Accounting - Internal audit and control

Case Study: Family Games, Inc.

Source:

Ethical Obligations and Decision Making in Accounting (5th Edition)

By Steven M. Mintz, Roselyn E. Morris

Question : Assume that Carl Land is CPA and Helen Strom has CIA license. Please answer the following questions from the perspective of Helen Strom.

2.What are alternative courses of action to the dilemma you are facing? What are the possible trade-offs?

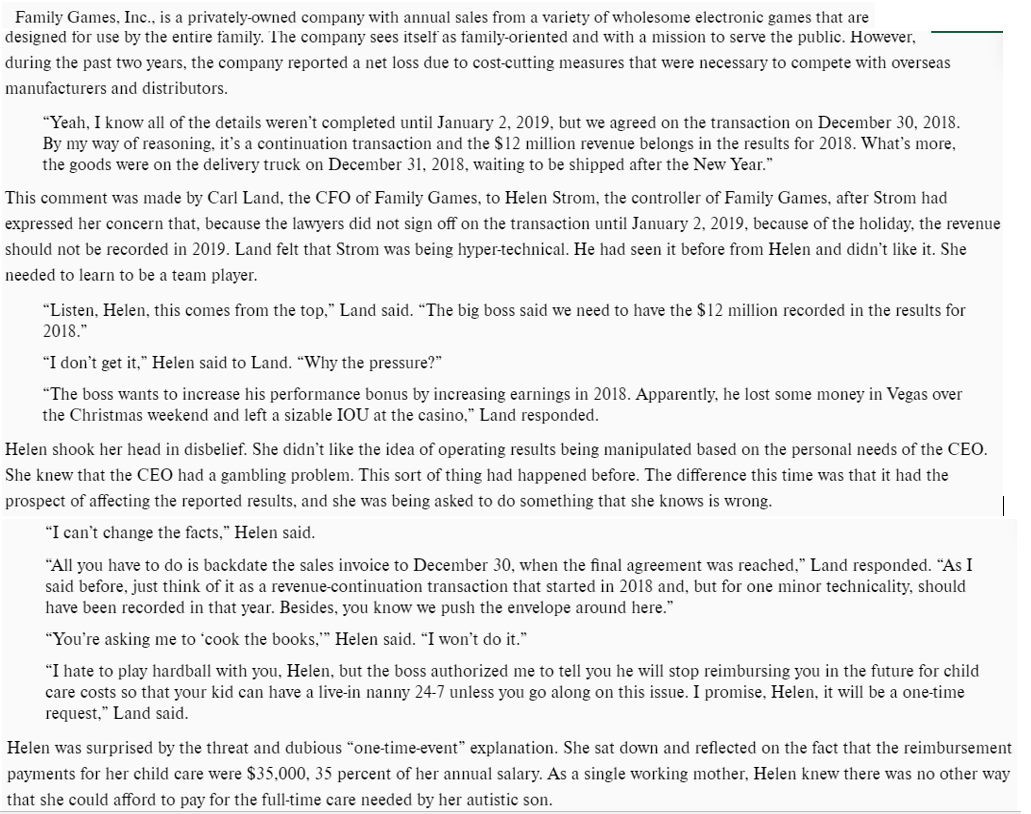

Family Games. Inc.. is a privately-owned company with annual sales front a variety of wholesome electronic games that are designed for use by the entire family. 'lhe company sees itself as family-oriented and with a mission to serve the public. However. during the past two years, the company reported a net loss due to costcutting measures that were necessary to compete with overseas manufacturers and distributors. \"Yeah, I know all of the details weren't completed until January 2. 2019. but we agreed on the transaction on December 30, 20i8. By my way of reasoning, it's a continuation transaction and the $12 million revenue belongs in the results for 2018. What's more, the goods were on the delivery truck on December 31. ZOIB. waiting to be shipped after the New Year.\" This comment was made by Carl Land. the CFO of Family Games. to Helen Stront. the controller of Family Games. after Stront had expressed her concern that, because the lawyers did not sign off on the transaction until January 2. 2019, because of the holiday, the revenue should not be recorded in 20l9. Land felt that Strom was being hyperetechnical. He had seen it before from Helen and didn't like it. She needed to learn to be a team player. \"Listen. Helen, this comes from the top." Land said. \"The big boss said we need to have the S 12 million recorded in the results for lots.\" \"I don't get it.\" Helen said to Land. \"Why the pressure?\" \"The boss wants to increase his performance bonus by increasing earnings in 2018. Apparently, he lost some money iii Vegas over the Christmas weekend and left a sizable IOU at the casino,\" Land responded. Helen shook her head in disbelief. She didn't like the idea of operating results being manipulated based on the personal needs of the CEO. She knew that the CEO had a gambling problem. This sort of thing had happened before. The dicrence this titne was that it had the prospect of affecting the reported results. and she was being asked to do something that she knows is wrong. l \"I can't change the facts," Helen said. \"All you have to do is backdate the sales invoice to December 30, when the nal agreement was reached,\" Land responded. \"As I said before, just think of it as a revenue-continuation transaction that started in 2018 and, but for one minor technicality, should have been recorded in that year. Besides, you know we push the envelope around here.\" \"You're asking me to 'cook the books.\" Helen said. \"I won't do it." \"I hate to play hardball with you. Heten. but the boss authorized me to tell you he will stop reimbursing you in the future for child care costs so that your kid can have a livein nanny 2+7 unless you go along on this issue. I promise. Helen. it will be a onetime request,\" Land said. Helen was surprised by the threat and dubious \"onetime-event" explanation. She sat down and reected on the fact that the reimbursement payments for her child care were $35,000. 35 percent of her annual salary. As a single working mother. Helen knew there was no other way that she could a'ord to pay for the full-time care needed by her autistic son