Question

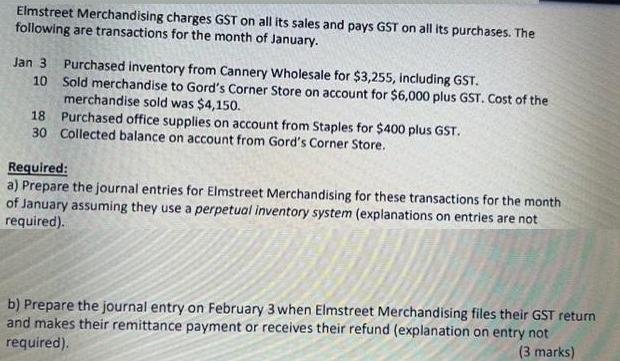

Elmstreet Merchandising charges GST on all its sales and pays GST on all its purchases. The following are transactions for the month of January.

Elmstreet Merchandising charges GST on all its sales and pays GST on all its purchases. The following are transactions for the month of January. Jan 3 Purchased inventory from Cannery Wholesale for $3,255, including GST. 10 Sold merchandise to Gord's Corner Store on account for $6,000 plus GST. Cost of the merchandise sold was $4,150. 18 Purchased office supplies on account from Staples for $400 plus GST. 30 Collected balance on account from Gord's Corner Store. Required: a) Prepare the journal entries for Elmstreet Merchandising for these transactions for the month of January assuming they use a perpetual inventory system (explanations on entries are not required). b) Prepare the journal entry on February 3 when Elmstreet Merchandising files their GST return and makes their remittance payment or receives their refund (explanation on entry not required). (3 marks)

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann L. Johnston, Peter R. Norwood

10th Canadian edition Volume 1

978-0134213101, 134213106, 133855376, 978-0133855371

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App