Answered step by step

Verified Expert Solution

Question

1 Approved Answer

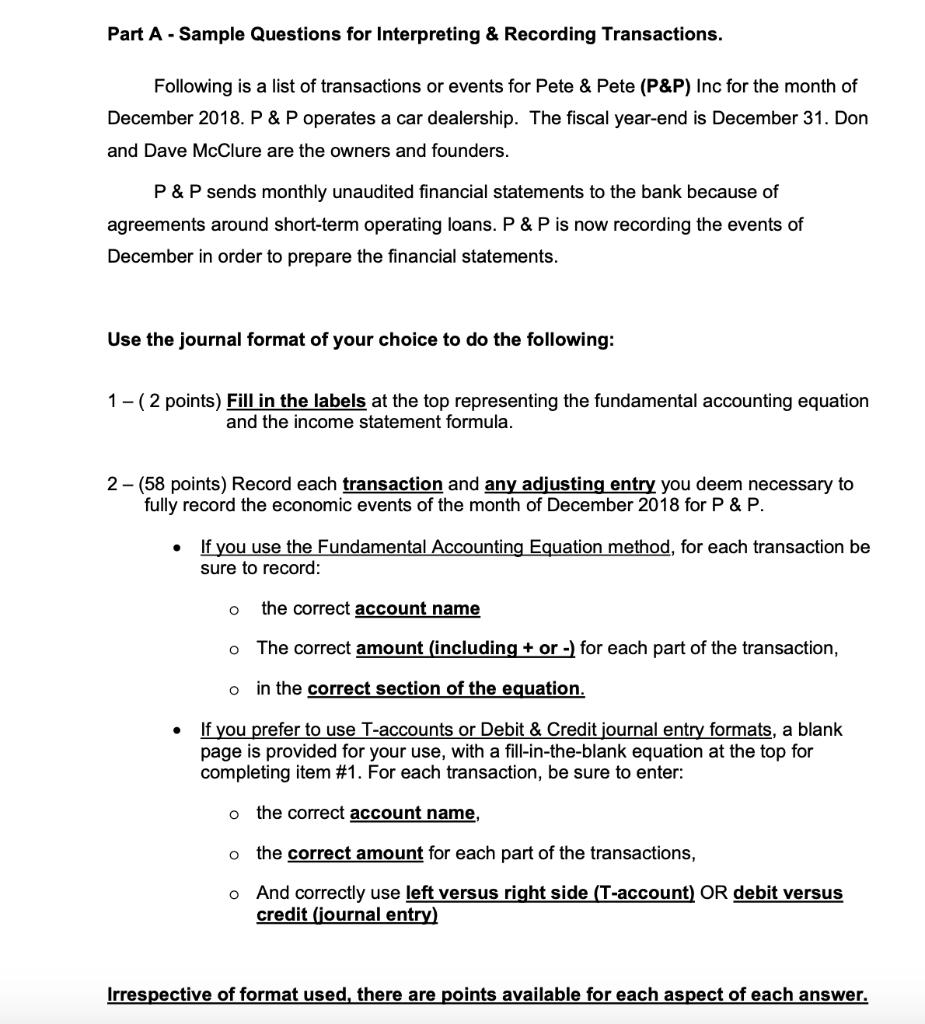

Part A - Sample Questions for Interpreting & Recording Transactions. Following is a list of transactions or events for Pete & Pete (P&P) Inc

