Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Basically, can someone show me the solutions for the following T accounts: - Goodwill - Investment in Stake plc - Deferred Consideration Payable Account -

Basically, can someone show me the solutions for the following T accounts:

- Goodwill

- Investment in Stake plc

- Deferred Consideration Payable Account

- Contingent Cash Consideration Payable Account

- Group Plant Account

- Group Machinery Account

- Investment in Axe account

- Group Inventory

- Group Receivables

- Group Bank Account

- S Retained Profit Account

- Group Retained Profit Account

- NCI account

- Group Payable Account

- Equity Shares Account (Parent)

- Share Premium Account (Parent)

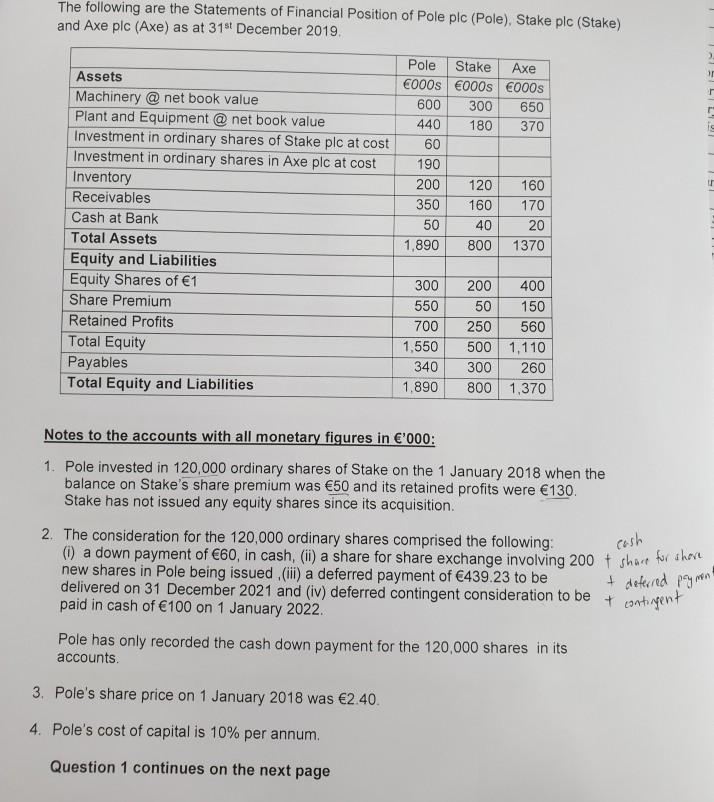

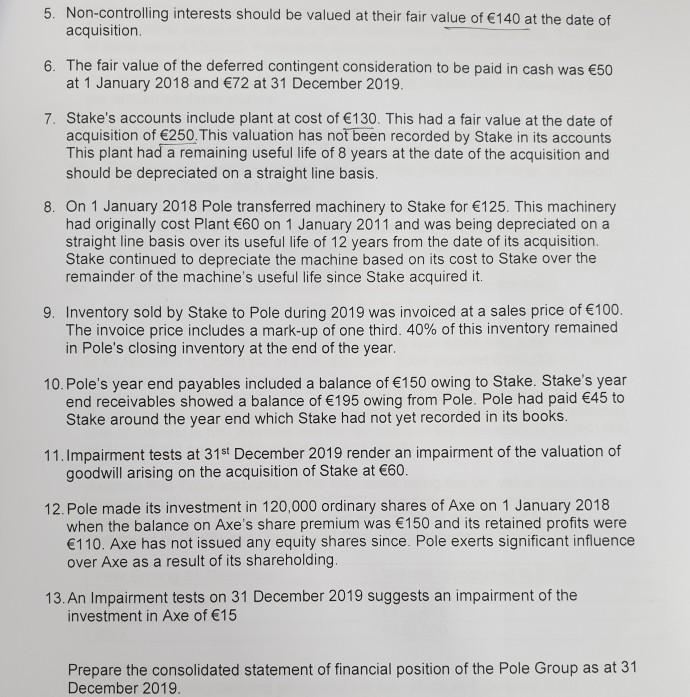

The following are the Statements of Financial Position of Pole plc (Pole), Stake plc (Stake) and Axe plc (Axe) as at 31st December 2019. Assets Machinery @ net book value Plant and Equipment @ net book value Investment in ordinary shares of Stake plc at cost Investment in ordinary shares in Axe plc at cost Inventory Receivables Cash at Bank Total Assets Equity and Liabilities Equity Shares of 1 Share Premium Retained Profits Total Equity Payables Total Equity and Liabilities Axe Pole Stake 000s 000s 000s 650 180 370 600 300 440 60 190 200 350 50 1,890 3. Pole's share price on 1 January 2018 was 2.40. 4. Pole's cost of capital is 10% per annum. Question 1 continues on the next page 120 160 160 170 40 20 800 1370 1,550 340 1,890 400 150 560 500 1,110 300 260 800 1,370 300 550 700 250 200 50 Notes to the accounts with all monetary figures in '000: 1. Pole invested in 120,000 ordinary shares of Stake on the 1 January 2018 when the balance on Stake's share premium was 50 and its retained profits were 130. Stake has not issued any equity shares since its acquisition. Pole has only recorded the cash down payment for the 120,000 shares in its accounts. or 2. The consideration for the 120,000 ordinary shares comprised the following: cash (i) a down payment of 60, in cash, (ii) a share for share exchange involving 200 + share for shore new shares in Pole being issued ,(iii) a deferred payment of 439.23 to be delivered on 31 December 2021 and (iv) deferred contingent consideration to be paid in cash of 100 on 1 January 2022. + deferred payment + contingent tr

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the T accounts for the given financial transactions we need to analyze the information pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started