Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all I need is 27 abc but you need 26 to get 27 I think 1. What is the change in equity value forecasted by

all I need is 27 abc but you need 26 to get 27 I think

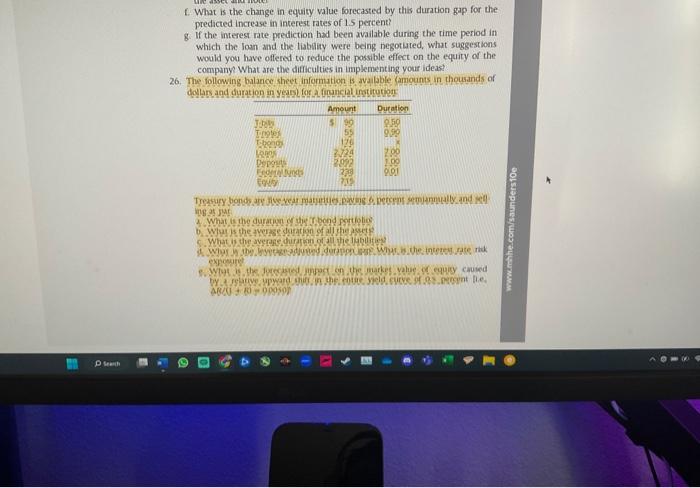

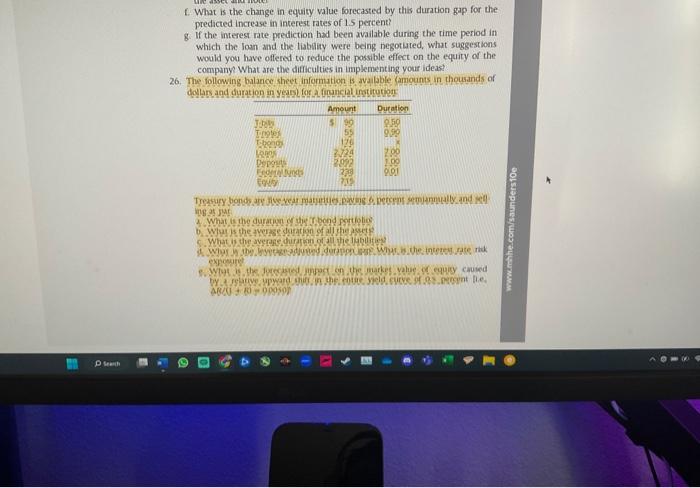

1. What is the change in equity value forecasted by this duration gap for the predicted increase in interest rates of 15 percent? g. If the interest rate prediction had been available during the rime period in which the Ioan and the liabaity were being negotated, what suggestions would you have offered to reduce the possible effect on the equity or the company What are the dificulties in implementing your ideast 26. The following balance sheet information is avalable famounts in thousands of dolars and duration in years for a conucial instirutions meg of jut 4. What is tee duratem qu uive Tbond pertiolie e. Whth of the jureared ypose of the markst value of equigy cquicd AQed + ko oposp f. If the yield curve shifts downward 0.25 percent [ie, R/(1+R)=0.0025 ]. what is the forecasted impact on the market value of equity? g. What variables are available to the financial institution to immunize the balance sheet? How much would each variable need to change to get DGAP to equal o? 27. Refer again to the financial institurions in problem 26. a. What is the change in whe value of the firm's assets for a relative upward shift in the encire yield curve of 0.5 percent? b. What is the change in the value of the firm's liabilities for a relative upward shift in the encire yield curve of 0.4 percent? c. What is the resulting change in the value of equity for the firm? 28. Assume that a goal of the regulatory agencies of financial institutions is to immunize the ratio of equity to total assets, that is,(E/A)=0. Explain how this goal changes the desired duration gap for the institution. Why does this differ from the duration gap necessary to immunize the total equity? How would your answers to part (h) in problem 24 and part (g) in problem 26 change if immunizing equity to total assets was the goal? 29. Identify and discuss three criticisms of using the duration gap model to immunize the portfolio of a financial institution. 30. In general, what changes have occurred in the financial markets that would allow financial institutions to restructure their balance sheets more rapidly and efficiently to meet desired goals? Why is it critical for an FI manager who has a portfolio immunized to match a desired investment horizon to rebalance the portfolio periodically? What is convexity? Why is convexity a desirable feature to capture in a portfolio of assets? 31. A financial institution has an investment horizon of two years 9.33 months (or 2.777 years). The institution has converted all assets into a portfolio of 8 percent, $1,000 three-year bonds that are trading at a yleld to maturity of 10 percent. The bonds pay interest annually. The portfolio manager believes that the assets are immunized against interest rate changes: a. Is the portfolio immunized at the time of the bond purchase What is the duration of the bonds? 1. What is the change in equity value forecasted by this duration gap for the predicted increase in interest rates of 15 percent? g. If the interest rate prediction had been available during the rime period in which the Ioan and the liabaity were being negotated, what suggestions would you have offered to reduce the possible effect on the equity or the company What are the dificulties in implementing your ideast 26. The following balance sheet information is avalable famounts in thousands of dolars and duration in years for a conucial instirutions meg of jut 4. What is tee duratem qu uive Tbond pertiolie e. Whth of the jureared ypose of the markst value of equigy cquicd AQed + ko oposp f. If the yield curve shifts downward 0.25 percent [ie, R/(1+R)=0.0025 ]. what is the forecasted impact on the market value of equity? g. What variables are available to the financial institution to immunize the balance sheet? How much would each variable need to change to get DGAP to equal o? 27. Refer again to the financial institurions in problem 26. a. What is the change in whe value of the firm's assets for a relative upward shift in the encire yield curve of 0.5 percent? b. What is the change in the value of the firm's liabilities for a relative upward shift in the encire yield curve of 0.4 percent? c. What is the resulting change in the value of equity for the firm? 28. Assume that a goal of the regulatory agencies of financial institutions is to immunize the ratio of equity to total assets, that is,(E/A)=0. Explain how this goal changes the desired duration gap for the institution. Why does this differ from the duration gap necessary to immunize the total equity? How would your answers to part (h) in problem 24 and part (g) in problem 26 change if immunizing equity to total assets was the goal? 29. Identify and discuss three criticisms of using the duration gap model to immunize the portfolio of a financial institution. 30. In general, what changes have occurred in the financial markets that would allow financial institutions to restructure their balance sheets more rapidly and efficiently to meet desired goals? Why is it critical for an FI manager who has a portfolio immunized to match a desired investment horizon to rebalance the portfolio periodically? What is convexity? Why is convexity a desirable feature to capture in a portfolio of assets? 31. A financial institution has an investment horizon of two years 9.33 months (or 2.777 years). The institution has converted all assets into a portfolio of 8 percent, $1,000 three-year bonds that are trading at a yleld to maturity of 10 percent. The bonds pay interest annually. The portfolio manager believes that the assets are immunized against interest rate changes: a. Is the portfolio immunized at the time of the bond purchase What is the duration of the bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started