Answered step by step

Verified Expert Solution

Question

1 Approved Answer

adjusting entries d) Adjusting entries: 10. At year end, the company still owed $2,000 to employee for the last week of work in December, this

adjusting entries

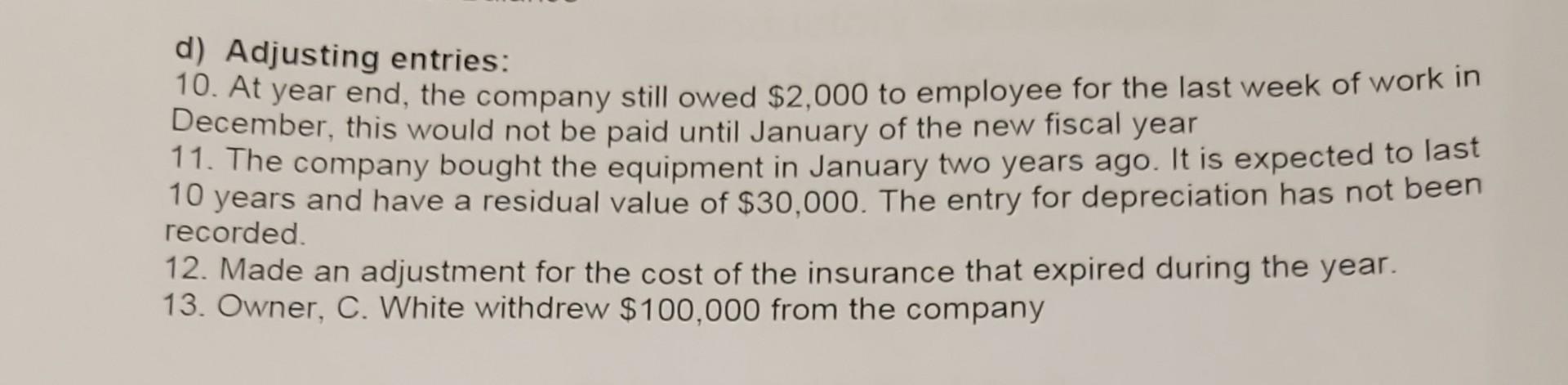

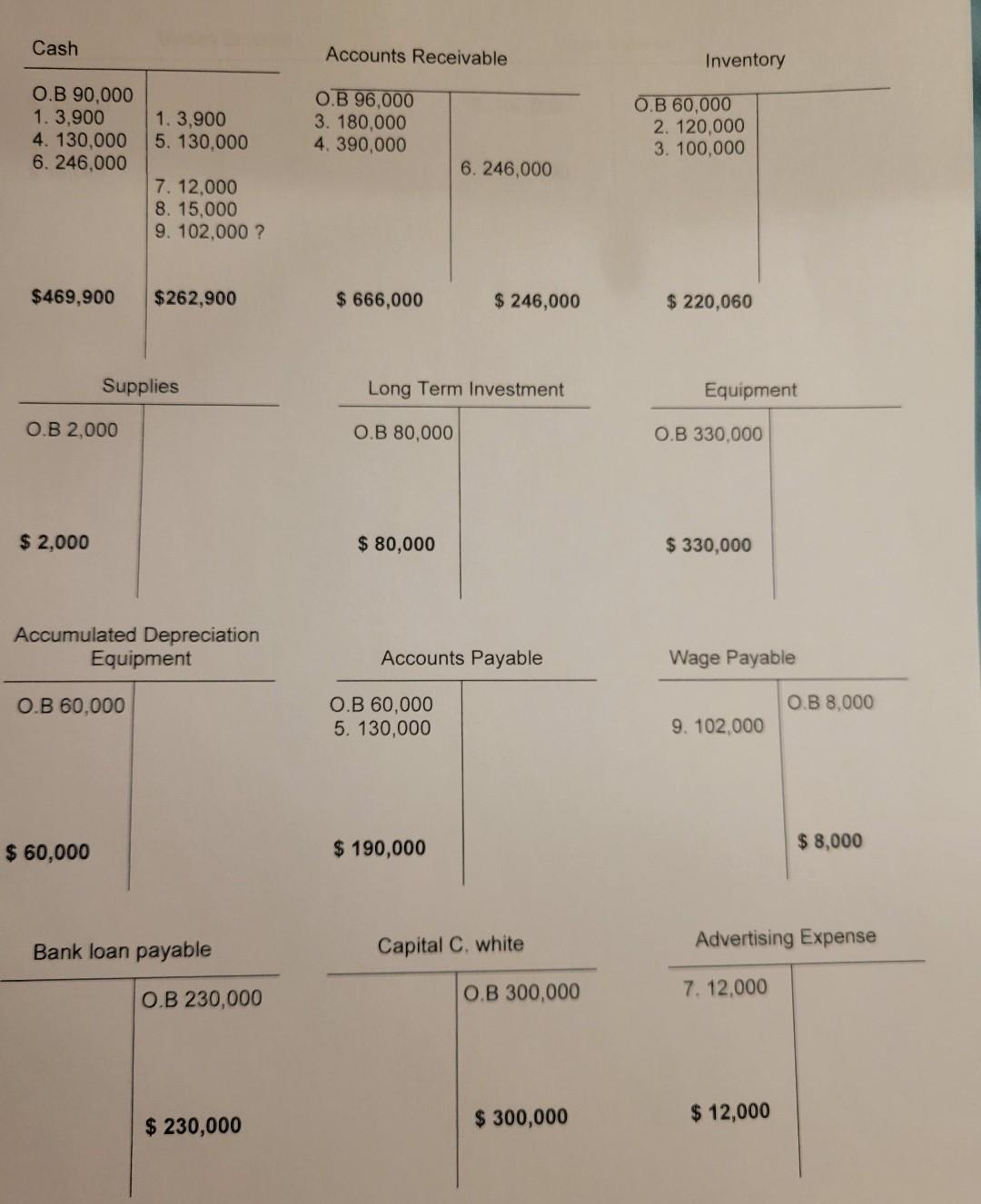

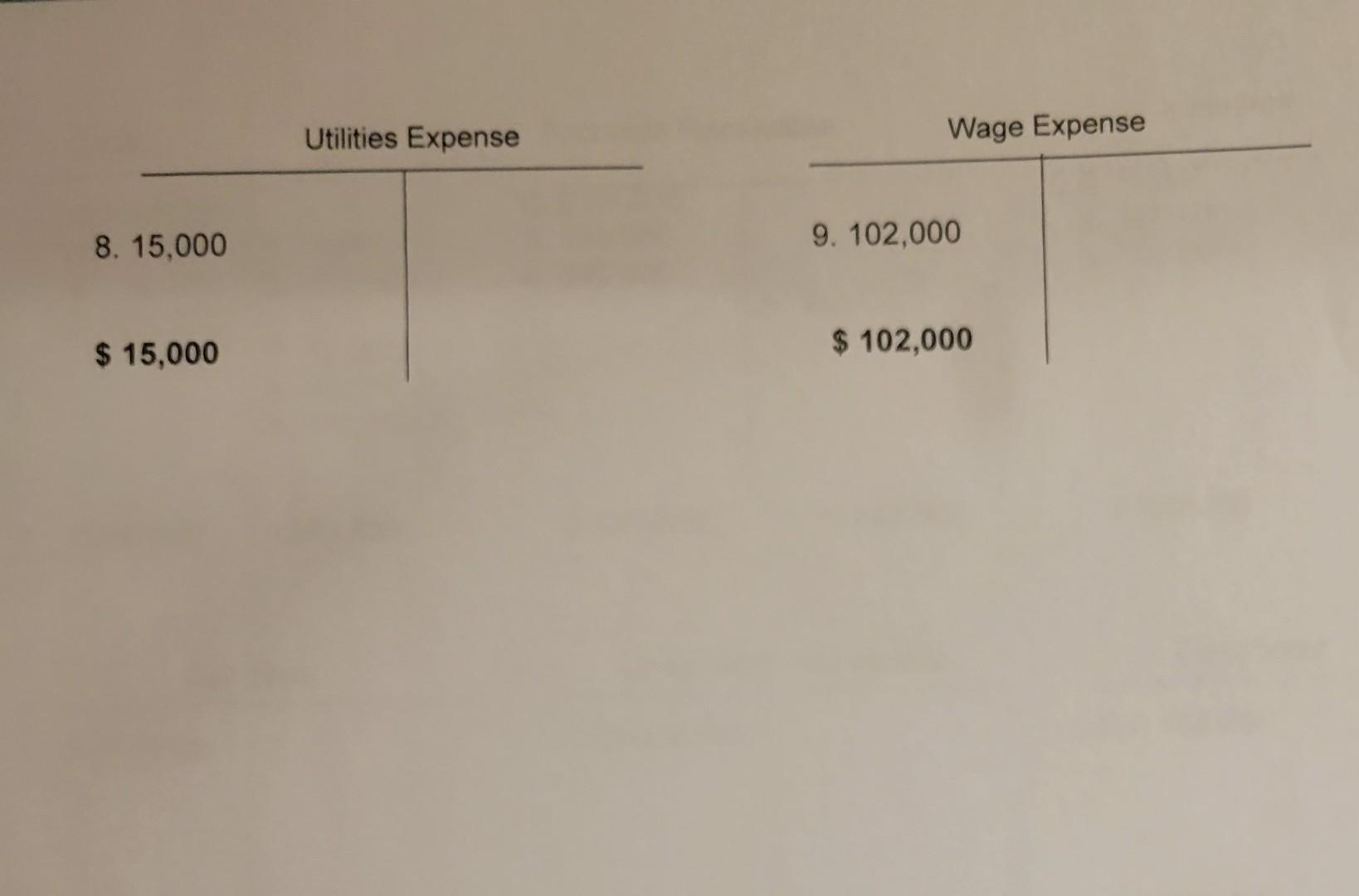

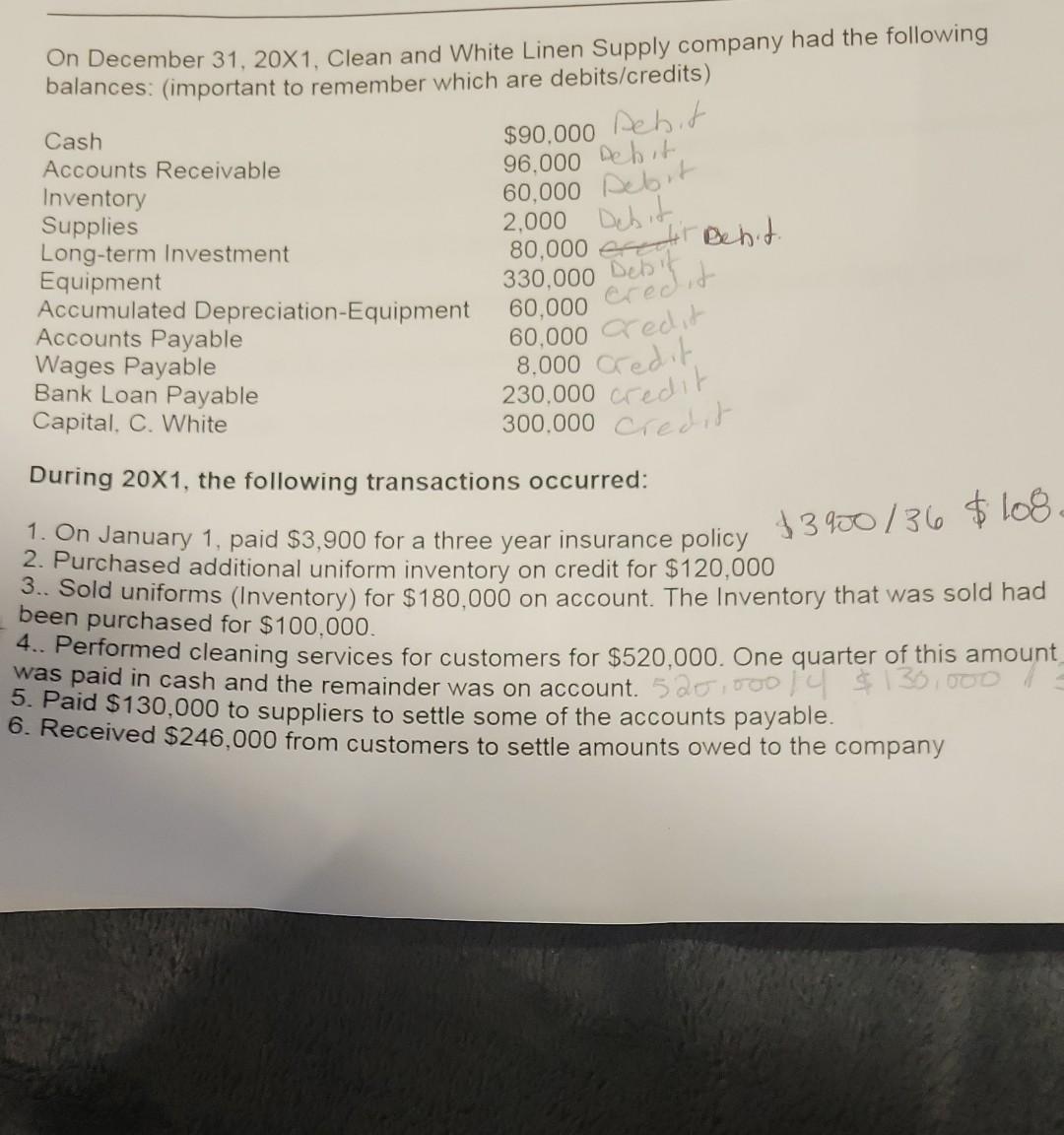

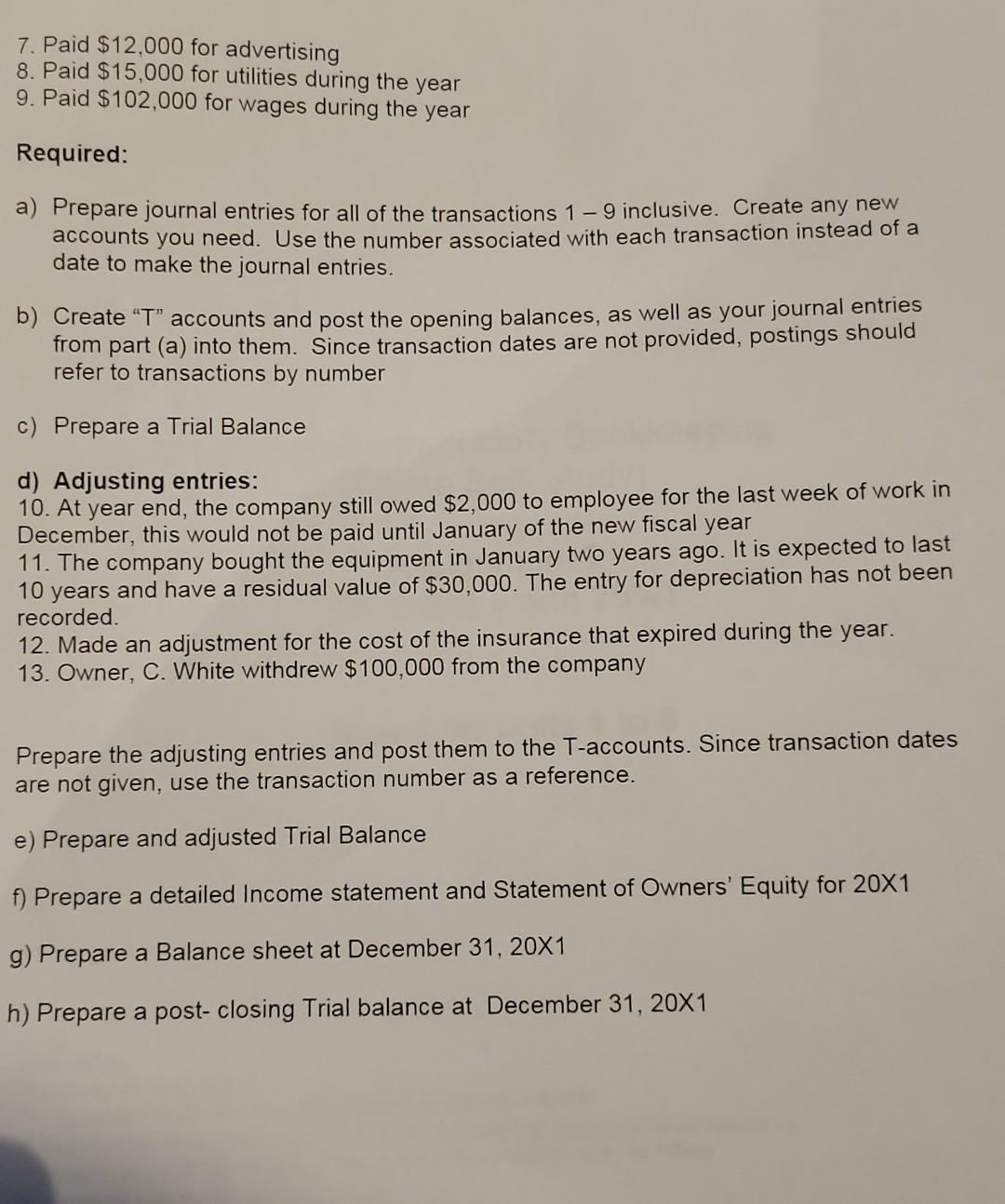

d) Adjusting entries: 10. At year end, the company still owed $2,000 to employee for the last week of work in December, this would not be paid until January of the new fiscal year 11. The company bought the