Answered step by step

Verified Expert Solution

Question

1 Approved Answer

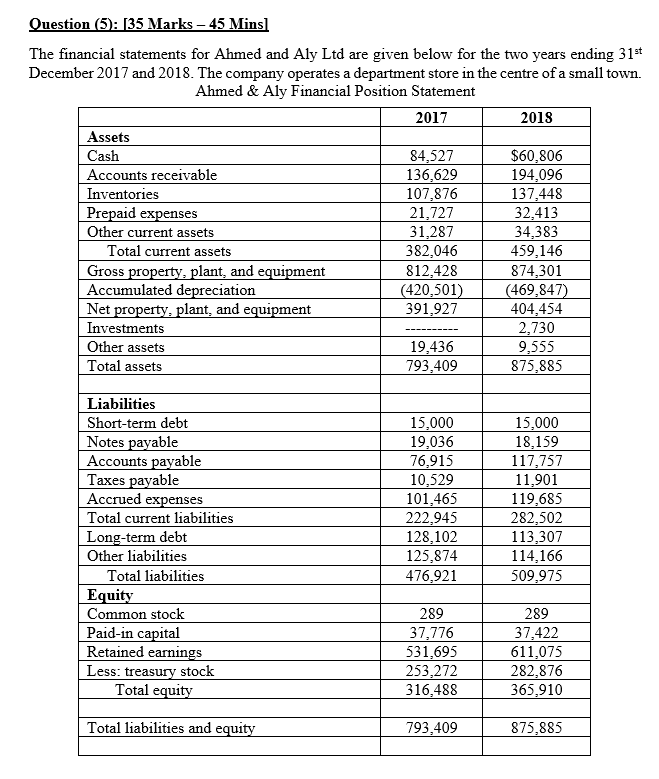

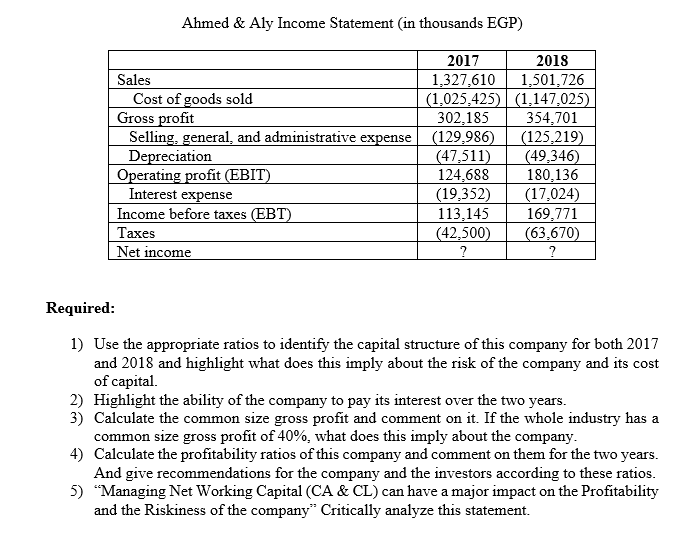

Ahmed & Aly Income Statement (in thousands EGP) Required: 1) Use the appropriate ratios to identify the capital structure of this company for both 2017

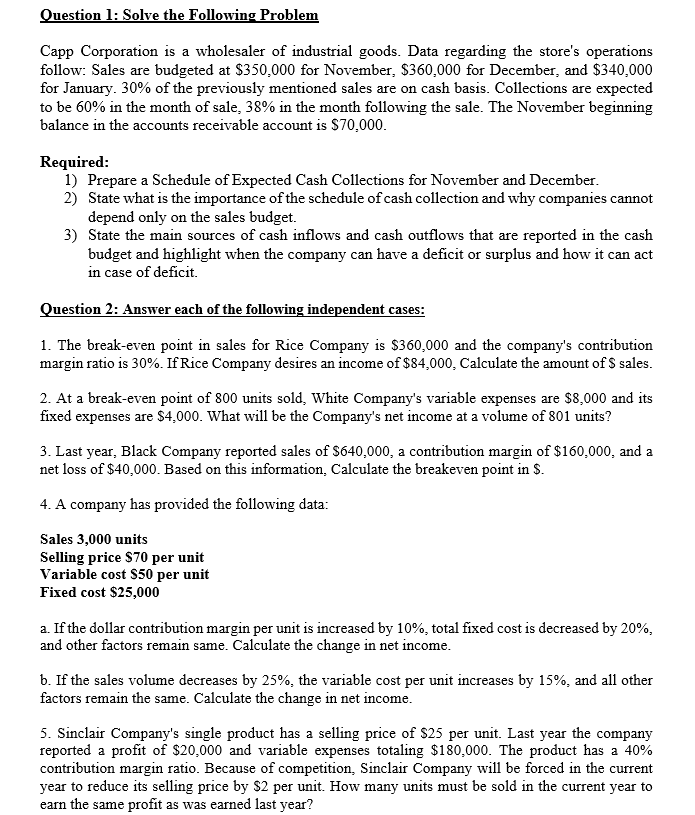

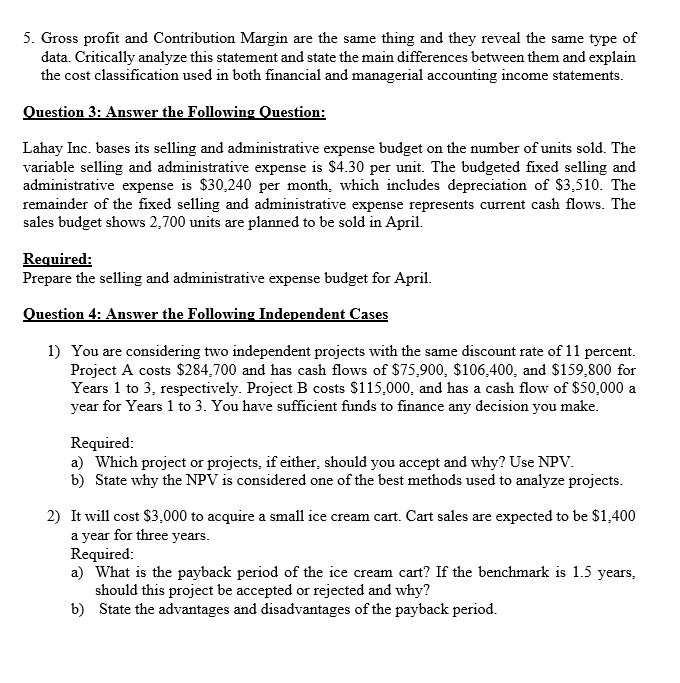

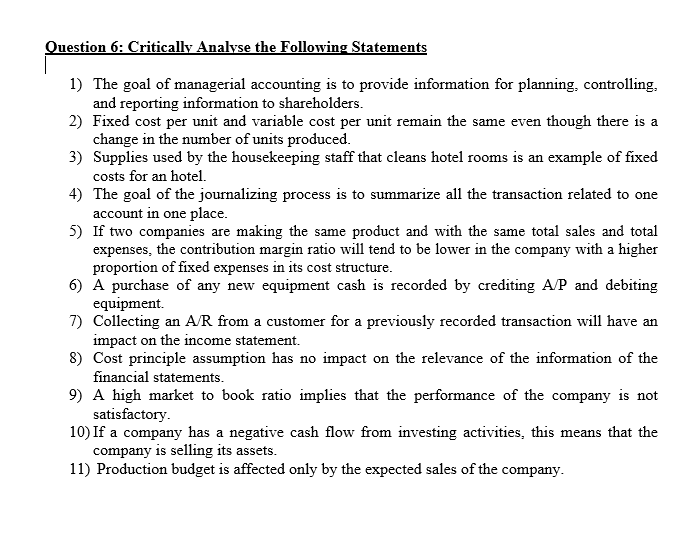

Ahmed \\& Aly Income Statement (in thousands EGP) Required: 1) Use the appropriate ratios to identify the capital structure of this company for both 2017 and 2018 and highlight what does this imply about the risk of the company and its cost of capital. 2) Highlight the ability of the company to pay its interest over the two years. 3) Calculate the common size gross profit and comment on it. If the whole industry has a common size gross profit of \40, what does this imply about the company. 4) Calculate the profitability ratios of this company and comment on them for the two years. And give recommendations for the company and the investors according to these ratios. 5) \"Managing Net Working Capital (CA \\& CL) can have a major impact on the Profitability and the Riskiness of the company\" Critically analyze this statement. 5. Gross profit and Contribution Margin are the same thing and they reveal the same type of data. Critically analyze this statement and state the main differences between them and explain the cost classification used in both financial and managerial accounting income statements. Question 3: Answer the Following Ouestion: Lahay Inc. bases its selling and administrative expense budget on the number of units sold. The variable selling and administrative expense is \\( \\$ 4.30 \\) per unit. The budgeted fixed selling and administrative expense is \\( \\$ 30,240 \\) per month, which includes depreciation of \\( \\$ 3,510 \\). The remainder of the fixed selling and administrative expense represents current cash flows. The sales budget shows 2,700 units are planned to be sold in April. Required: Prepare the selling and administrative expense budget for April. Question 4: Answer the Following Independent Cases 1) You are considering two independent projects with the same discount rate of 11 percent. Project A costs \\( \\$ 284,700 \\) and has cash flows of \\( \\$ 75,900, \\$ 106,400 \\), and \\( \\$ 159,800 \\) for Years 1 to 3 , respectively. Project \\( B \\) costs \\( \\$ 115,000 \\), and has a cash flow of \\( \\$ 50,000 \\) a year for Years 1 to 3 . You have sufficient funds to finance any decision you make. Required: a) Which project or projects, if either, should you accept and why? Use NPV. b) State why the NPV is considered one of the best methods used to analyze projects. 2) It will cost \\( \\$ 3,000 \\) to acquire a small ice cream cart. Cart sales are expected to be \\( \\$ 1,400 \\) a year for three years. Required: a) What is the payback period of the ice cream cart? If the benchmark is 1.5 years, should this project be accepted or rejected and why? b) State the advantages and disadvantages of the payback period. Question 1: Solve the Following Problem Capp Corporation is a wholesaler of industrial goods. Data regarding the store's operations follow: Sales are budgeted at \\( \\$ 350,000 \\) for November, \\( \\$ 360,000 \\) for December, and \\( \\$ 340,000 \\) for January. \30 of the previously mentioned sales are on cash basis. Collections are expected to be \60 in the month of sale, \38 in the month following the sale. The November beginning balance in the accounts receivable account is \\( \\$ 70,000 \\). Required: 1) Prepare a Schedule of Expected Cash Collections for November and December. 