Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ace acount title Net Assets Released from Restriction is reported as a Revenue account. A. Suspense account (similar to a contra-revenue), C. Expense account. D.

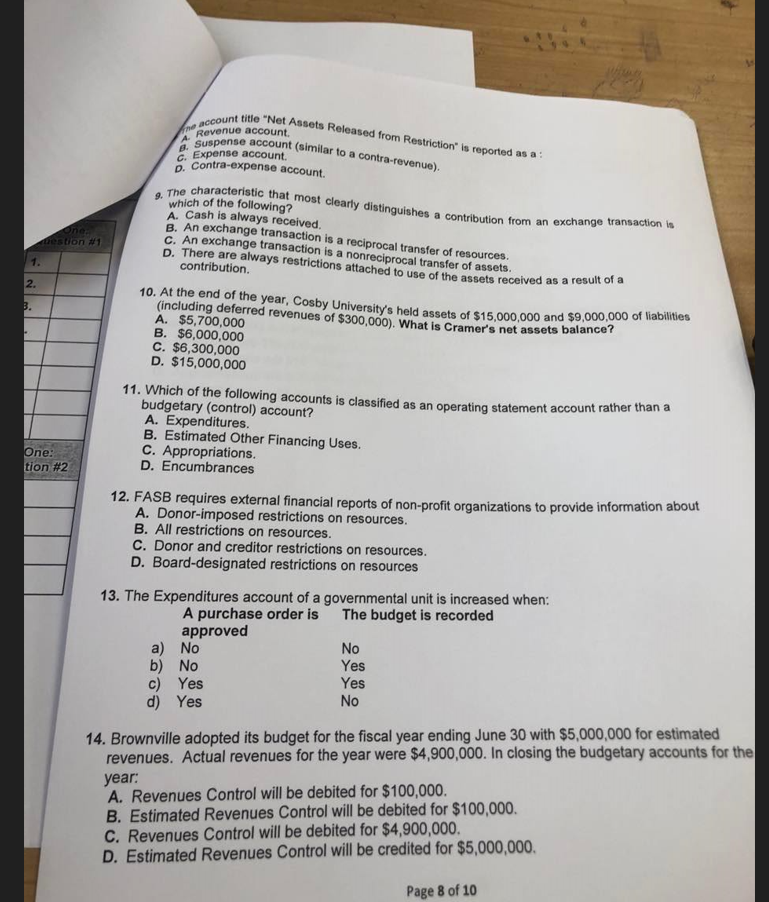

ace acount title "Net Assets Released from Restriction" is reported as a Revenue account. A. Suspense account (similar to a contra-revenue), C. Expense account. D. Contra-expense account. 9. The characteristic that most clearly distinguishes a contribution from an exchange transaction is which of the following? A. Cash is always received B. An exchange transaction is a reciprocal transfer of resources. C. An exchange transaction is a nonreciprocal transfer of assets. D. There are always restrictions attached to use of the assets received as a result of a contribution. 10. At the end of the year, Cosby University's held assets of $15,000,000 and $9,000,000 of liabilities (including deferred revenues of $300,000). What is Cramer's net assets balance? A. $5,700,000 B. $6,000,000 C. $6,300,000 D. $15,000,000 11. Which of the following accounts is classified as an operating statement account rather than a budgetary (control) account? A. Expenditures. B. Estimated Other Financing Uses. C. Appropriations. D. Encumbrances 12. FASB requires external financial reports of non-profit organizations to provide information about A. Donor-imposed restrictions on resources. B. All restrictions on resources. C. Donor and creditor restrictions on resources. D. Board-designated restrictions on resources 13. The Expenditures account of a governmental unit is increased when: A purchase order is The budget is recorded approved a) No b) No No c) Yes Yes d) Yes Yes No 14. Brownville adopted its budget for the fiscal year ending June 30 with $5,000,000 for estimated revenues. Actual revenues for the year were $4,900,000. In closing the budgetary accounts for the year: A. Revenues Control will be debited for $100,000. B. Estimated Revenues Control will be debited for $100,000. C. Revenues Control will be debited for $4,900,000. D. Estimated Revenues Control will be credited for $5,000,000

ace acount title "Net Assets Released from Restriction" is reported as a Revenue account. A. Suspense account (similar to a contra-revenue), C. Expense account. D. Contra-expense account. 9. The characteristic that most clearly distinguishes a contribution from an exchange transaction is which of the following? A. Cash is always received B. An exchange transaction is a reciprocal transfer of resources. C. An exchange transaction is a nonreciprocal transfer of assets. D. There are always restrictions attached to use of the assets received as a result of a contribution. 10. At the end of the year, Cosby University's held assets of $15,000,000 and $9,000,000 of liabilities (including deferred revenues of $300,000). What is Cramer's net assets balance? A. $5,700,000 B. $6,000,000 C. $6,300,000 D. $15,000,000 11. Which of the following accounts is classified as an operating statement account rather than a budgetary (control) account? A. Expenditures. B. Estimated Other Financing Uses. C. Appropriations. D. Encumbrances 12. FASB requires external financial reports of non-profit organizations to provide information about A. Donor-imposed restrictions on resources. B. All restrictions on resources. C. Donor and creditor restrictions on resources. D. Board-designated restrictions on resources 13. The Expenditures account of a governmental unit is increased when: A purchase order is The budget is recorded approved a) No b) No No c) Yes Yes d) Yes Yes No 14. Brownville adopted its budget for the fiscal year ending June 30 with $5,000,000 for estimated revenues. Actual revenues for the year were $4,900,000. In closing the budgetary accounts for the year: A. Revenues Control will be debited for $100,000. B. Estimated Revenues Control will be debited for $100,000. C. Revenues Control will be debited for $4,900,000. D. Estimated Revenues Control will be credited for $5,000,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started