The following information relates to Carpets R Us, a manufacturer and wholesaler of carpets and rugs. The company has a policy of valuing stock

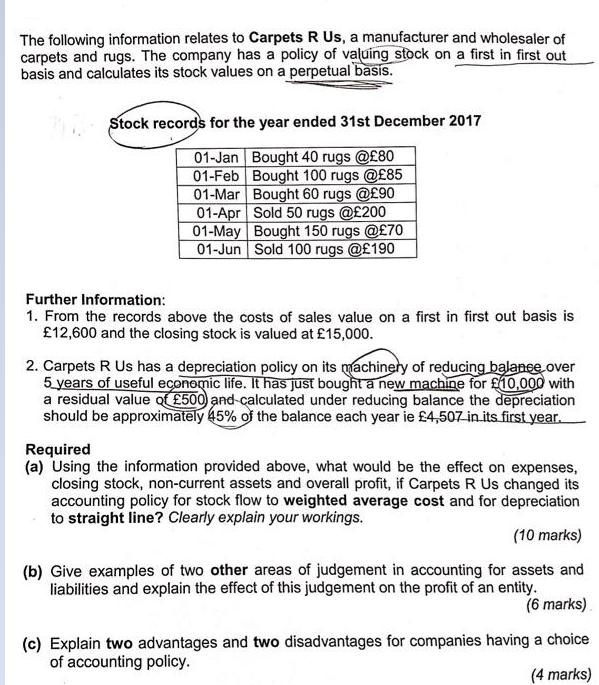

The following information relates to Carpets R Us, a manufacturer and wholesaler of carpets and rugs. The company has a policy of valuing stock on a first in first out basis and calculates its stock values on a perpetual basis. Stock records for the year ended 31st December 2017 01-Jan Bought 40 rugs @80 01-Feb Bought 100 rugs @85 01-Mar Bought 60 rugs @90 01-Apr Sold 50 rugs @200 01-May Bought 150 rugs @70 01-Jun Sold 100 rugs @190 Further Information: 1. From the records above the costs of sales value on a first in first out basis is 12,600 and the closing stock is valued at 15,000. 2. Carpets R Us has a depreciation policy on its machinery of reducing balanee over 5 years of useful economic life. It has just bought a new machine for 10,000 with a residual value Qf 500 and calculated under reducing balance the depreciation should be approximately 45% of the balance each year ie 4,507- in.its first year. Required (a) Using the information provided above, what would be the effect on expenses, closing stock, non-current assets and overall profit, if Carpets R Us changed its accounting policy for stock flow to weighted average cost and for depreciation to straight line? Clearly explain your workings. (10 marks) (b) Give examples of two other areas of judgement in accounting for assets and liabilities and explain the effect of this judgement on the profit of an entity. (6 marks) (c) Explain two advantages and two disadvantages for companies having a choice of accounting policy. (4 marks)

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

EXISTING METHOD Valuation of Cost of Goods Sold and Closing Stock on the basis of FIFO Method Cost of Goods Sold 4050 8550 12600 Closing Stock 15000 Calculation of Depreciation using Reducing Balance ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started