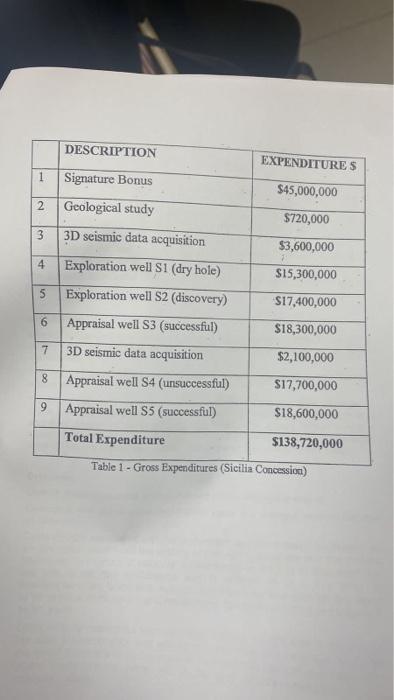

All such carried costs are subject to technical, commercial and management review at least once a year to confirm the continued intent to develop or otherwise extract value from the discovery. When this is no longer the case, the costs are written off. When proved reserves of oll and natural gas are determined and development is approved by management, the relevant expenditure is transferred to property, plant and equipment. Noflow: Exploration expenditure, including licence acquisition costs, is capitalised as an intangible asset when incurred and certain expenditure, such as geological and geophysical exploration costs, is expensed. Unsuccessful exploration and appraisal wells are expensed. A review of each licence or fieid is carried out; at least annually, to ascertain whether commercial reserves have been discovered. Ucence acquisition expenditures are recognised at cost less amortisation. They are mortised on a straight-line basis over the term of the related contracts or concession. When proved reserves are determined, the relevant expenditure, incloding any remaining licence acquisition costs, is transferred to property, plant and equipment. Required: In Table 1 below you will find the gros5 expenditures for the concession in its first accounting period. At the end of the period, no decision had been made as to commerciality of the discovery. For each of the three companies, calculate how much would have been initially capitalised, how much written off in the period and the total charged to expense at the end of the period. \begin{tabular}{|l|l|c|} \hline & DESCRIPTION & EXPENDITURE S \\ \hline 1 & Signature Bonus & $45,000,000 \\ \hline 2 & Geological study & $720,000 \\ \hline 3 & 3D seismic data acquisition & $3,600,000 \\ \hline 4 & Exploration well S1 (dry hole) & $15,300,000 \\ \hline 5 & Exploration well S2 (discovery) & $17,400,000 \\ \hline 6 & Appraisal well S3 (successful) & $18,300,000 \\ \hline 7 & 3D seismic data acquisition & $2,100,000 \\ \hline 8 & Appraisal well S4 (unsuccessful) & $17,700,000 \\ \hline 9 & Appraisal well S5 (successful) & $18,600,000 \\ \hline & Total Expenditure & $138,720,000 \\ \hline \end{tabular} Table 1 - Gross Expenditures (Sieilia Concession) ACCT 530: Specialized Accounting In-class Assianment \#1 The companies, Quickfiow, Dripflow and Noflow are partners in the sicilia concession and have one-third of the equity each, le. cach has a 33.333% share. The Sicilia concessilon is for an initiat 3 vear period at the end of which the partners have to relinquish a minimum of 50% of the licence area, but all of the licence can be relinquithed if the partners consider the licence area to have no further prospectivity. All of the three companies follow the successful efforts method of accounting for pre-development expenditures. The specinc successful efforts policles applied by each company are as follows: Quickfiow: All exploration and evaluation costs are initially capitalised within intangible assets until the success or otherwise of the well or prospect has been. established. The costs of unsuccessful exploration wells are written off to the income statement. If commercial reserves are established and a final investment decision is taken then the relevant cost is transferred from intangible exploration and appraisal assets to development and production assets within tangible assets. Expenditures incurred after the commerciality of the fleld has been established are capitalised within development and production assets. Dripflow: Licence acquisition costs are capitalised within intangible assets. Geological and geophysical exploration costs are charged against income as incurred. Costs directly associated with an exploration well are initially capitalized as an intangible asset until the drilling of the well is complete and the results have been evaluated. If potentially commercial quantities of hydrocarbons are not found, the expioration well is written off as a dry hole. If hydrocarbons are found and, subject to further appraisal activity, are likely to be capable of commercial development, the costs continue to be carried as an asset. Costs directly associated with appraisal activity, undertaken to determine he size, characteristics and commercial potential of a reservoir following he initial discovery of hydrocarbons, Including the costs of appraisal wells there hydrocarbons were not found, are initially capitallzed as an atangible asset