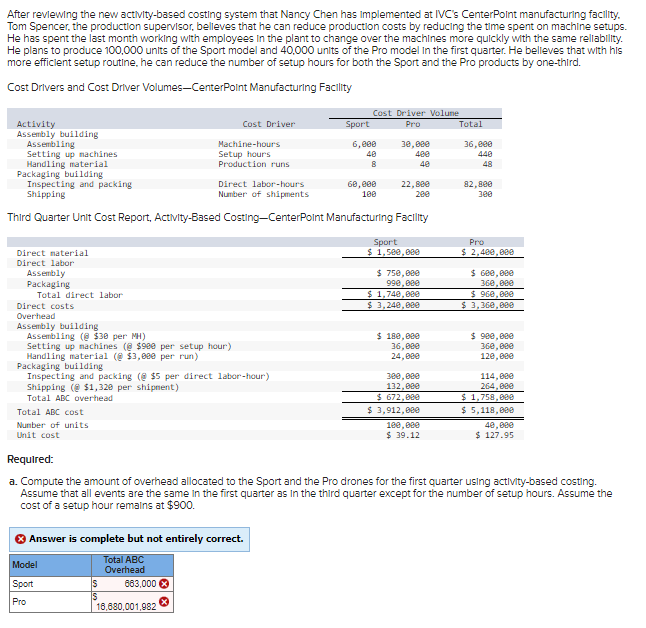

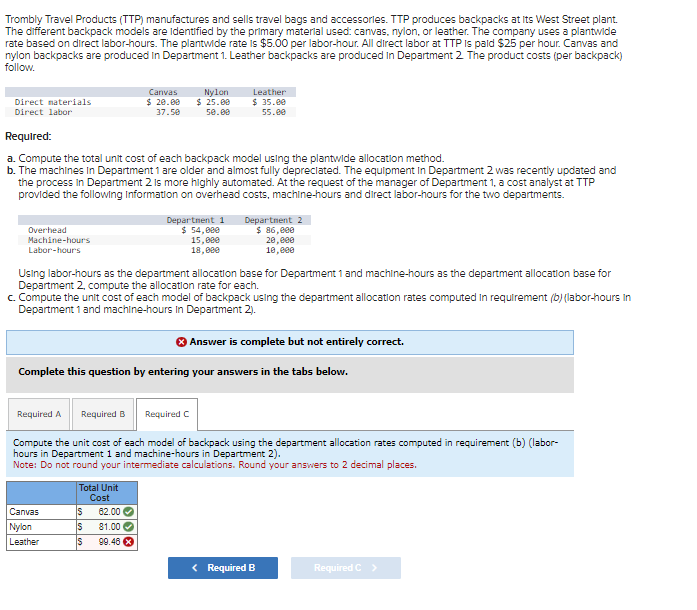

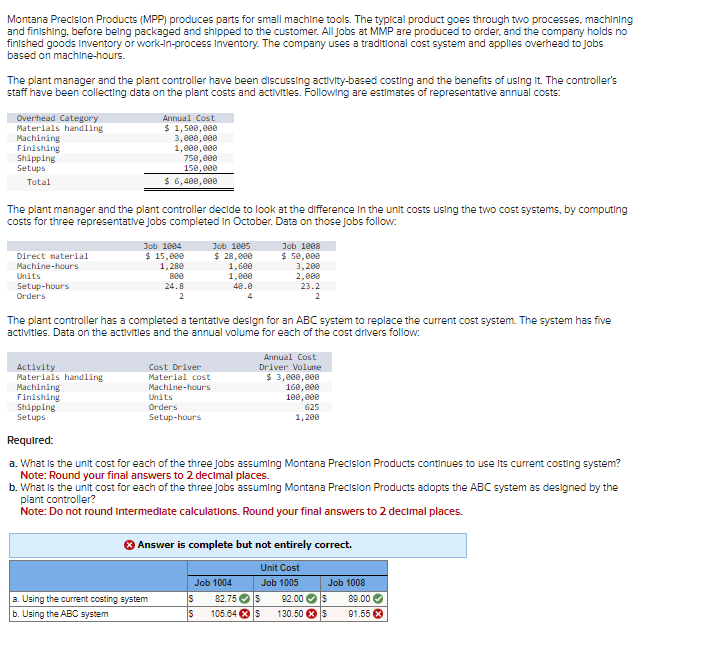

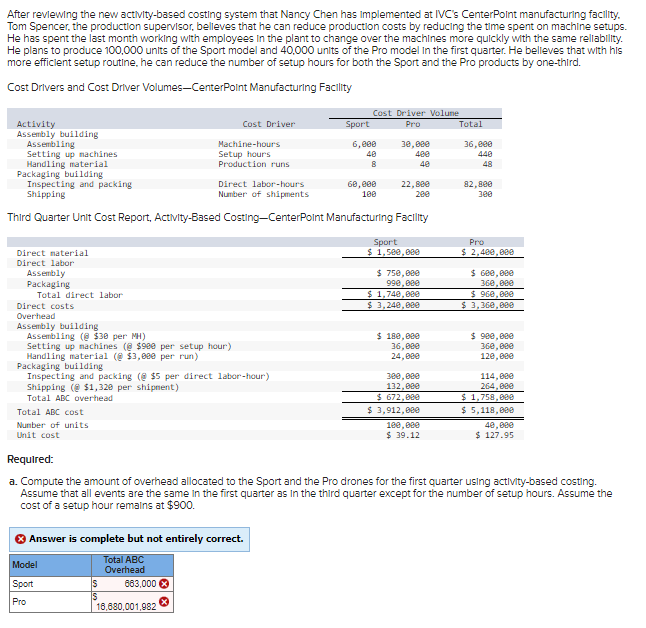

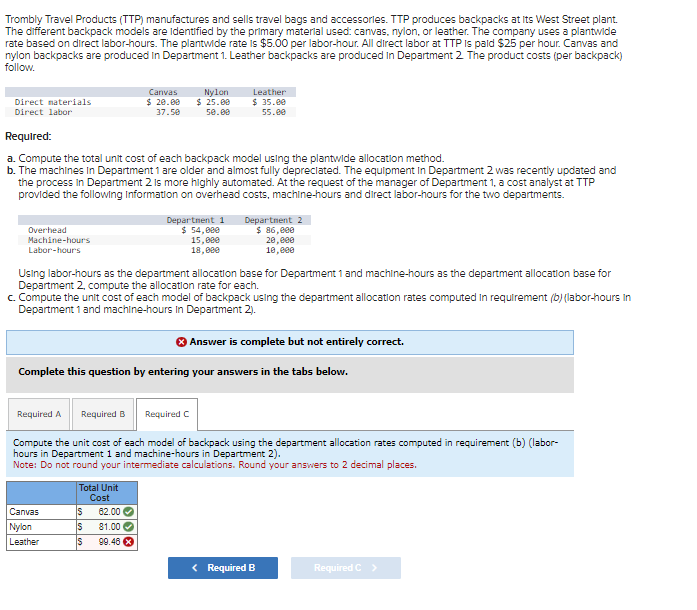

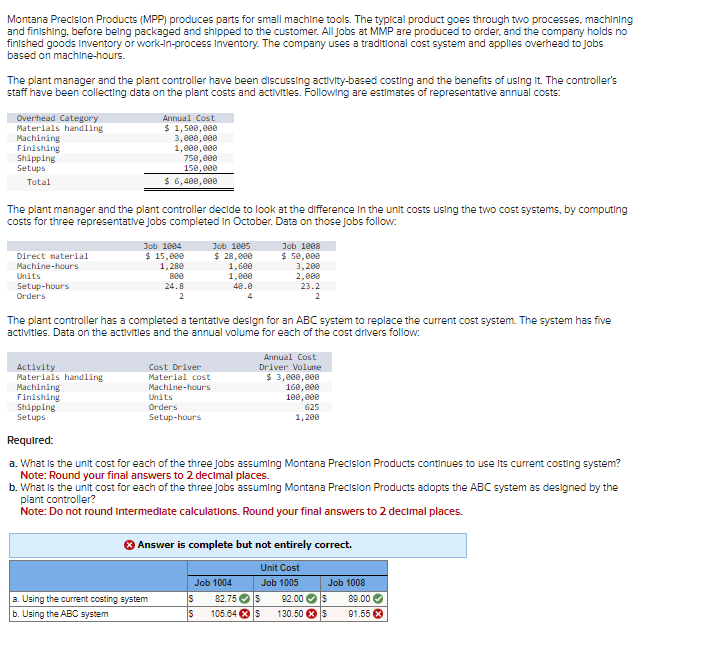

After revlewing the new activity-based costing system that Nancy Chen has implemented at IVC's CenterPoint manufacturing facility. Tom Spencer, the production supervisor, belleves that he can reduce production costs by reducing the time spent on machine setups. He has spent the last month working with employees in the plant to change over the machines more quickly with the same reliability. He plans to produce 100,000 units of the Sport model and 40,000 units of the Pro model in the first quarter. He believes that with his more efficlent setup routine, he can reduce the number of setup hours for both the Sport and the Pro products by one-third. Cost Drivers and Cost Driver Volumes-CenterPoint Manufacturing Facility Third Quarter Unit Cost Report, Activity-Based Costing-CenterPoint Manufacturing Facility Required: a. Compute the amount of overhead allocated to the Sport and the Pro drones for the first quarter using activity-based costing. Assume that all events are the same in the first quarter as in the third quarter except for the number of setup hours. Assume the cost of a setup hour remalns at $900. Answer is complete but not entirely correct. Trombly Travel Products (TTP) manufactures and sells travel bags and accessorles. TTP produces backpacks at Its West