2) State what is the importance of the schedule of cash collection and why companies cannot depend only on the sales budget. 3) State the main sources of cash inflows and cash outflows that are reported in the cash budget and highlight when the company can have a deficit or surplus and how it can act in case of deficit. Question 2: Answer each of the following independent cases: 1. The break-even point in sales for Rice Company is \\( \\$ 360,000 \\) and the company's contribution margin ratio is \30. If Rice Company desires an income of \\( \\$ 84,000 \\), Calculate the amount of \\( \\$ \\) sales. 2. At a break-even point of 800 units sold, White Company's variable expenses are \\( \\$ 8,000 \\) and its fixed expenses are \\( \\$ 4,000 \\). What will be the Company's net income at a volume of 801 units? 3. Last year, Black Company reported sales of \\( \\$ 640,000 \\), a contribution margin of \\( \\$ 160,000 \\), and a net loss of \\( \\$ 40,000 \\). Based on this information, Calculate the breakeven point in \\( \\$ \\). 4. A company has provided the following data: Sales 3,000 units Selling price \\( \\$ 70 \\) per unit Variable cost \\$50 per unit Fixed cost \\( \\$ 25,000 \\) a. If the dollar contribution margin per unit is increased by \10, total fixed cost is decreased by \20, and other factors remain same. Calculate the change in net income. b. If the sales volume decreases by \25, the variable cost per unit increases by \15, and all other factors remain the same. Calculate the change in net income. 5. Sinclair Company's single product has a selling price of \\( \\$ 25 \\) per unit. Last year the company reported a profit of \\( \\$ 20,000 \\) and variable expenses totaling \\( \\$ 180,000 \\). The product has a \40 contribution margin ratio. Because of competition, Sinclair Company will be forced in the current year to reduce its selling price by \\( \\$ 2 \\) per unit. How many units must be sold in the current year to earn the same profit as was earned last year? Question 6: Critically Analvse the Following Statements 1) The goal of managerial accounting is to provide information for planning, controlling, and reporting information to shareholders. 2) Fixed cost per unit and variable cost per unit remain the same even though there is a change in the number of units produced. 3) Supplies used by the housekeeping staff that cleans hotel rooms is an example of fixed costs for an hotel. 4) The goal of the journalizing process is to summarize all the transaction related to one account in one place. 5) If two companies are making the same product and with the same total sales and total expenses, the contribution margin ratio will tend to be lower in the company with a higher proportion of fixed expenses in its cost structure. 6) A purchase of any new equipment cash is recorded by crediting \\( A / P \\) and debiting equipment. 7) Collecting an \\( A / R \\) from a customer for a previously recorded transaction will have an impact on the income statement. 8) Cost principle assumption has no impact on the relevance of the information of the financial statements. 9) A high market to book ratio implies that the performance of the company is not satisfactory. 