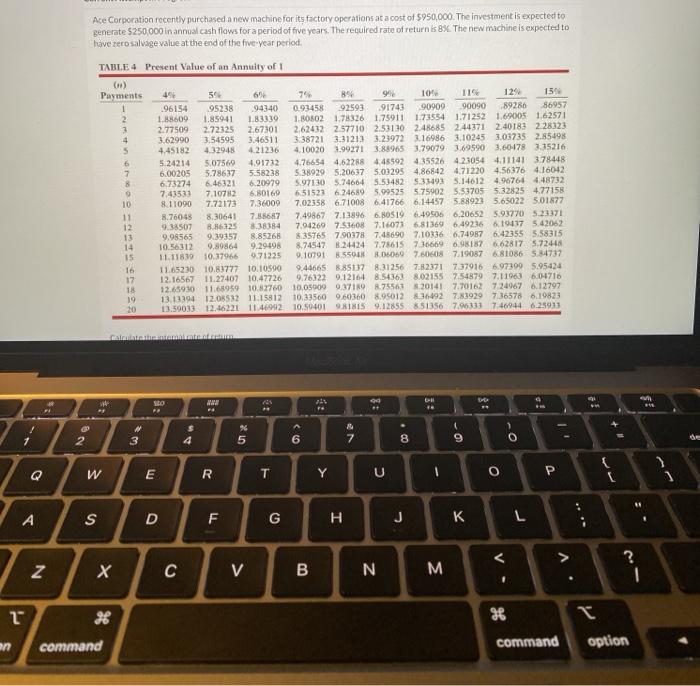

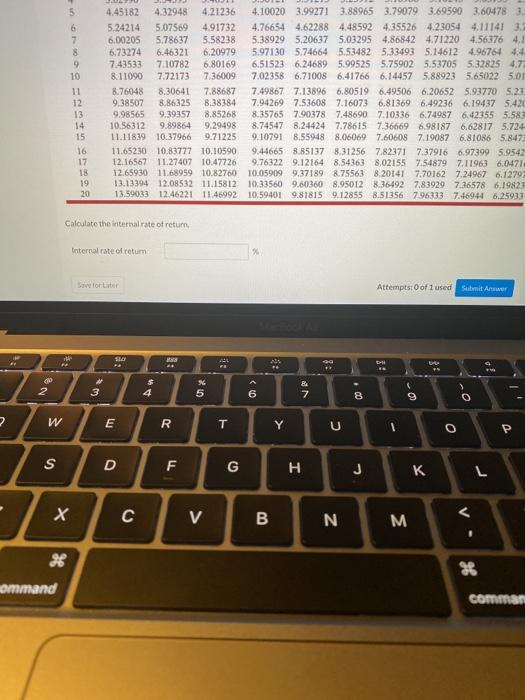

Ace Corporation recently purchased a new machine for its factory operations at a cost of $950,000. The investment is expected to generate $250,000 in annual cash flows for a period of five years. The required rate of return is 8%. The new machine is expected to have rero salvage value at the end of the five-year period, TABLE4 Present Value of an Annuity of 6) Payments 490 59 69 74 994 10 129 154 96154 95238 94340 0.93458 92593 91743 90909 90090 89286 86957 2 1.68609 1.85941 1.83330 1.80502 1.78326 1.75911 1.73554 1.71252 1.6.2005 1.62571 3 2.77509 2.72325 2.67301 2.62432 257710 2.53130 2.48685 2.44371 2.40183 228323 3.62990 3.54595 3.46511 3.38721 3.312133.23972 3.16986 3.10245 3.03735 2.85498 5 4.45182 4.32948 4.21236 4.10020.99271 3.88965 3.79079 3.69590 3.60478 3.35216 6 5.24214 5.07569 4.91732 4.76654 4.62288 4.45592 435526 4.23054 4.11141 3.78448 7 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86542 4.712204.56376 4.16042 8 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33498 5.146124.96764 448732 0 7.43533 7.10782 6.80160 6.51521 6.24689 5.99525 5.759025.53705 5.32825 4.77158 10 8.11090 7.72173 7.36009 7.02358 6.71008 6,417666.14457 5.88923 5.650225.01877 11 8.76045 8,30641 7.55687 7.49867 7.13896 6.80519 6.49506 6,20652 5.93770 S.23371 12 9.38507 8.86125 8.38384 7.942697.516087.16073 6.813696.49236 610417 5.42062 13 9.98565 9.39357 8.85268 8.35765 790378 7.45690 7.10336 6.74987 6.42355 5.58315 14 10.56312 9.89864 9.29498 8.74547 24424 2.75615730669 6.981876.62817 5.72448 15 11.118.19 10.37966 9.71225 9.107915504 .050607.60608 7.19087 6.810865.84737 11.65230 10.83777 10.10590 9.44665 885137 8.312567.823717379166.97399 5.95424 17 12.16567 11.27407 10,47726 9.76322 9.12164 8.54361 8.02155 7.548797.11963 6.04716 18 12.65930 11.68959 10.82760 10.05009 9.371898.75567 20141 7.70162 724967 0.12797 19 13.13394 12.05532 11.15812 10.33560 9.60360 8.05012 36492 7.839297.36578 6.19823 20 13.50033 12.16221 11.46992 10.50401918IS 9.12855 851356 7.96333 7.469446.25933 tanto *** 211 re DHI ce Pe S 4 96 5 8 7 2 3 6 8 0 9 { W E R T Y U P 0 A S D F G H J K L N V B N M * command command option 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3. 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3. 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.1 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 44 7.43533 7.10782 6.80169 6.51523 6.24689599525 5.75902 5.53705 532825 4.77 8.11090 7.72173 7.36009 7.02358 6.71008 6,41766 6.14457 5.88923 5.650225.01 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23 9.38507 8.86325 8.38384 7.94269 7.53608 7.160736.81369 6.49236 6.19437 5.420 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.749876.42355 5.583 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.724 11.11839 10.37966 9.71225 9.10791 8.55948 8.060697.60608 7.190876,81086 5.847 11.65230 10.83777 10.10590 9.446658.85137 8.312567.82371 7.37916 6.97399 5.9542 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7. 11963 6.0471. 12.65930. 11.68959 10.82760 10.059099.371898.755638 20141 7.70162 7.24967 6.1279 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.364927.839297.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.513567.96333 7.469:44 6.25933 Calculate the internal rate of return Internal rate of retum % Store Attempts: 0 of 1 used Submit A SIE . . : 2 $ 4 8 3 % 5 0) N 8 9 O 2 w E R Y U O S D F G H L C V B N M