Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Expander plc wishes to acquire a 70% stake in Target plc by purchasing 280 million of Target's 400 million 1 ordinary shares. Target currently

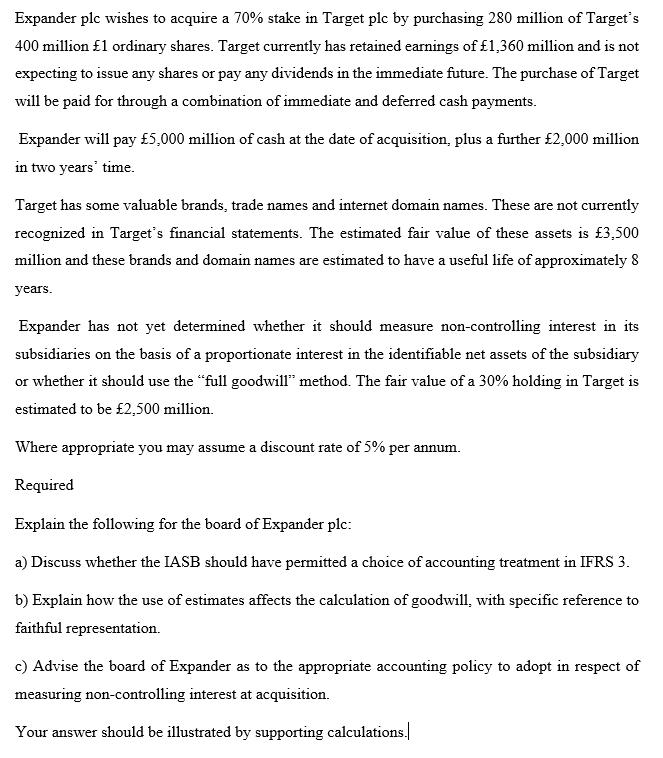

Expander plc wishes to acquire a 70% stake in Target plc by purchasing 280 million of Target's 400 million 1 ordinary shares. Target currently has retained earnings of 1,360 million and is not expecting to issue any shares or pay any dividends in the immediate future. The purchase of Target will be paid for through a combination of immediate and deferred cash payments. Expander will pay 5,000 million of cash at the date of acquisition, plus a further 2,000 million in two years' time. Target has some valuable brands, trade names and internet domain names. These are not currently recognized in Target's financial statements. The estimated fair value of these assets is 3,500 million and these brands and domain names are estimated to have a useful life of approximately 8 years. Expander has not yet determined whether it should measure non-controlling interest in its subsidiaries on the basis of a proportionate interest in the identifiable net assets of the subsidiary or whether it should use the "full goodwill" method. The fair value of a 30% holding in Target is estimated to be 2,500 million. Where appropriate you may assume a discount rate of 5% per annur Required Explain the following for the board of Expander plc: a) Discuss whether the IASB should have permitted a choice of accounting treatment in IFRS 3. b) Explain how the use of estimates affects the calculation of goodwill, with specific reference to faithful representation. c) Advise the board of Expander as to the appropriate accounting policy to adopt in respect of measuring non-controlling interest at acquisition. Your answer should be illustrated by supporting calculations.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started