10) If a company has a negative cash flow from investing activities, this means that the company is selling its assets. 11) Production budget is affected only by the expected sales of the company. The financial statements for Ahmed and Aly Ltd are given below for the two years ending \\( 31^{\\text {st }} \\) Decem * \" town. Ahmed \\& Aly Income Statement (in thousands EGP) Required: 1) Use the appropriate ratios to identify the capital structure of this company for both 2017 and 2018 and highlight what does this imply about the risk of the company and its cost of capital. 2) Highlight the ability of the company to pay its interest over the two years. 3) Calculate the common size gross profit and comment on it. If the whole industry has a common size gross profit of \40, what does this imply about the company. 4) Calculate the profitability ratios of this company and comment on them for the two years. And give recommendations for the company and the investors according to these ratios. 5) \"Managing Net Working Capital (CA \\& CL) can have a major impact on the Profitability and the Riskiness of the company\" Critically analyze this statement. 5. Gross profit and Contribution Margin are the same thing and they reveal the same type of data. Critically analyze this statement and state the main differences between them and explain the cost classification used in both financial and managerial accounting income statements. Question 3: Answer the Following Ouestion: Lahay Inc. bases its selling and administrative expense budget on the number of units sold. The variable selling and administrative expense is \\( \\$ 4.30 \\) per unit. The budgeted fixed selling and administrative expense is \\( \\$ 30,240 \\) per month, which includes depreciation of \\( \\$ 3,510 \\). The remainder of the fixed selling and administrative expense represents current cash flows. The sales budget shows 2,700 units are planned to be sold in April. Required: Prepare the selling and administrative expense budget for April. Question 4: Answer the Following Independent Cases 1) You are considering two independent projects with the same discount rate of 11 percent. Project A costs \\( \\$ 284,700 \\) and has cash flows of \\( \\$ 75,900, \\$ 106,400 \\), and \\( \\$ 159,800 \\) for Years 1 to 3 , respectively. Project \\( B \\) costs \\( \\$ 115,000 \\), and has a cash flow of \\( \\$ 50,000 \\) a year for Years 1 to 3 . You have sufficient funds to finance any decision you make. Required: a) Which project or projects, if either, should you accept and why? Use NPV. b) State why the NPV is considered one of the best methods used to analyze projects. 2) It will cost \\( \\$ 3,000 \\) to acquire a small ice cream cart. Cart sales are expected to be \\( \\$ 1,400 \\) a year for three years. Required: a) What is the payback period of the ice cream cart? If the benchmark is 1.5 years, should this project be accepted or rejected and why? b) State the advantages and disadvantages of the payback period. Question 1: Solve the Following Problem Capp Corporation is a wholesaler of industrial goods. Data regarding the store's operations follow: Sales are budgeted at \\( \\$ 350,000 \\) for November, \\( \\$ 360,000 \\) for December, and \\( \\$ 340,000 \\) for January. \30 of the previously mentioned sales are on cash basis. Collections are expected to be \60 in the month of sale, \38 in the month following the sale. The November beginning balance in the accounts receivable account is \\( \\$ 70,000 \\). Required: 1) Prepare a Schedule of Expected Cash Collections for November and December. 