Answered step by step

Verified Expert Solution

Question

1 Approved Answer

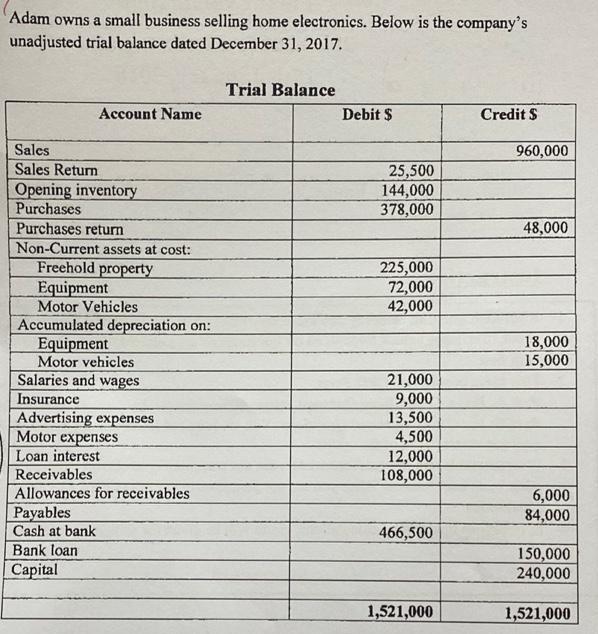

Adam owns a small business selling home electronics. Below is the company's unadjusted trial balance dated December 31, 2017. Sales Sales Return Account Name

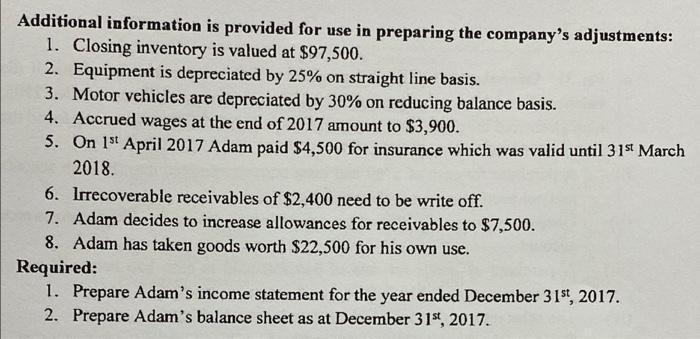

Adam owns a small business selling home electronics. Below is the company's unadjusted trial balance dated December 31, 2017. Sales Sales Return Account Name Opening inventory Purchases Purchases return Non-Current assets at cost: Freehold property Equipment Motor Vehicles Accumulated depreciation on: Equipment Motor vehicles Salaries and wages Insurance Advertising expenses Motor expenses Loan interest Receivables Allowances for receivables Payables Cash at bank Bank loan Capital Trial Balance Debit $ 25,500 144,000 378,000 225,000 72,000 42,000 21,000 9,000 13,500 4,500 12,000 108,000 466,500 1,521,000 Credit S 960,000 48,000 18,000 15,000 6,000 84,000 150,000 240,000 1,521,000 Additional information is provided for use in preparing the company's adjustments: 1. Closing inventory is valued at $97,500. 2. Equipment is depreciated by 25% on straight line basis. 3. Motor vehicles are depreciated by 30% on reducing balance basis. 4. Accrued wages at the end of 2017 amount to $3,900. 5. On 1st April 2017 Adam paid $4,500 for insurance which was valid until 31st March 2018. 6. Irrecoverable receivables of $2,400 need to be write off. 7. Adam decides to increase allowances for receivables to $7,500. 8. Adam has taken goods worth $22,500 for his own use. Required: 1. Prepare Adam's income statement for the year ended December 31st, 2017. 2. Prepare Adam's balance sheet as at December 31st, 2017.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started