Answered step by step

Verified Expert Solution

Question

1 Approved Answer

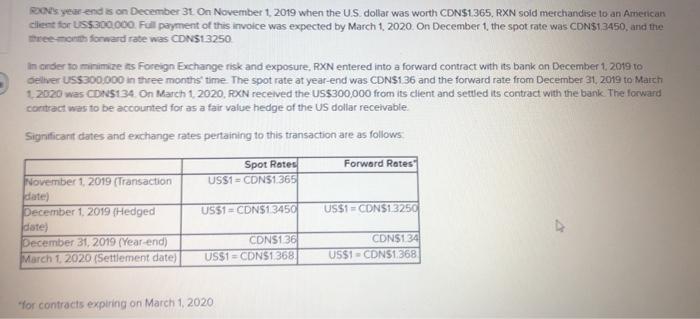

RXN's year end is on December 31 On November t, 2019 when the U.S. dollar was worth CDNS1.365, RXN soid merchandese to an American

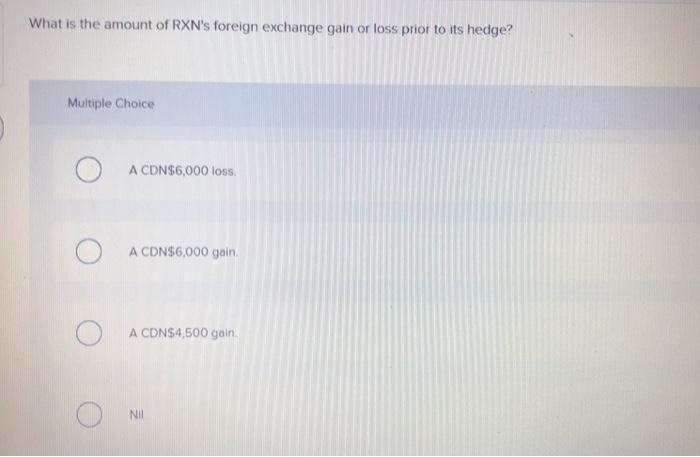

RXN's year end is on December 31 On November t, 2019 when the U.S. dollar was worth CDNS1.365, RXN soid merchandese to an American cient for USS300.000. Full payment of this invoice was expected by March 1, 2020. On December 1, the spot rate was CDNS1.3450, and the mree-month forward rate was CDNS1.3250 In order to minimize its Foreign Exchange risk and exposure, RXN entered into a forward contract with its bank on December 1, 2019 to deliver USS300.000 in three months time The spot rate at year-end was CDNS136 and the forward rate from December 31, 2019 to Maich 1,2020 was CDNS134. On March 1, 2020, RXN received the US$300,000 from its client and settled its contract with the bank The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows Forwerd Rates Spot Retes US$1 - CONS1.365 November 1, 2019 (Transaction date) December 1, 2019 (Hedged date) December 31, 2019 (Year-end) March 1, 2020 (Settlement date) US$1= CDNS1.3450 US$1= CONS1.3250 CDNS1.36 CDNS1.34 US$1= CDNS1.368. USS1- CDNS1.368 "for contracts expiring on March 1, 2020 What is the amount of RXN's foreign exchange gain or loss prior to its hedge? Multiple Choice A CDN$6,000 loss. A CDN$6,000 gain. A CDN$4,500 gain. NI

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

foreign exchange gain l loss is chonge in vave of monetary item ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started