Question

Accounts receivable are funds due from a customer and a firm's credit policy has a direct impact on the level of receivables held by a

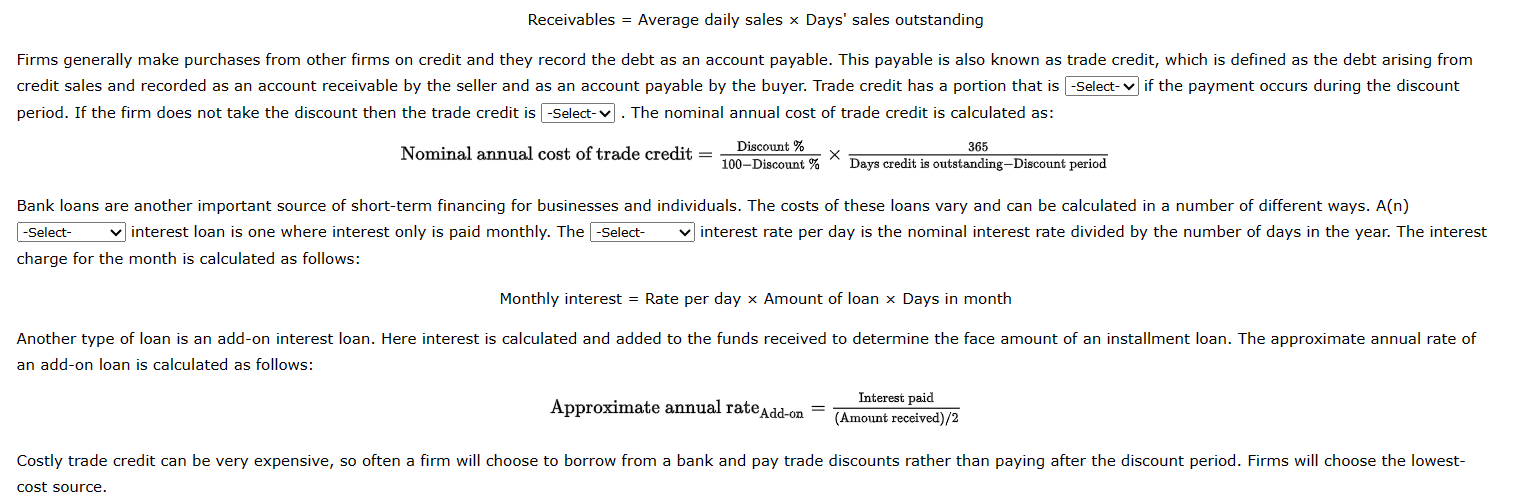

Accounts receivable are funds due from a customer and a firm's credit policy has a direct impact on the level of receivables held by a firm. The credit policy is a set of rules that consists of four variables: credit period, discounts, credit standards, and collection policy. The credit period is the length of time customers have to pay for purchases; discounts are price reductions given for early payments; credit standards reflect the financial strength of customers that must be exhibited to qualify for credit; and the collection policy is the degree of toughness in enforcing the credit terms. Credit policy is important for three major reasons: (1) It has a major effect on sales. (2) It influences the amount of funds tied up in receivables. (3) It affects bad debt losses. The total amount of accounts receivable outstanding at any given time is determined by the volume of credit sales and the average length of time between sales and collections. This equation can be written as:

Receivables = Average daily sales Days' sales outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started