Answered step by step

Verified Expert Solution

Question

1 Approved Answer

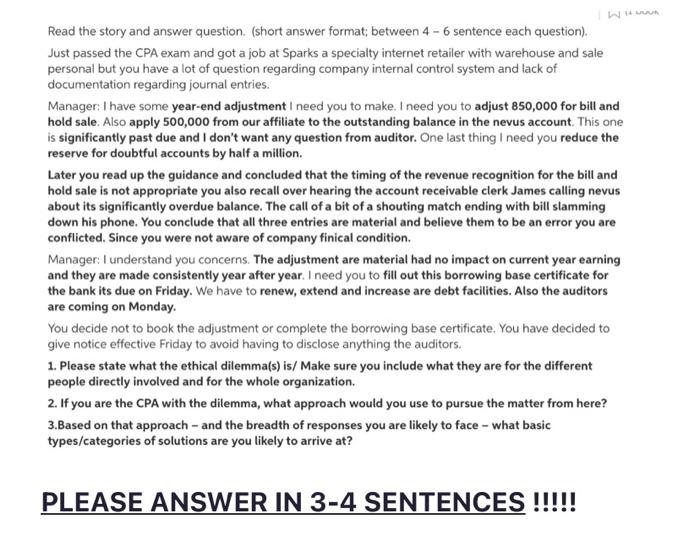

After watching the video, please state what the ethical dilemma(s) is/ Make sure you include what they are for the different people directly involved and

After watching the video, please state what the ethical dilemma(s) is/ Make sure you include what they are for the different people directly involved and for the whole organization.

If you are the CPA with the dilemma, what approach would you use to pursue the matter from here?

Based on that approach and the breadth of responses you are likely to face what basic types/categories of solutions are you likely to arrive at?

Describe how youd decide what specific actions to take?

Supposing a set of facts you obtained, describe exactly what you should do in this situation if youre the CPA. What would your goals be from those actions?

How would you decide if this worked or not? What criteria would you use to come up with an evaluation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started