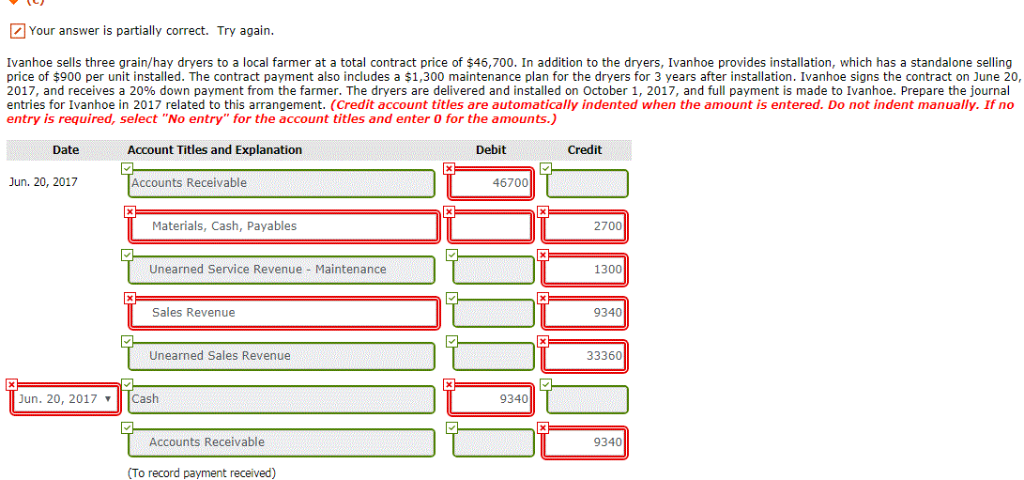

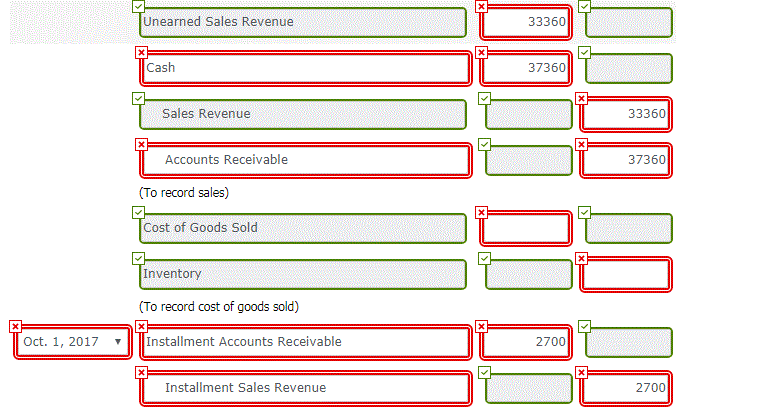

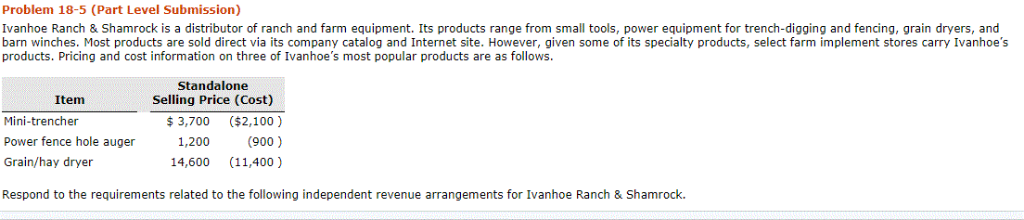

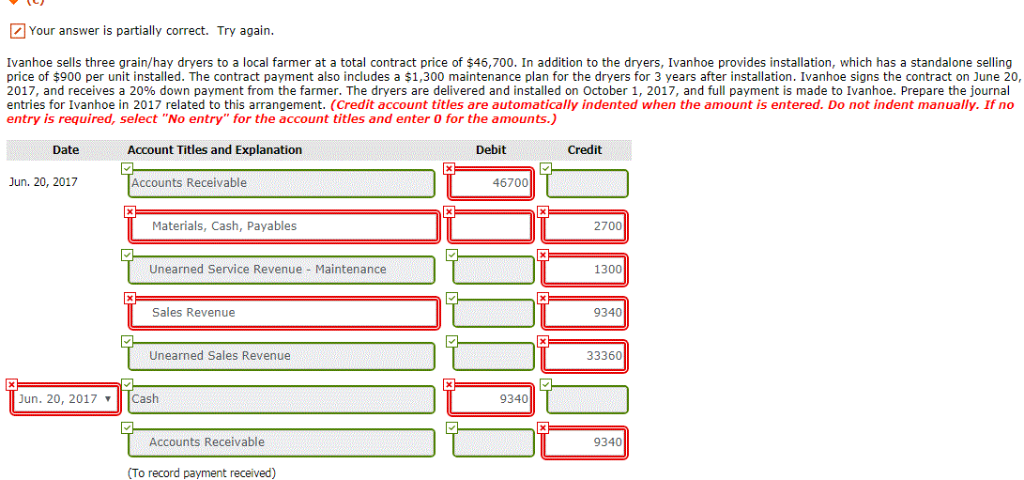

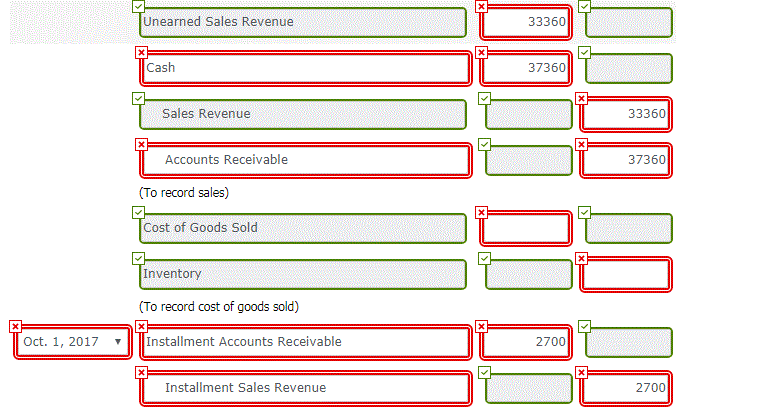

Problem 18-5 (Part Level Submission) Ivanhoe Ranch & Shamrock is a distributor of ranch and farm equipment. Its products range from small tools, power equipment for trench-digging and fencing, grain dryers, and barn winches. Most products are sold direct via its company catalog and Internet site. However, given some of its specialty products, select farm implement stores carry Ivanhoe's products. Pricing and cost information on three of Ivanhoe's most popular products are as follows Item Selling Price (Cost) 3,700 ($2,100) Mini-trencher Power fence hole auger 1,200) Grain/hay dryer Respond to the requirements related to the following independent revenue arrangements for Ivanhoe Ranch & Shamrock. 14,600 (11,400) Your answer is partially correct. Try again. Ivanhoe sells three grain/hay dryers to a local farmer at a total contract price of $46,700. In addition to the dryers, Ivanhoe provides installation, which has a standalone selling price of $900 per unit installed. The contract payment also includes a $1,300 maintenance plan for the dryers for 3 years after installation. Ivanhoe signs the contract on June 20, 2017, and receives a 20% down payment from the farmer. The dryers are delivered and installed on October 1, 2017, and full payment is made to Ivanhoe. Prepare the journal entries for Ivanhoe in 2017 related to this arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Credit Jun. 20, 2017 Accounts Receivable 46700 Materials, Cash, Payables 2700 Unearned Service Revenue Maintenance 1300 Sales Revenue 9340 Unearned Sales Revenue 33360 Jun. 20, 2017 Cash 9340 Accounts Receivable 9340 (To record payment received) Unearned Sales Revenue 33360 Cash 37360 Sales Revenue 33360 Accounts Receivable 37360 To record sales) Cost of Goods Sold Inventory (To