Answered step by step

Verified Expert Solution

Question

1 Approved Answer

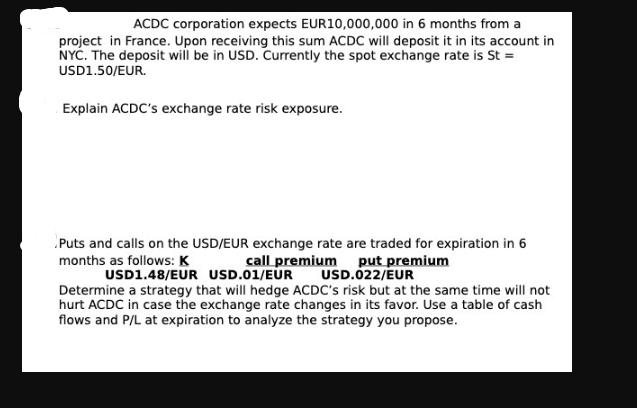

ACDC corporation expects EUR10,000,000 in 6 months from a project in France. Upon receiving this sum ACDC will deposit it in its account in

ACDC corporation expects EUR10,000,000 in 6 months from a project in France. Upon receiving this sum ACDC will deposit it in its account in NYC. The deposit will be in USD. Currently the spot exchange rate is St = USD1.50/EUR. Explain ACDC's exchange rate risk exposure. Puts and calls on the USD/EUR exchange rate are traded for expiration in 6 months as follows: K put premium USD.022/EUR USD1.48/EUR USD.01/EUR call premium Determine a strategy that will hedge ACDC's risk but at the same time will not hurt ACDC in case the exchange rate changes in its favor. Use a table of cash flows and P/L at expiration to analyze the strategy you propose.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ACDCs Exchange Rate Risk Exposure ACDC corporation is exposed to exchange rate risk due to the fact that it expects to receive EUR10000000 in 6 months ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started