Street plant. The dlfferent backpack models are ldentified by the prlmary materlal used: canvas, nylon, or leather. The company uses a plantwide rate based on direct labor-hours. The plantwide rate is $5.00 per labor-hour. All direct labor at TTP Is pald $25 per hour. Canvas and nylon backpacks are produced In Department 1. Leather backpacks are produced in Department 2 The product costs (per backpack) follow. Required: a. Compute the total unit cost of each backpack model using the plantwide allocation method. b. The machines in Department 1 are older and almost fully depreclated. The equipment In Department 2 was recently updated and the process in Department 2 is more highly automated. At the request of the manager of Department 1, a cost analyst at TTP provided the following Information on overhead costs, machine-hours and direct labor-hours for the two departments. Using labor-hours as the department allocation base for Department 1 and machine-hours as the department allocation base for Department 2 , compute the allocation rate for each. c. Compute the unit cost of each model of backpack using the department allocation rates computed in requirement (b) (labor-hours in Department 1 and machine-hours in Department 2). Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the unit cost of each model of backpack using the department allocation rates computed in requirement (b) (laborhours in Department 1 and machine-hours in Department 2). Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. Montana Precision Products (MPP) produces parts for small machine tools. The typical product goes through two processes, machining and finishing, before being packaged and shipped to the customer. All jobs at MMP are produced to order, and the company holds no finlshed goods Inventory or work-In-process inventory. The company uses a traditlonal cost system and applies overhead to jobs based on machine-hours. The plant manager and the plant controller have been discussing activity-based costing and the benefits of using it. The controller's staff have been collecting data on the plant costs and actlvitles. Following are estimates of representative annual costs: The plant manager and the plant controller decide to look at the difference In the unit costs using the two cost systems, by computing costs for three representatlve jobs completed in October. Data on those jobs follow: The plant controller has a completed a tentative design for an ABC system to replace the current cost system. The system has five actlvitles. Data on the actlvitles and the annual volume for each of the cost drivers follow: Required: a. What is the unit cost for each of the three jobs assuming Montana Preclsion Products continues to use Its current costing system? Note: Round your final answers to 2 decimal places. b. What is the unit cost for each of the three jobs assuming Montana Precision Products adopts the ABC system as designed by the plant controller? Note: Do not round Intermedlate calculations. Round your final answers to 2 decimal places