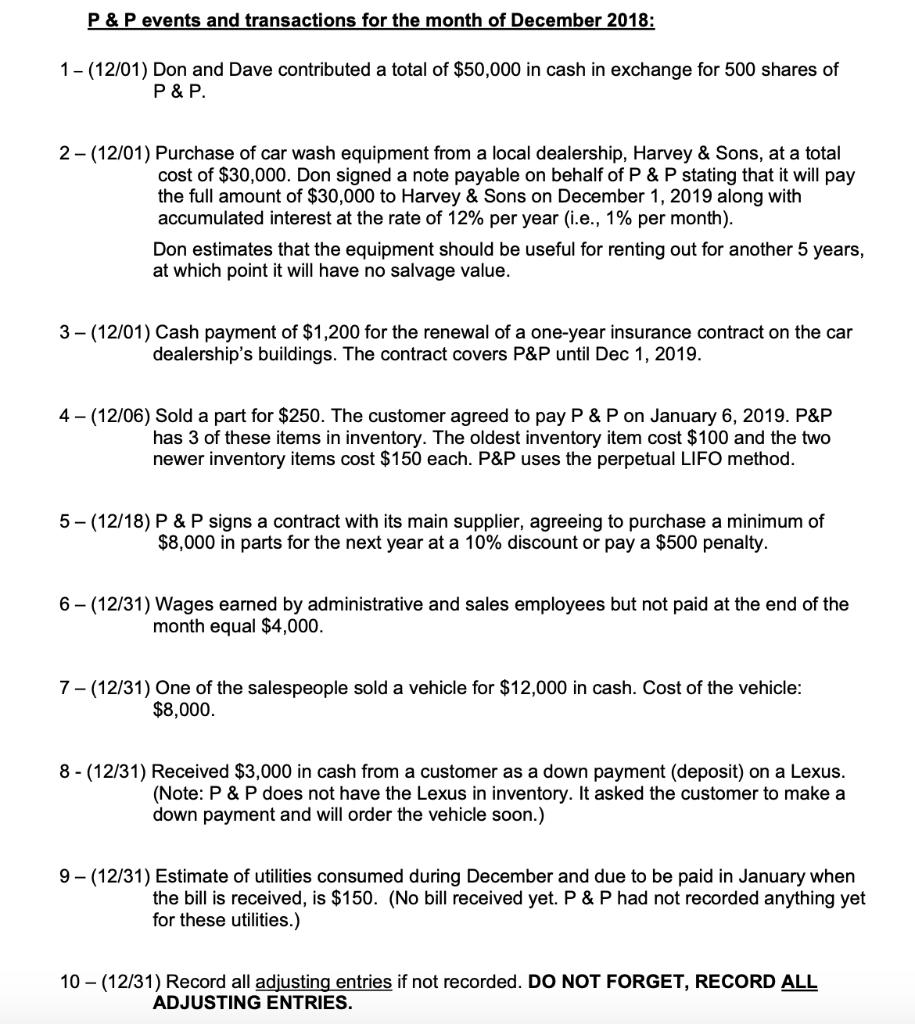

Part A - Sample Questions for Interpreting & Recording Transactions. Following is a list of transactions or events for Pete & Pete (P&P) Inc for the month of December 2018. P & P operates a car dealership. The fiscal year-end is December 31. Don and Dave McClure are the owners and founders. P & P sends monthly unaudited financial statements to the bank because of agreements around short-term operating loans. P & P is now recording the events of December in order to prepare the financial statements. Use the journal format of your choice to do the following: 1- (2 points) Fill in the labels at the top representing the fundamental accounting equation and the income statement formula. 2- (58 points) Record each transaction and any adjusting entry you deem necessary to fully record the economic events of the month of December 2018 for P & P. If you use the Fundamental Accounting Equation method, for each transaction be sure to record: the correct account name The correct amount (including + or -) for each part of the transaction, o in the correct section of the equation. If you prefer to use T-accounts or Debit & Credit journal entry formats, a blank page is provided for your use, with a fill-in-the-blank equation at the top for completing item #1. For each transaction, be sure to enter: o the correct account name, the correct amount for each part of the transactions, o And correctly use left versus right side (T-account) OR debit versus credit (journal entry) Irrespective of format used, there are points available for each aspect of each answer. P &P events and transactions for the month of December 2018: 1- (12/01) Don and Dave contributed a total of $50,000 in cash in exchange for 500 shares of P & P. 2- (12/01) Purchase of car wash equipment from a local dealership, Harvey & Sons, at a total cost of $30,000. Don signed a note payable on behalf of P & P stating that it will pay the full amount of $30,000 to Harvey & Sons on December 1, 2019 along with accumulated interest at the rate of 12% per year (i.e., 1% per month). Don estimates that the equipment should be useful for renting out for another 5 years, at which point it will have no salvage value. 3 - (12/01) Cash payment of $1,200 for the renewal of a one-year insurance contract on the car dealership's buildings. The contract covers P&P until Dec 1, 2019. 4 - (12/06) Sold a part for $250. The customer agreed to pay P & P on January 6, 2019. P&P has 3 of these items in inventory. The oldest inventory item cost $100 and the two newer inventory items cost $150 each. P&P uses the perpetual LIFO method. 5- (12/18) P & P signs a contract with its main supplier, agreeing to purchase a minimum of $8,000 in parts for the next year at a 10% discount or pay a $500 penalty. 6 - (12/31) Wages earned by administrative and sales employees but not paid at the end of the month equal $4,000. 7- (12/31) One of the salespeople sold a vehicle for $12,000 in cash. Cost of the vehicle: $8,000. 8 - (12/31) Received $3,000 in cash from a customer as a down payment (deposit) on a Lexus. (Note: P & P does not have the Lexus in inventory. It asked the customer to make a down payment and will order the vehicle soon.) 9 - (12/31) Estimate of utilities consumed during December and due to be paid in January when the bill is received, is $150. (No bill received yet. P & P had not recorded anything yet for these utilities.) 10 - (12/31) Record all adjusting entries if not recorded. DO NOT FORGET, RECORD ALL ADJUSTING ENTRIES.

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Solution Date Account Debit Credit 12012018 Cash Ac Dr 50000 To common stock Ac ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started