Answered step by step

Verified Expert Solution

Question

1 Approved Answer

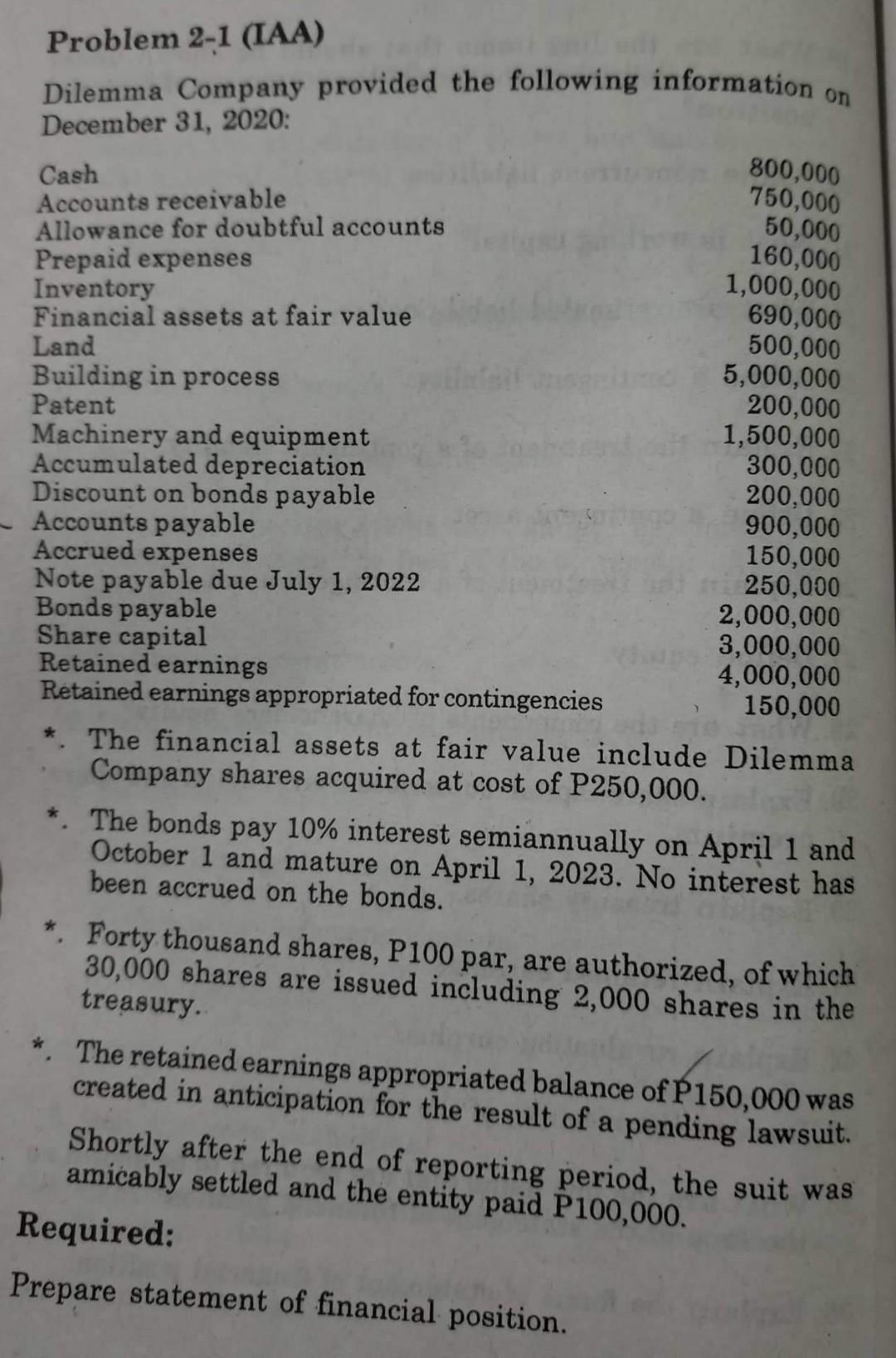

PRepare a statement of Financial Position. Thankyou so much Problem 2-1 (IAA) Dilemma Company provided the following information on December 31, 2020: 800,000 Cash 750,000

PRepare a statement of Financial Position. Thankyou so much

Problem 2-1 (IAA) Dilemma Company provided the following information on December 31, 2020: 800,000 Cash 750,000 Accounts receivable 50,000 Allowance for doubtful accounts 160,000 Prepaid expenses 1,000,000 Inventory 690,000 Financial assets at fair value 500,000 Land 5,000,000 Building in process 200,000 Patent Machinery and equipment 1,500,000 Accumulated depreciation 300,000 Discount on bonds payable 200,000 Accounts payable 900,000 Accrued expenses 150,000 Note payable due July 1, 2022 250,000 Bonds payable 2,000,000 Share capital 3,000,000 Retained earnings 4,000,000 Retained earnings appropriated for contingencies 150,000 *. The financial assets at fair value include Dilemma Company shares acquired at cost of P250,000. * The bonds pay 10% interest semiannually on April 1 and October 1 and mature on April 1, 2023. No interest has been accrued on the bonds. * Forty thousand shares, P100 par, are authorized, of which 30,000 shares are issued including 2,000 shares in the treasury. * The retained earnings appropriated balance of P150,000 was created in anticipation for the result of a pending lawsuit. Shortly after the end of reporting period, the suit was amicably settled and the entity paid P100,000. Required: Prepare statement of financial positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started