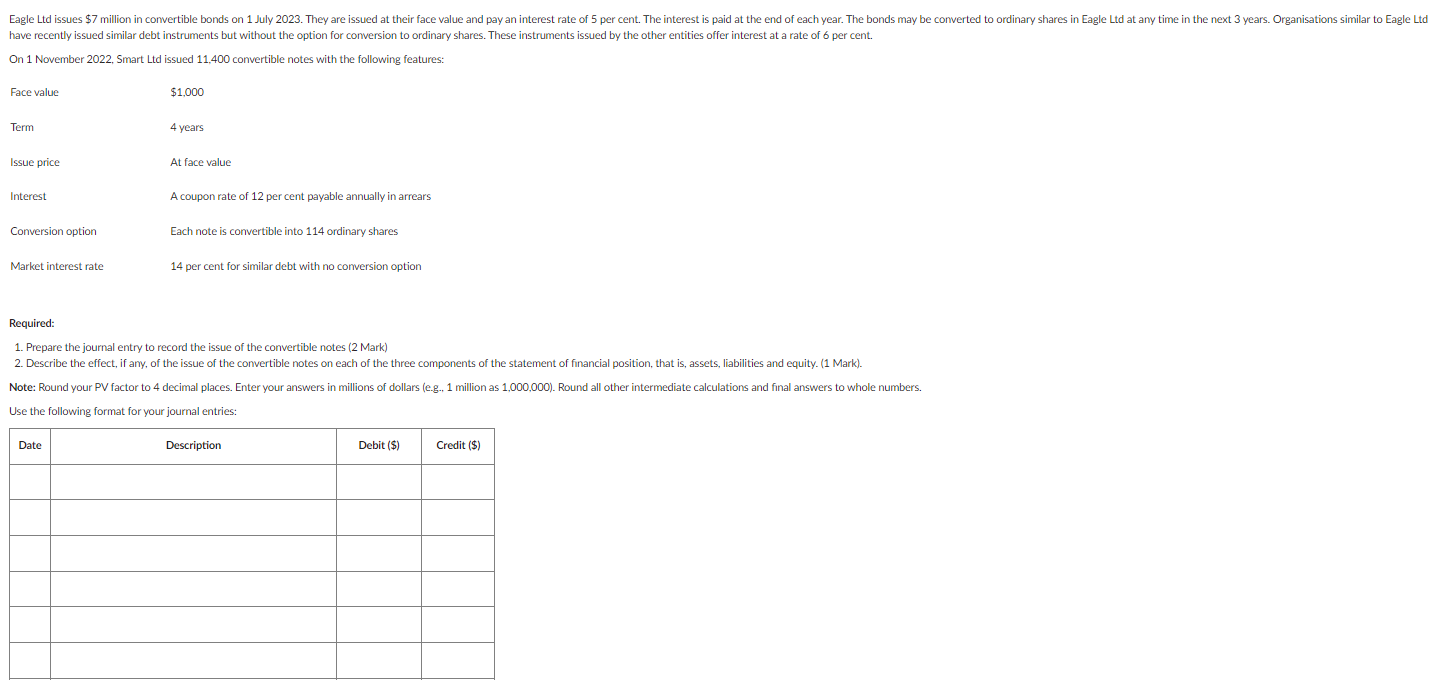

Question

AirCar Ltd leased a flying car from Sydney Lessor Ltd. Sydney Lessor has no material initial direct costs. AirCar Ltd does not plan to acquire

AirCar Ltd leased a flying car from Sydney Lessor Ltd. Sydney Lessor has no material initial direct costs. AirCar Ltd does not plan to acquire the flying car at the end of the lease because it expects that, by then, it will need a larger flying car. The terms of the lease are as follows: Date of entering lease: 1 July 2023. Duration of lease: 4 years. Life of leased asset: 5 years. Lease payments: $92,000 at the beginning of each year. First lease payment: 1 July 2023. Lease expires: 1 July 2027. Interest rate implicit in the lease: 8 per cent. Guaranteed residual: $74,000.

Required:

Prepare the journal entries to account for the lease in the books of AirCar Ltd at 1 July 2023, 30 June 2024 and 1 July 2024.

Note: Use the following format for your journal entries:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started