Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is available: (a) The construction period will last for one year, beginning on 1st April of year and ending on 31st

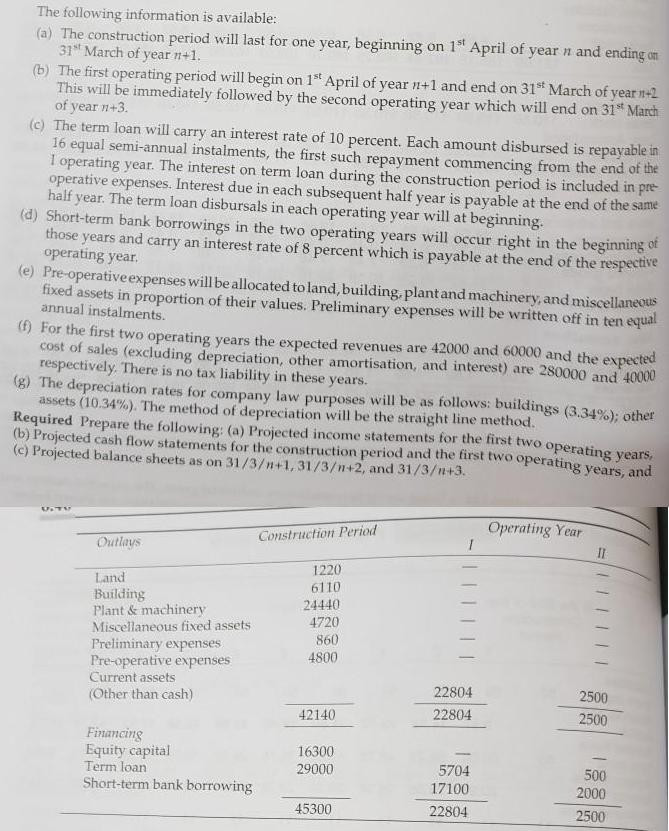

The following information is available: (a) The construction period will last for one year, beginning on 1st April of year and ending on 31st March of year n+1. (b) The first operating period will begin on 1st April of year n+1 and end on 31st March of year n+2 This will be immediately followed by the second operating year which will end on 31st March of year n+3. (c) The term loan will carry an interest rate of 10 percent. Each amount disbursed is repayable in 16 equal semi-annual instalments, the first such repayment commencing from the end of the I operating year. The interest on term loan during the construction period is included in pre- operative expenses. Interest due in each subsequent half year is payable at the end of the same half year. The term loan disbursals in each operating year will at beginning. (d) Short-term bank borrowings in the two operating years will occur right in the beginning of those years and carry an interest rate of 8 percent which is payable at the end of the respective operating year. (e) Pre-operative expenses will be allocated to land, building, plant and machinery, and miscellaneous fixed assets in proportion of their values. Preliminary expenses will be written off in ten equal annual instalments. (f) For the first two operating years the expected revenues are 42000 and 60000 and the expected cost of sales (excluding depreciation, other amortisation, and interest) are 280000 and 40000 respectively. There is no tax liability in these years. (g) The depreciation rates for company law purposes will be as follows: buildings (3.34%); other assets (10.34%). The method of depreciation will be the straight line method. Required Prepare the following: (a) Projected income statem (b) Projected cash flow statements for the construction period and the first two operating years, and ents for the first two operating years, (c) Projected balance sheets as on 31/3/n+1, 31/3/n+2, and 31/3/1+3. U.TV Outlays Land Building Plant & machinery Miscellaneous fixed assets Preliminary expenses Pre-operative expenses Current assets (Other than cash) Financing Equity capital Term loan Short-term bank borrowing Construction Period 1220 6110 24440 4720 860 4800 42140 16300 29000 45300 1 22804 22804 5704 17100 22804 Operating Year II 2500 2500 500 2000 2500

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Projected Income Statement Rs 000 Particulars Year 1 Year 2 Sales 4200000 6000000 Cost of Sales 2800000 4000000 Gross Profit 1400000 2000000 Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started