Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Admission of Partnership Q5 Question 5 Mr Hyena, Tiger and Lion are in partnership sharing profits in a 3:2:1 ratio. On 30 June 2016, Wolf

Admission of Partnership Q5

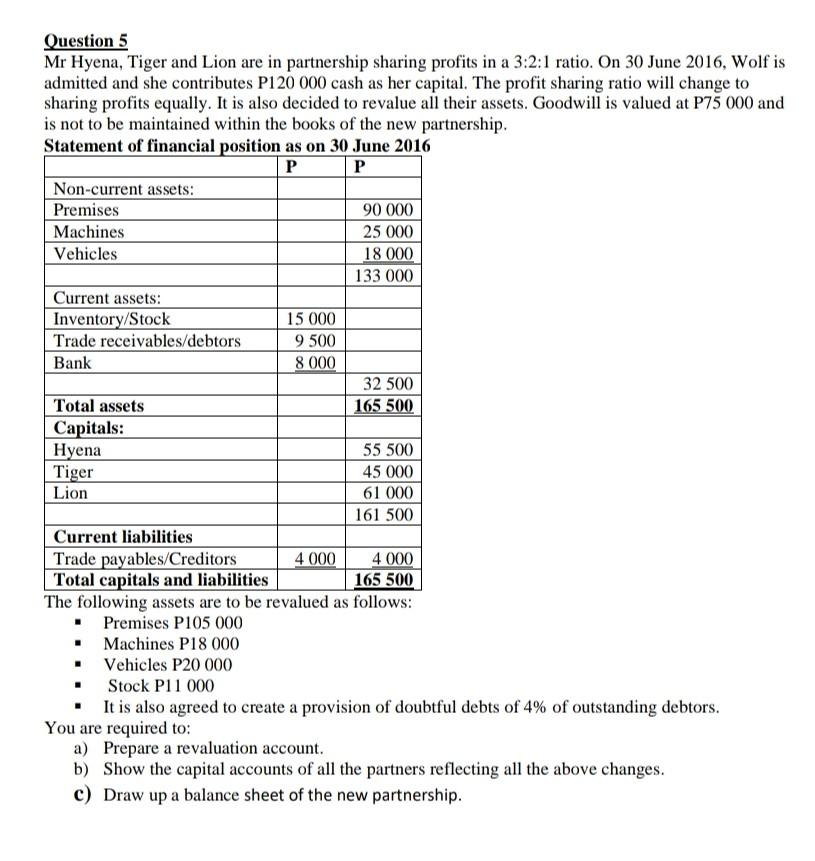

Question 5 Mr Hyena, Tiger and Lion are in partnership sharing profits in a 3:2:1 ratio. On 30 June 2016, Wolf is admitted and she contributes P120 000 cash as her capital. The profit sharing ratio will change to sharing profits equally. It is also decided to revalue all their assets. Goodwill is valued at P75 000 and is not to be maintained within the books of the new partnership. Statement of financial position as on 30 June 2016 P P Non-current assets: Premises 90 000 Machines 25 000 Vehicles 18 000 133 000 Current assets: Inventory/Stock 15 000 Trade receivables/debtors 9 500 Bank 8 000 32 500 Total assets 165 500 Capitals: Hyena 55 500 Tiger 45 000 Lion 61 000 161 500 Current liabilities Trade payables/Creditors 4 000 4 000 Total capitals and liabilities 165 500 The following assets are to be revalued as follows: . Premises P105 000 Machines P18 000 - Vehicles P20 000 . Stock P11 000 It is also agreed to create a provision of doubtful debts of 4% of outstanding debtors. You are required to: a) Prepare a revaluation account. b) Show the capital accounts of all the partners reflecting all the above changes. c) Draw up a balance sheet of the new partnershipStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started