2) State what is the importance of the schedule of cash collection and why companies cannot depend only on the sales budget. 3) State the main sources of cash inflows and cash outflows that are reported in the cash budget and highlight when the company can have a deficit or surplus and how it can act in case of deficit. Question 2: Answer each of the following independent cases: 1. The break-even point in sales for Rice Company is \\( \\$ 360,000 \\) and the company's contribution margin ratio is \30. If Rice Company desires an income of \\( \\$ 84,000 \\), Calculate the amount of \\( \\$ \\) sales. 2. At a break-even point of 800 units sold, White Company's variable expenses are \\( \\$ 8,000 \\) and its fixed expenses are \\( \\$ 4,000 \\). What will be the Company's net income at a volume of 801 units? 3. Last year, Black Company reported sales of \\( \\$ 640,000 \\), a contribution margin of \\( \\$ 160,000 \\), and a net loss of \\( \\$ 40,000 \\). Based on this information, Calculate the breakeven point in \\( \\$ \\). 4. A company has provided the following data: Sales 3,000 units Selling price \\( \\$ 70 \\) per unit Variable cost \\$50 per unit Fixed cost \\( \\$ 25,000 \\) a. If the dollar contribution margin per unit is increased by \10, total fixed cost is decreased by \20, and other factors remain same. Calculate the change in net income. b. If the sales volume decreases by \25, the variable cost per unit increases by \15, and all other factors remain the same. Calculate the change in net income. 5. Sinclair Company's single product has a selling price of \\( \\$ 25 \\) per unit. Last year the company reported a profit of \\( \\$ 20,000 \\) and variable expenses totaling \\( \\$ 180,000 \\). The product has a \40 contribution margin ratio. Because of competition, Sinclair Company will be forced in the current year to reduce its selling price by \\( \\$ 2 \\) per unit. How many units must be sold in the current year to earn the same profit as was earned last year? Question 6: Critically Analvse the Following Statements 1) The goal of managerial accounting is to provide information for planning, controlling, and reporting information to shareholders. 2) Fixed cost per unit and variable cost per unit remain the same even though there is a change in the number of units produced. 3) Supplies used by the housekeeping staff that cleans hotel rooms is an example of fixed costs for an hotel. 4) The goal of the journalizing process is to summarize all the transaction related to one account in one place. 5) If two companies are making the same product and with the same total sales and total expenses, the contribution margin ratio will tend to be lower in the company with a higher proportion of fixed expenses in its cost structure. 6) A purchase of any new equipment cash is recorded by crediting \\( A / P \\) and debiting equipment. 7) Collecting an \\( A / R \\) from a customer for a previously recorded transaction will have an impact on the income statement. 8) Cost principle assumption has no impact on the relevance of the information of the financial statements. 9) A high market to book ratio implies that the performance of the company is not satisfactory. 10) If a company has a negative cash flow from investing activities, this means that the company is selling its assets. 11) Production budget is affected only by the expected sales of the company. The financial statements for Ahmed and Aly Ltd are given below for the two years ending \\( 31^{\\text {st }} \\) Decem * \" town