equipment in January two years ago. It is expected to last 10 years and have a residual value of $30,000. The entry for depreciation has not been recorded. 12. Made an adjustment for the cost of the insurance that expired during the year. 13. Owner, C. White withdrew $100,000 from the company Accounts Receivable Inventory Accumulated Depreciation Utilities Expense Wage Expense 8. 15,000 9. 102,000 $15,000 $102,000 On December 31,201, Clean and White Linen Supply company had the following balances: (important to remember which are debits/credits) During 201, the following transactions occurred: 1. On January 1, paid $3,900 for a three year insurance policy $3900/36 \$108 2. Purchased additional uniform inventory on credit for $120,000 3.. Sold uniforms (Inventory) for $180,000 on account. The Inventory that was sold had been purchased for $100,000 4.. Performed cleaning services for customers for $520,000. One quarter of this amoun was paid in cash and the remainder was on account. 5. Paid $130,000 to suppliers to settle some of the accounts payable. 6. Received $246,000 from customers to settle amounts owed to the company 7. Paid $12,000 for advertising 8. Paid $15,000 for utilities during the year 9. Paid $102,000 for wages during the year Required: a) Prepare journal entries for all of the transactions 19 inclusive. Create any new accounts you need. Use the number associated with each transaction instead of a date to make the journal entries. b) Create "T" accounts and post the opening balances, as well as your journal entries from part (a) into them. Since transaction dates are not provided, postings should refer to transactions by number c) Prepare a Trial Balance d) Adjusting entries: 10. At year end, the company still owed $2,000 to employee for the last week of work in December, this would not be paid until January of the new fiscal year 11. The company bought the equipment in January two years ago. It is expected to last 10 years and have a residual value of $30,000. The entry for depreciation has not been recorded. 12. Made an adjustment for the cost of the insurance that expired during the year. 13. Owner, C. White withdrew $100,000 from the company Prepare the adjusting entries and post them to the T-accounts. Since transaction dates are not given, use the transaction number as a reference. e) Prepare and adjusted Trial Balance f) Prepare a detailed Income statement and Statement of Owners' Equity for 201 g) Prepare a Balance sheet at December 31, 20X1 h) Prepare a post- closing Trial balance at December 31,201

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started