Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCT2036 Fall 2018 Assignment Please prepare solutions to the two exercises below. I will accept HANDWRITTEN RESPONSES ONLY; marks will be deducted for typed submissions.

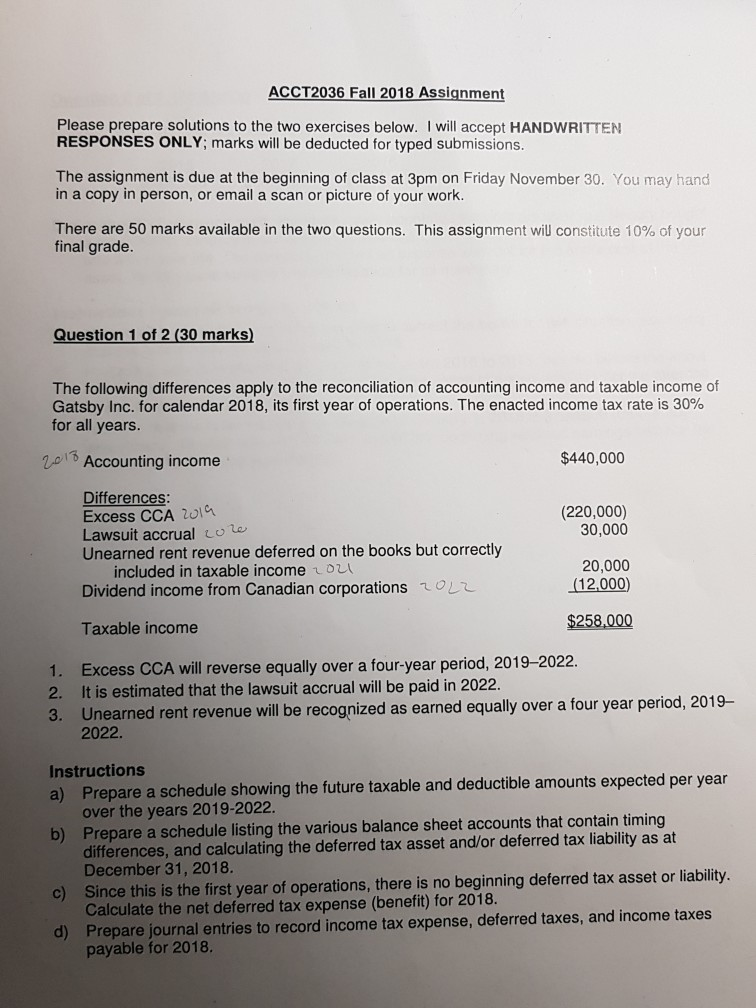

ACCT2036 Fall 2018 Assignment Please prepare solutions to the two exercises below. I will accept HANDWRITTEN RESPONSES ONLY; marks will be deducted for typed submissions. The assignment is due at the beginning of class at 3pm on Friday November 30. You may hand in a copy in person, or email a scan or picture of your work. There are 50 marks available in the two questions. This assignment will constitute 10% of your final grade. Question 1 of 2 (30 marks) The following differences apply to the reconciliation of accounting income and taxable income of Gatsby Inc. for calendar 2018, its first year of operations. The enacted income tax rate is 30% for all years. al Accounting income $440,000 Differences; Excess CCA 201 Lawsuit accrual Lol Unearned rent revenue deferred on the books but correctly (220,000) 30,000 included in taxable income LoL Dividend income from Canadian corporations 20,000 (12.000) Taxable income $258,000 1. Excess CCA will reverse equally over a four-year period, 2019-2022 2. It is estimated that the lawsuit accrual will be paid in 2022. 3. Unearned rent revenue will be recognized as earned equally over a four year period, 2019- 2022. Instructions a) Prepare a schedule showing the future taxable and deductible amounts expected b) Prepare a schedule listing the various balance sheet accounts that contain timing c) Since this is the first year of operations, there is no beginning deferred tax asset or liability. d) Prepare journal entries to record income tax expense, deferred taxes, and income taxes per year over the years 2019-2022 differences, and calculating the deferred tax asset and/or deferred tax liability as at December 31, 2018. Calculate the net deferred tax expense (benefit) for 2018. payable for 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started