Ahmed \\& Aly Income Statement (in thousands EGP) Required: 1) Use the appropriate ratios to identify the capital structure of this company for both 2017 and 2018 and highlight what does this imply about the risk of the company and its cost of capital. 2) Highlight the ability of the company to pay its interest over the two years. 3) Calculate the common size gross profit and comment on it. If the whole industry has a common size gross profit of \40, what does this imply about the company. 4) Calculate the profitability ratios of this company and comment on them for the two years. And give recommendations for the company and the investors according to these ratios. 5) \"Managing Net Working Capital (CA \\& CL) can have a major impact on the Profitability and the Riskiness of the company\" Critically analyze this statement. 5. Gross profit and Contribution Margin are the same thing and they reveal the same type of data. Critically analyze this statement and state the main differences between them and explain the cost classification used in both financial and managerial accounting income statements. Question 3: Answer the Following Ouestion: Lahay Inc. bases its selling and administrative expense budget on the number of units sold. The variable selling and administrative expense is \\( \\$ 4.30 \\) per unit. The budgeted fixed selling and administrative expense is \\( \\$ 30,240 \\) per month, which includes depreciation of \\( \\$ 3,510 \\). The remainder of the fixed selling and administrative expense represents current cash flows. The sales budget shows 2,700 units are planned to be sold in April. Required: Prepare the selling and administrative expense budget for April. Question 4: Answer the Following Independent Cases 1) You are considering two independent projects with the same discount rate of 11 percent. Project A costs \\( \\$ 284,700 \\) and has cash flows of \\( \\$ 75,900, \\$ 106,400 \\), and \\( \\$ 159,800 \\) for Years 1 to 3 , respectively. Project \\( B \\) costs \\( \\$ 115,000 \\), and has a cash flow of \\( \\$ 50,000 \\) a year for Years 1 to 3 . You have sufficient funds to finance any decision you make. Required: a) Which project or projects, if either, should you accept and why? Use NPV. b) State why the NPV is considered one of the best methods used to analyze projects. 2) It will cost \\( \\$ 3,000 \\) to acquire a small ice cream cart. Cart sales are expected to be \\( \\$ 1,400 \\) a year for three years. Required: a) What is the payback period of the ice cream cart? If the benchmark is 1.5 years, should this project be accepted or rejected and why? b) State the advantages and disadvantages of the payback period. Question 1: Solve the Following Problem Capp Corporation is a wholesaler of industrial goods. Data regarding the store's operations follow: Sales are budgeted at \\( \\$ 350,000 \\) for November, \\( \\$ 360,000 \\) for December, and \\( \\$ 340,000 \\) for January. \30 of the previously mentioned sales are on cash basis. Collections are expected to be \60 in the month of sale, \38 in the month following the sale. The November beginning balance in the accounts receivable account is \\( \\$ 70,000 \\). Required: 1) Prepare a Schedule of Expected Cash Collections for November and December. 