record cost of goods sold) Oct. 1, 2017 Installment Accounts Receivable 2700 Installment Sales Revenue 2700 Problem 18-5 (Part Level Submission) Ivanhoe Ranch & Shamrock is a distributor of ranch and farm equipment. Its products range from small tools, power equipment for trench-digging and fencing, grain dryers, and barn winches. Most products are sold direct via its company catalog and Internet site. However, given some of its specialty products, select farm implement stores carry Ivanhoe's products. Pricing and cost information on three of Ivanhoe's most popular products are as follows Item Selling Price (Cost) 3,700 ($2,100) Mini-trencher Power fence hole auger 1,200) Grain/hay dryer Respond to the requirements related to the following independent revenue arrangements for Ivanhoe Ranch & Shamrock. 14,600 (11,400) Your answer is partially correct. Try again. Ivanhoe sells three grain/hay dryers to a local farmer at a total contract price of $46,700. In addition to the dryers, Ivanhoe provides installation, which has a standalone selling price of $900 per unit installed. The contract payment also includes a $1,300 maintenance plan for the dryers for 3 years after installation. Ivanhoe signs the contract on June 20, 2017, and receives a 20% down payment from the farmer. The dryers are delivered and installed on October 1, 2017, and full payment is made to Ivanhoe. Prepare the journal entries for Ivanhoe in 2017 related to this arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Credit Jun. 20, 2017 Accounts Receivable 46700 Materials, Cash, Payables 2700 Unearned Service Revenue Maintenance 1300 Sales Revenue 9340 Unearned Sales Revenue 33360 Jun. 20, 2017 Cash 9340 Accounts Receivable 9340 (To record payment received) Unearned Sales Revenue 33360 Cash 37360 Sales Revenue 33360 Accounts Receivable 37360 To record sales) Cost of Goods Sold Inventory (To record cost of goods sold) Oct. 1, 2017 Installment Accounts Receivable 2700 Installment Sales Revenue 2700