Question

University Club had a budget cut from the government. Now the ??club is planning on the below course of action. 1) The first was to

University Club had a budget cut from the government. Now the ??club is planning on the below course of action.

1) The first was to increase the membership from $10 and above. 2) Make club membership mandatory but Union permission is required and Club is hesitant to approach them due to cumbersome rules or 3) Close the club.

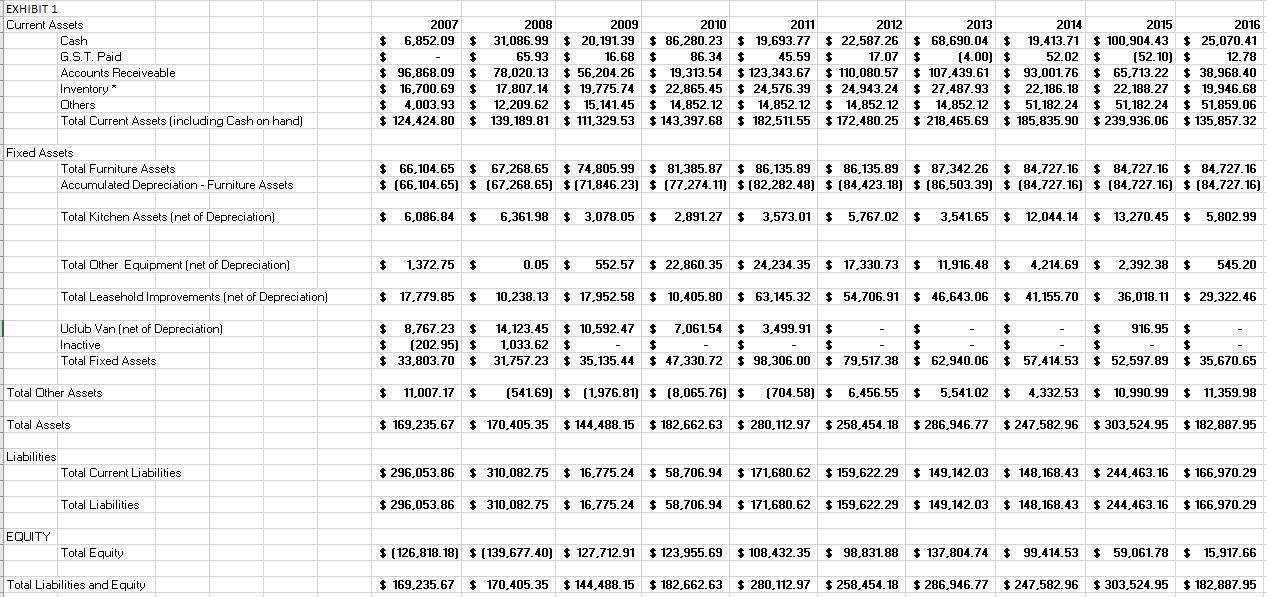

Note: G.S.T. = goods and services tax; * Inventory includes food and liquor.

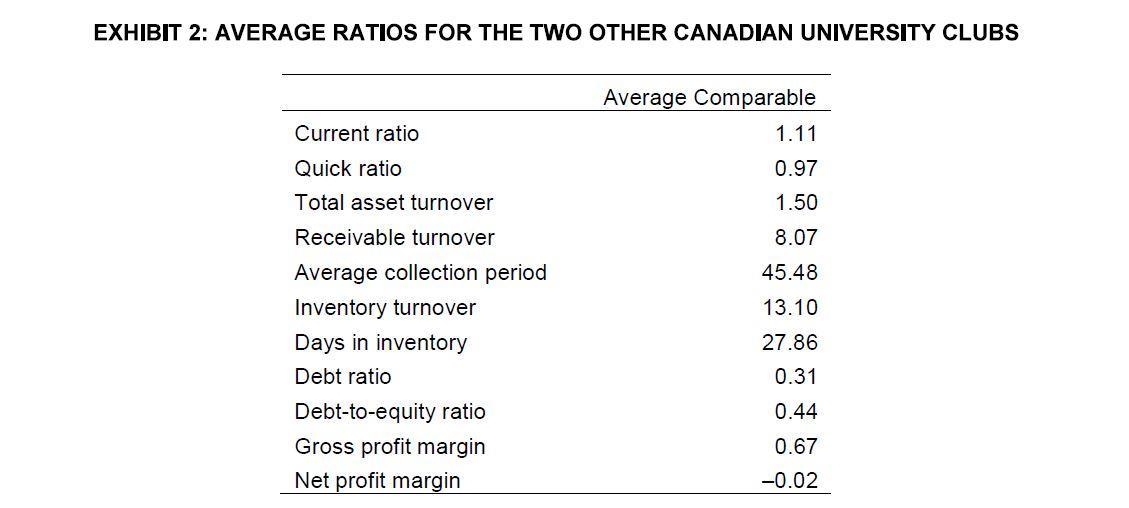

Ratio analysis would reveal whether the club was viable, or could be made viable, without university subsidy. Deeper analysis will identify issues hidden in the numbers, which if addressed properly, could help revitalize the club.