2) State what is the importance of the schedule of cash collection and why companies cannot depend only on the sales budget. 3) State the main sources of cash inflows and cash outflows that are reported in the cash budget and highlight when the company can have a deficit or surplus and how it can act in case of deficit. Question 2: Answer each of the following independent cases: 1. The break-even point in sales for Rice Company is \\( \\$ 360,000 \\) and the company's contribution margin ratio is \30. If Rice Company desires an income of \\( \\$ 84,000 \\), Calculate the amount of \\( \\$ \\) sales. 2. At a break-even point of 800 units sold, White Company's variable expenses are \\( \\$ 8,000 \\) and its fixed expenses are \\( \\$ 4,000 \\). What will be the Company's net income at a volume of 801 units? 3. Last year, Black Company reported sales of \\( \\$ 640,000 \\), a contribution margin of \\( \\$ 160,000 \\), and a net loss of \\( \\$ 40,000 \\). Based on this information, Calculate the breakeven point in \\( \\$ \\). 4. A company has provided the following data: Sales 3,000 units Selling price \\( \\$ 70 \\) per unit Variable cost \\$50 per unit Fixed cost \\( \\$ 25,000 \\) a. If the dollar contribution margin per unit is increased by \10, total fixed cost is decreased by \20, and other factors remain same. Calculate the change in net income. b. If the sales volume decreases by \25, the variable cost per unit increases by \15, and all other factors remain the same. Calculate the change in net income. 5. Sinclair Company's single product has a selling price of \\( \\$ 25 \\) per unit. Last year the company reported a profit of \\( \\$ 20,000 \\) and variable expenses totaling \\( \\$ 180,000 \\). The product has a \40 contribution margin ratio. Because of competition, Sinclair Company will be forced in the current year to reduce its selling price by \\( \\$ 2 \\) per unit. How many units must be sold in the current year to earn the same profit as was earned last year? Question 6: Critically Analvse the Following Statements 1) The goal of managerial accounting is to provide information for planning, controlling, and reporting information to shareholders. 2) Fixed cost per unit and variable cost per unit remain the same even though there is a change in the number of units produced. 3) Supplies used by the housekeeping staff that cleans hotel rooms is an example of fixed costs for an hotel. 4) The goal of the journalizing process is to summarize all the transaction related to one account in one place. 5) If two companies are making the same product and with the same total sales and total expenses, the contribution margin ratio will tend to be lower in the company with a higher proportion of fixed expenses in its cost structure. 6) A purchase of any new equipment cash is recorded by crediting \\( A / P \\) and debiting equipment. 7) Collecting an \\( A / R \\) from a customer for a previously recorded transaction will have an impact on the income statement. 8) Cost principle assumption has no impact on the relevance of the information of the financial statements. 9) A high market to book ratio implies that the performance of the company is not satisfactory. 10) If a company has a negative cash flow from investing activities, this means that the company is selling its assets. 