Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information: 1. On December 31, 2016, Blue acquired 25% of Myers Co.s common stock for $276,600. On that date, the carrying value of Myerss

Additional information:

| 1. | On December 31, 2016, Blue acquired 25% of Myers Co.s common stock for $276,600. On that date, the carrying value of Myerss assets and liabilities, which approximated their fair values, was $1,106,400. Myers reported income of $122,000 for the year ended December 31, 2017. No dividend was paid on Myerss common stock during the year. | |

| 2. | During 2017, Blue loaned $273,800 to TLC Co., an unrelated company. TLC made the first semiannual principal repayment of $21,600, plus interest at 10%, on December 31, 2017. | |

| 3. | On January 2, 2017, Blue sold equipment costing $59,400, with a carrying amount of $37,900, for $40,400 cash. | |

| 4. | On December 31, 2017, Blue entered into a capital lease for an office building. The present value of the annual rental payments is $373,600, which equals the fair value of the building. Blue made the first rental payment of $59,400 when due on January 2, 2018. | |

| 5. | Net income for 2017 was $351,100. | |

| 6. | Blue declared and paid the following cash dividends for 2017 and 2016. |

| 2017 | 2016 | |||

| Declared | December 15, 2017 | December 15, 2016 | ||

| Paid | February 28, 2018 | February 28, 2017 | ||

| Amount | $79,200 | $100,900 |

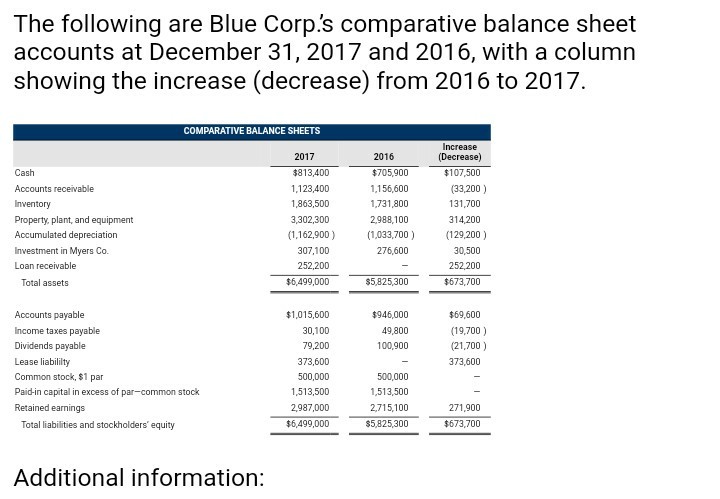

The following are Blue Corp.'s comparative balance sheet accounts at December 31, 2017 and 2016, with a column showing the increase (decrease) from 2016 to 2017. COMPARATIVE BALANCE SHEETS 2016 $705,900 1,156,600 1,731,800 2,988,100 (1,033,700) 2017 $107,500 $813,400 1,123,400 1,863,500 3,302,300 (1,162,900) 307,100 252,200 $6,499,000 Cash Accounts receivable Inventory Property, plant, and equipment (33,200) 131,700 314,200 (129.200) 30,500 252,200 $673,700 Investment in Myers Co Loan receivable 276,600 Total assets 5,825300$673 700 Accounts payable Income taxes payable Dividends payable Lease liabililty Common stock, $1 par Paid-in capital in excess of par-common stock Retained earnings $1,015,600 30,100 79,200 373,600 500,000 1,513,500 2,987,000 $6,499,000 $69,600 (19,700) (21,700) 373,600 $946,000 49,800 100,900 500,000 1,513,500 2,715,100 $5,825,300 271,900 Total liabilities and stockholders equity 673,700 Additional information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started