Answered step by step

Verified Expert Solution

Question

1 Approved Answer

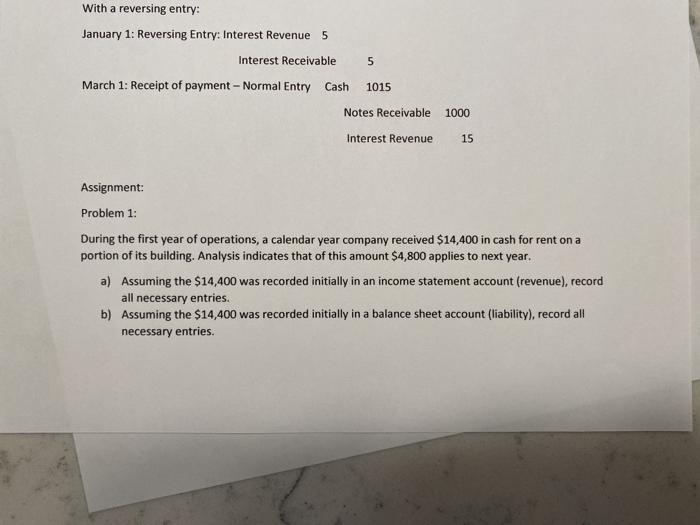

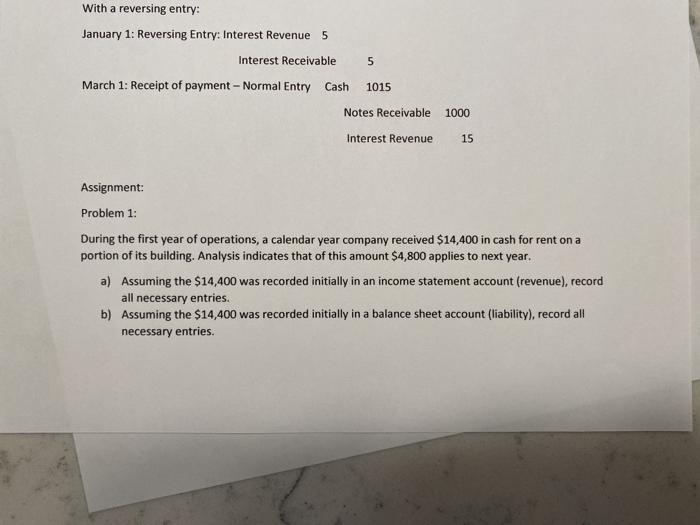

accurals and defferals With a reversing entry: January 1: Reversing Entry: Interest Revenue 5 Interest Receivable 5 March 1: Receipt of payment - Normal Entry

accurals and defferals

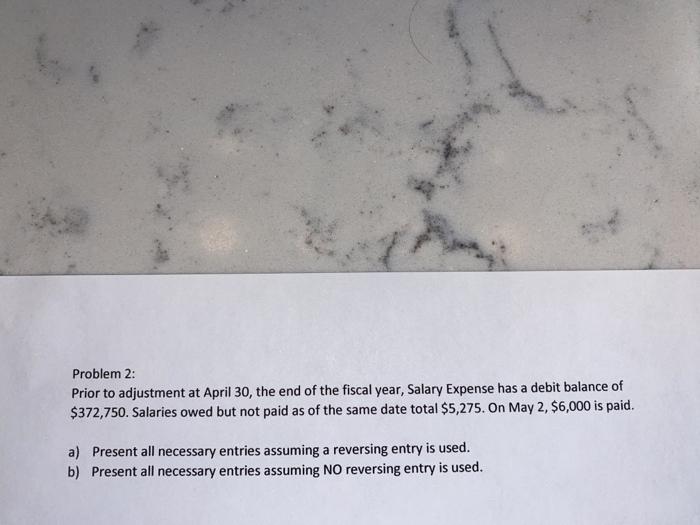

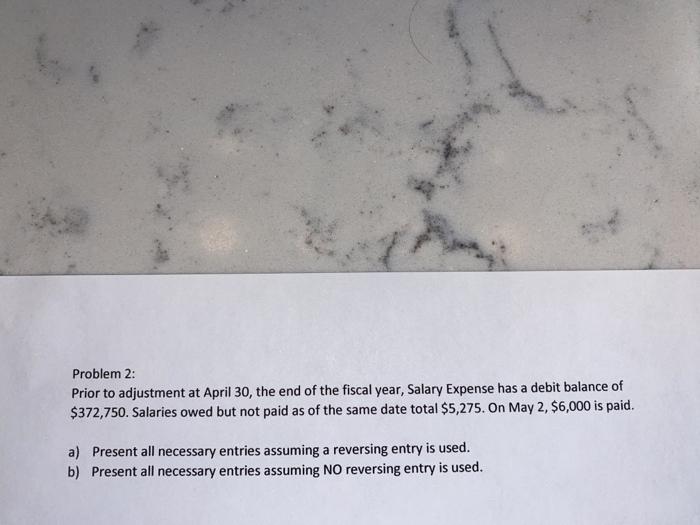

With a reversing entry: January 1: Reversing Entry: Interest Revenue 5 Interest Receivable 5 March 1: Receipt of payment - Normal Entry Cash 1015 Notes Receivable 1000 Interest Revenue 15 Assignment: Problem 1: During the first year of operations, a calendar year company received $14,400 in cash for rent on a portion of its building. Analysis indicates that of this amount $4,800 applies to next year. a) Assuming the $14,400 was recorded initially in an income statement account (revenue), record all necessary entries. b) Assuming the $14,400 was recorded initially in a balance sheet account (liability), record all necessary entries. Problem 2: Prior to adjustment at April 30, the end of the fiscal year, Salary Expense has a debit balance of $372,750. Salaries owed but not paid as of the same date total $5,275. On May 2, $6,000 is paid. a) Present all necessary entries assuming a reversing entry is used. b) Present all necessary entries assuming NO reversing entry is used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started