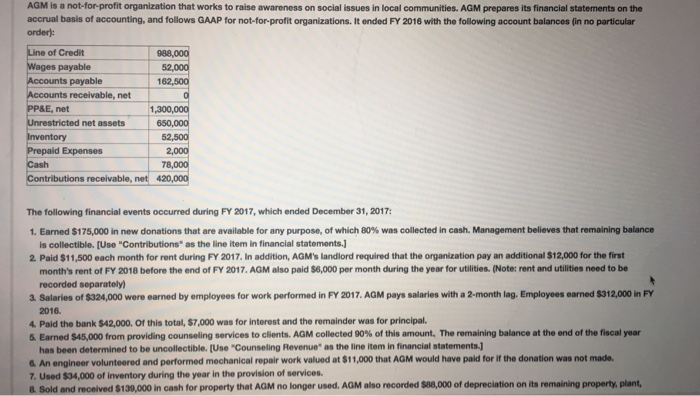

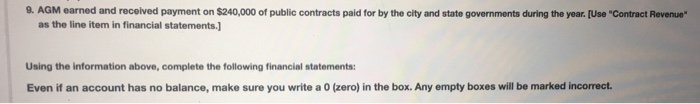

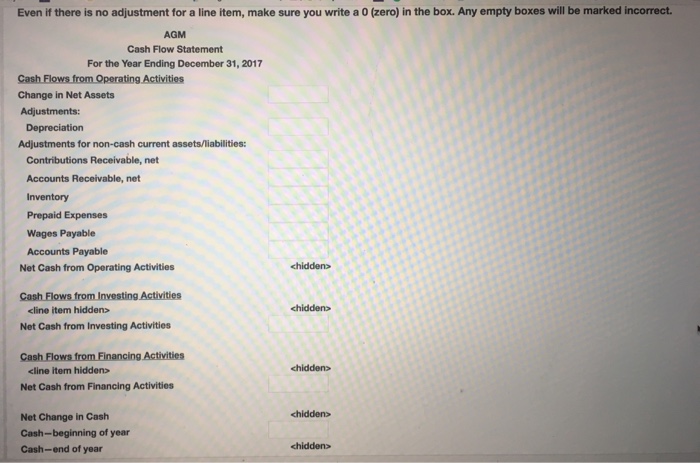

AGM is a not-for-profit organization that works to raise awareness on social issues in local communities. AGM prepares its financial statements on the accrual basis of accounting, and follows GAAP for not-for-profit organizations. It ended FY 2016 with the following account balances (in no particular order): of Credit payable Accounts payable Accounts receivable, net 182,500 P&E, net stricted net assets ry Expenses tributions receivable, net4 The following financial events occurred during FY 2017, which ended December 31, 2017: 1. Eamed $175 000 in new donations that are available for any purpose, of which a % was collected in cash. Management believes that remaining balance is collectible. [Use "Contributions" as the line item in financial statements 2 Paid $11,500 each month for rent during FY 2017. In addition, AGM's landlord required that the organization pay an additional $12,000 for the first month's rent of FY 2018 before the end of FY 2017. AGM also paid $6,000 per month during the year for utilities. (Note: rent and utilities need to be recorded separately) 2016. Earned $45,000 f providing counseling services to clients. AGM collected 90% of this amount 3 Salaries of $324,000 were earned by employees for work performed in FY 2017. AGM pays salaries with a 2-month lag. Employees earned $312,000 in FY 4 Paid the bank $42,000. Of this total, $7,000 was for interest and the remainder was for principal. The emain ng balance at the end of the fiscal year has been determined to be uncollectible. (Use "Counseling Revenue" as the line item in financial statements. G. An engineer volunteered and performed mechanical repair work valued at $11,000 that AGM would have paid for if the donation was not made. 7. Used $34,000 of inventory during the year in the provision of services. and received $139,000 in cash for property that AGM no longer used. AGM also recorded $88,000 of depreciation on its remaining property, plant, AGM is a not-for-profit organization that works to raise awareness on social issues in local communities. AGM prepares its financial statements on the accrual basis of accounting, and follows GAAP for not-for-profit organizations. It ended FY 2016 with the following account balances (in no particular order): of Credit payable Accounts payable Accounts receivable, net 182,500 P&E, net stricted net assets ry Expenses tributions receivable, net4 The following financial events occurred during FY 2017, which ended December 31, 2017: 1. Eamed $175 000 in new donations that are available for any purpose, of which a % was collected in cash. Management believes that remaining balance is collectible. [Use "Contributions" as the line item in financial statements 2 Paid $11,500 each month for rent during FY 2017. In addition, AGM's landlord required that the organization pay an additional $12,000 for the first month's rent of FY 2018 before the end of FY 2017. AGM also paid $6,000 per month during the year for utilities. (Note: rent and utilities need to be recorded separately) 2016. Earned $45,000 f providing counseling services to clients. AGM collected 90% of this amount 3 Salaries of $324,000 were earned by employees for work performed in FY 2017. AGM pays salaries with a 2-month lag. Employees earned $312,000 in FY 4 Paid the bank $42,000. Of this total, $7,000 was for interest and the remainder was for principal. The emain ng balance at the end of the fiscal year has been determined to be uncollectible. (Use "Counseling Revenue" as the line item in financial statements. G. An engineer volunteered and performed mechanical repair work valued at $11,000 that AGM would have paid for if the donation was not made. 7. Used $34,000 of inventory during the year in the provision of services. and received $139,000 in cash for property that AGM no longer used. AGM also recorded $88,000 of depreciation on its remaining property, plant