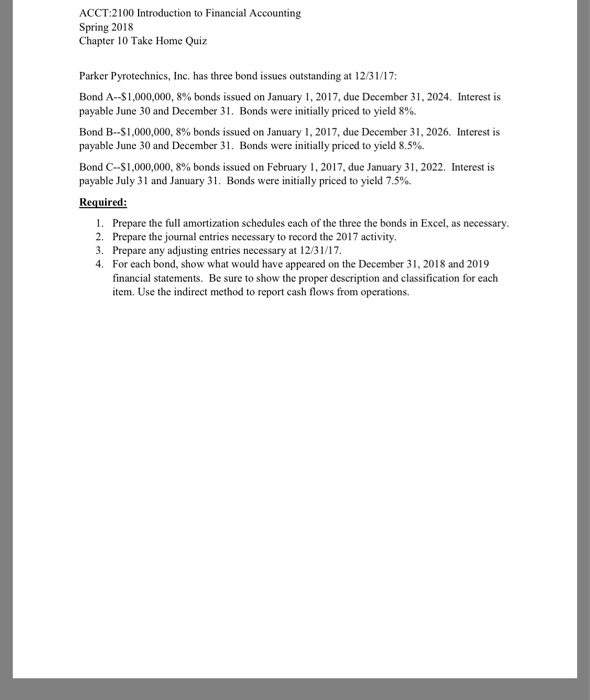

ACCT 2100 Introduction to Financial Accounting Spring 2018 Chapter 10 Take Home Quiz Parker Pyrotechnics, Inc. has three bond issues outstanding at 12/31/17 Interest is Bond A--$ 1,000,000, 8% bonds issued on January 1, 2017, due December 31 , 2024. payable June 30 and December 31 . Bonds were initially priced to yield 8%. Bond B--$1,000,000, 8% bonds issued on January 1, 2017, due December 31, 2026. Interest is payable June 30 and December 31 . Bonds were initially priced to yield 8.5%. Bond C--S 1,000,000, 8% bonds issued on February 1 , 2017, due January 31, 2022. Interest is payable July 31 and January 31, Bonds were initially priced to yield 7.5%. Required: 1. Prepare the full amortization schedules each of the three the bonds in Excel, as necessary 2. Prepare the journal entries necessary to record the 2017 activity. 3. Prepare any adjusting entries necessary at 12/31/17 4. For each bond, show what would have appeared on the December 31, 2018 and 2019 financial statements. Be sure to show the proper description and classification for each item. Use the indirect method to report cash flows from operations. ACCT 2100 Introduction to Financial Accounting Spring 2018 Chapter 10 Take Home Quiz Parker Pyrotechnics, Inc. has three bond issues outstanding at 12/31/17 Interest is Bond A--$ 1,000,000, 8% bonds issued on January 1, 2017, due December 31 , 2024. payable June 30 and December 31 . Bonds were initially priced to yield 8%. Bond B--$1,000,000, 8% bonds issued on January 1, 2017, due December 31, 2026. Interest is payable June 30 and December 31 . Bonds were initially priced to yield 8.5%. Bond C--S 1,000,000, 8% bonds issued on February 1 , 2017, due January 31, 2022. Interest is payable July 31 and January 31, Bonds were initially priced to yield 7.5%. Required: 1. Prepare the full amortization schedules each of the three the bonds in Excel, as necessary 2. Prepare the journal entries necessary to record the 2017 activity. 3. Prepare any adjusting entries necessary at 12/31/17 4. For each bond, show what would have appeared on the December 31, 2018 and 2019 financial statements. Be sure to show the proper description and classification for each item. Use the indirect method to report cash flows from operations