11) Production budget is affected only by the expected sales of the company. The financial statements for Ahmed and Aly Ltd are given below for the two years ending \\( 31^{\\text {st }} \\) Decem * \" town. Ahmed \\& Aly Income Statement (in thousands EGP) Required: 1) Use the appropriate ratios to identify the capital structure of this company for both 2017 and 2018 and highlight what does this imply about the risk of the company and its cost of capital. 2) Highlight the ability of the company to pay its interest over the two years. 3) Calculate the common size gross profit and comment on it. If the whole industry has a common size gross profit of \40, what does this imply about the company. 4) Calculate the profitability ratios of this company and comment on them for the two years. And give recommendations for the company and the investors according to these ratios. 5) \"Managing Net Working Capital (CA \\& CL) can have a major impact on the Profitability and the Riskiness of the company\" Critically analyze this statement. 5. Gross profit and Contribution Margin are the same thing and they reveal the same type of data. Critically analyze this statement and state the main differences between them and explain the cost classification used in both financial and managerial accounting income statements. Question 3: Answer the Following Ouestion: Lahay Inc. bases its selling and administrative expense budget on the number of units sold. The variable selling and administrative expense is \\( \\$ 4.30 \\) per unit. The budgeted fixed selling and administrative expense is \\( \\$ 30,240 \\) per month, which includes depreciation of \\( \\$ 3,510 \\). The remainder of the fixed selling and administrative expense represents current cash flows. The sales budget shows 2,700 units are planned to be sold in April. Required: Prepare the selling and administrative expense budget for April. Question 4: Answer the Following Independent Cases 1) You are considering two independent projects with the same discount rate of 11 percent. Project A costs \\( \\$ 284,700 \\) and has cash flows of \\( \\$ 75,900, \\$ 106,400 \\), and \\( \\$ 159,800 \\) for Years 1 to 3 , respectively. Project \\( B \\) costs \\( \\$ 115,000 \\), and has a cash flow of \\( \\$ 50,000 \\) a year for Years 1 to 3 . You have sufficient funds to finance any decision you make. Required: a) Which project or projects, if either, should you accept and why? Use NPV. b) State why the NPV is considered one of the best methods used to analyze projects. 2) It will cost \\( \\$ 3,000 \\) to acquire a small ice cream cart. Cart sales are expected to be \\( \\$ 1,400 \\) a year for three years. Required: a) What is the payback period of the ice cream cart? If the benchmark is 1.5 years, should this project be accepted or rejected and why? b) State the advantages and disadvantages of the payback period. Question 1: Solve the Following Problem Capp Corporation is a wholesaler of industrial goods. Data regarding the store's operations follow: Sales are budgeted at \\( \\$ 350,000 \\) for November, \\( \\$ 360,000 \\) for December, and \\( \\$ 340,000 \\) for January. \30 of the previously mentioned sales are on cash basis. Collections are expected to be \60 in the month of sale, \38 in the month following the sale. The November beginning balance in the accounts receivable account is \\( \\$ 70,000 \\). Required: 1) Prepare a Schedule of Expected Cash Collections for November and December. 2) State what is the importance of the schedule of cash collection and why companies cannot depend only on the sales budget. 