Calculate and interpret financial ratios as analytical tools for decision-making and using both quantitative and qualitative information, what should the board do?

?EXHIBIT 1 Current Assets Cash G.S.T. Paid Accounts Receiveable Inventory * Others Total Current Assets (including Cash on hand) Fixed Assets Total Furniture Assets Accumulated Depreciation - Furniture Assets Liabilities Total Kitchen Assets (net of Depreciation) Total Other Assets EQUITY Total Other Equipment (net of Depreciation) Total Leasehold Improvements (net of Depreciation) Uclub Van (net of Depreciation) Inactive Total Fixed Assets Total Assets Total Current Liabilities: Total Liabilities Total Equity Total Liabilities and Equity 2007 2010 2011 2012 2013 2014 2016 $ 17.07 $ (4.00) $ 12.78 2008 2009 $ 6,852.09 $ 31,086.99 $ 20,191.39 $ 86,280.23 $ 19,693.77 $ 22,587.26 $ 68,690.04 $ 19,413.71 $100,904.43 $ 25,070.41 $ 65.93 $ 16.68 $ 86.34 $ 45.59 $ 52.02 $ (52.10) $ $ 96,868.09 $ 78,020.13 $ 56,204.26 $ 19,313.54 $ 123,343.67 $ 110,080.57 $ 107,439.61 $ 93,001.76 $ 65,713.22 $ 16,700.69 $ 17,807.14 $ 19,775.74 $ 22,865.45 $ 24,576.39 $ 24,943.24 $27.487.93 $ 22,186.18 $ 22,188.27 $ 4,003.93 $ 12,209.62 $ 15,141.45 $ 14,852.12 $ 14,852.12 $ 14,852.12 $ 14,852.12 $ 51,182.24 $ 51,182.24 $ 124,424.80 $ 139,189.81 $ 111,329.53 $143,397.68 $ 182,511.55 $172,480.25 $ 218,465.69 $ 185,835.90 $239,936.06 $ 38,968.40 $ 19,946.68 $ 51,859.06 $ 135,857.32 $ 66,104.65 $ 67,268.65 $ (66,104.65) $ (67,268.65) 6,361.98 6,086.84 $ $ $ 2,392.38 $ 545.20 0.05 $ 552.57 $ 22,860.35 $ 24,234.35 $17,330.73 $ 11,916.48 $ 10,238.13 $ 17,952.58 $ 10,405.80 $ 63,145.32 $ 54,706.91 $ 46,643.06 $ 41,155.70 $ 36,018.11 $ 29,322.46 $ $ 14,123.45 $ 10,592.47 $ 7,061.54 $ 3,499.91 $ 1,033.62 $ $ $ $ 31,757.23 $ 35,135.44 $ 47,330.72 $ 98,306.00 $ 79,517.38 $ 916.95 $ $ $ $ $ $ 62,940.06 $ 57,414.53 $ 52,597.89 $ 35,670.65 (541.69) $ (1,976.81) $ (8,065.76) $ (704.58) $ 6,456.55 $ 5,541.02 $ 4,332.53 $ 10,990.99 $ 11,359.98 $ 169,235.67 $170,405.35 $144,488.15 $182,662.63 $ 280,112.97 $ 258,454.18 $286,946.77 $247,582.96 $303,524.95 $182,887.95 1,372.75 $ $ 17,779.85 $ $ $ $ 8,767.23 $ (202.95) $ 33,803.70 $ $ 11,007.17 $ 2015 $74,805.99 $ 81,385.87 $ 86.135.89 $ 86.135.89 $ 87,342.26 $ 84,727.16 $ 84,727.16 $ 84,727.16 $ (71,846.23) $ (77,274.11) $ (82,282.48) $ (84,423.18) $ (86,503.39) $ (84,727.16) $ ([84,727.16) $ (84,727.16) $3,078.05 $ 2,891.27 $ 3,573.01 $ 5,767.02 $ 3,541.65 $ 12,044.14 $ 13,270.45 $ 5,802.99 4,214.69 $ $296,053.86 $ 310,082.75 $ 16,775.24 $ 58,706.94 $171,680.62 $159,622.29 $ 149,142.03 $ 148,168.43 $296,053.86 $ 310,082.75 $ 16,775.24 $ 58,706.94 $171,680.62 $159,622.29 $ 149,142.03 $ 148,168.43 244,463.16 $ 166,970.29 244,463.16 $ 244,463.16 $ 166,970.29 $(126,818.18) $ (139,677.40) $127.712.91 $123,955.69 $ 108,432.35 $ 98,831.88 $ 137,804.74 $ 99,414.53 $ 59,061.78 $ 169,235.67 $ 170,405.35 $144,488.15 $182.662.63 $280,112.97 $258,454.18 $286,946.77 $247.582.96 $303,524.95 $ 15,917.66 $ 182,887.95

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

lantative analysis 2000 Inventory 12 Receivable Inventory and Receivable turn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started