Answered step by step

Verified Expert Solution

Question

1 Approved Answer

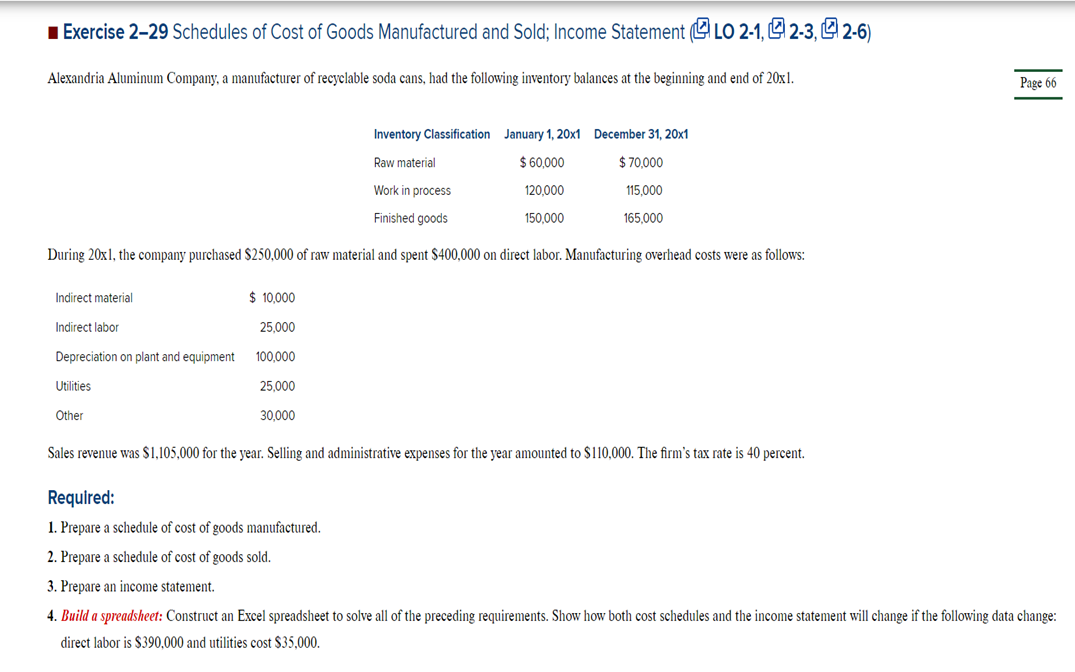

Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. Page 66 During 20xl,

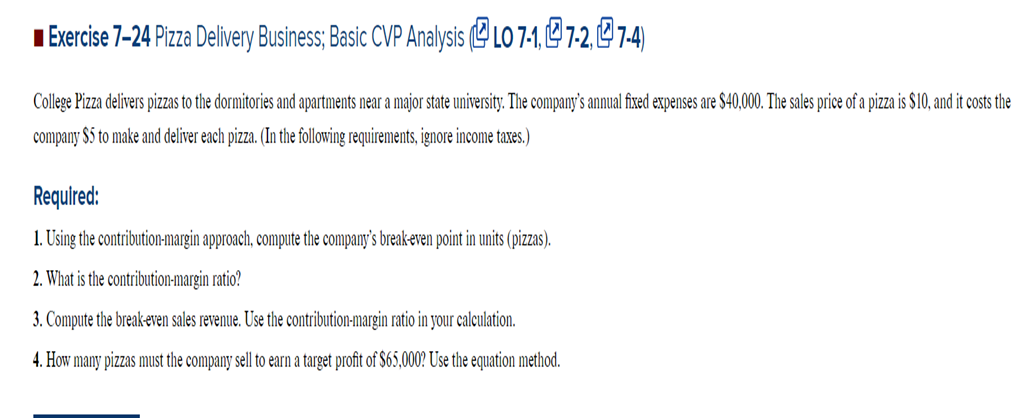

Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. Page 66 During 20xl, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Sales revenue was $1,105,000 for the year. Selling and administrative expenses for the year amounted to $110,000. The firm's tax rate is 40 percent. Required: 1. Prepare a schedule of cost of goods manufactured. 2. Prepare a schedule of cost of goods sold. 3. Prepare an income statement. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000. College Pizza delivers pizzas to the dormitories and apartments near a major state university. The company's annual fixed expenses are $40,000. The sales price of a pizza is $10, and it costs the company $5 to make and deliver each pizza. (In the following requirements, ignore income taxes.) Required: 1. Using the contribution-margin approach, compute the company's breakeven point in units (pizzas). 2. What is the contribution-margin ratio? 3. Compute the breakeven sales revenue. Use the contribution-margin ratio in your calculation. 4. How many pizzas must the company sell to earn a target profit of $65,000 ? Use the equation method

Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. Page 66 During 20xl, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Sales revenue was $1,105,000 for the year. Selling and administrative expenses for the year amounted to $110,000. The firm's tax rate is 40 percent. Required: 1. Prepare a schedule of cost of goods manufactured. 2. Prepare a schedule of cost of goods sold. 3. Prepare an income statement. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000. College Pizza delivers pizzas to the dormitories and apartments near a major state university. The company's annual fixed expenses are $40,000. The sales price of a pizza is $10, and it costs the company $5 to make and deliver each pizza. (In the following requirements, ignore income taxes.) Required: 1. Using the contribution-margin approach, compute the company's breakeven point in units (pizzas). 2. What is the contribution-margin ratio? 3. Compute the breakeven sales revenue. Use the contribution-margin ratio in your calculation. 4. How many pizzas must the company sell to earn a target profit of $65,000 ? Use the equation method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started