3) State the main sources of cash inflows and cash outflows that are reported in the cash budget and highlight when the company can have a deficit or surplus and how it can act in case of deficit. Question 2: Answer each of the following independent cases: 1. The break-even point in sales for Rice Company is \\( \\$ 360,000 \\) and the company's contribution margin ratio is \30. If Rice Company desires an income of \\( \\$ 84,000 \\), Calculate the amount of \\( \\$ \\) sales. 2. At a break-even point of 800 units sold, White Company's variable expenses are \\( \\$ 8,000 \\) and its fixed expenses are \\( \\$ 4,000 \\). What will be the Company's net income at a volume of 801 units? 3. Last year, Black Company reported sales of \\( \\$ 640,000 \\), a contribution margin of \\( \\$ 160,000 \\), and a net loss of \\( \\$ 40,000 \\). Based on this information, Calculate the breakeven point in \\( \\$ \\). 4. A company has provided the following data: Sales 3,000 units Selling price \\( \\$ 70 \\) per unit Variable cost \\$50 per unit Fixed cost \\( \\$ 25,000 \\) a. If the dollar contribution margin per unit is increased by \10, total fixed cost is decreased by \20, and other factors remain same. Calculate the change in net income. b. If the sales volume decreases by \25, the variable cost per unit increases by \15, and all other factors remain the same. Calculate the change in net income. 5. Sinclair Company's single product has a selling price of \\( \\$ 25 \\) per unit. Last year the company reported a profit of \\( \\$ 20,000 \\) and variable expenses totaling \\( \\$ 180,000 \\). The product has a \40 contribution margin ratio. Because of competition, Sinclair Company will be forced in the current year to reduce its selling price by \\( \\$ 2 \\) per unit. How many units must be sold in the current year to earn the same profit as was earned last year? Question 6: Critically Analvse the Following Statements 1) The goal of managerial accounting is to provide information for planning, controlling, and reporting information to shareholders. 2) Fixed cost per unit and variable cost per unit remain the same even though there is a change in the number of units produced. 3) Supplies used by the housekeeping staff that cleans hotel rooms is an example of fixed costs for an hotel. 4) The goal of the journalizing process is to summarize all the transaction related to one account in one place. 5) If two companies are making the same product and with the same total sales and total expenses, the contribution margin ratio will tend to be lower in the company with a higher proportion of fixed expenses in its cost structure. 6) A purchase of any new equipment cash is recorded by crediting \\( A / P \\) and debiting equipment. 7) Collecting an \\( A / R \\) from a customer for a previously recorded transaction will have an impact on the income statement. 8) Cost principle assumption has no impact on the relevance of the information of the financial statements. 9) A high market to book ratio implies that the performance of the company is not satisfactory. 10) If a company has a negative cash flow from investing activities, this means that the company is selling its assets. 11) Production budget is affected only by the expected sales of the company. The financial statements for Ahmed and Aly Ltd are given below for the two years ending \\( 31^{\\text {st }} \\) Decem * \" town Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started