Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the info is given plz help out 3. The cost to banks of accidentally being caught short of reserves is equal to the rate

all the info is given plz help out

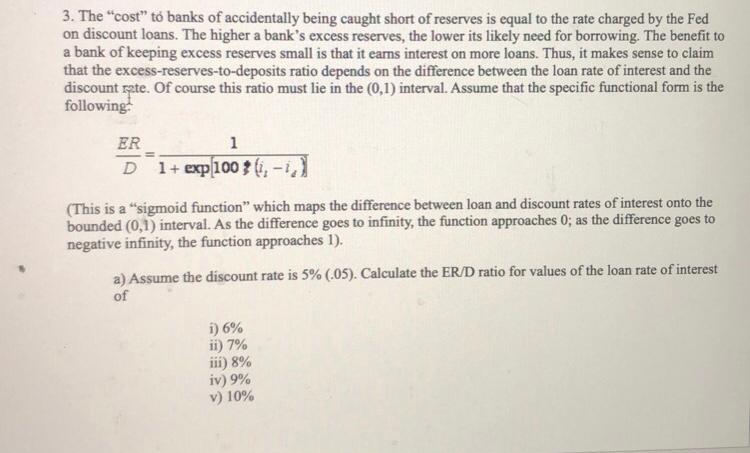

3. The "cost" to banks of accidentally being caught short of reserves is equal to the rate charged by the Fed on discount loans. The higher a bank's excess reserves, the lower its likely need for borrowing. The benefit to a bank of keeping excess reserves small is that it eams interest on more loans. Thus, it makes sense to claim that the excess-reserves-to-deposits ratio depends on the difference between the loan rate of interest and the discount rate. Of course this ratio must lie in the (0,1) interval. Assume that the specific functional form is the following! ER 1 D 1+ exp 100 li,-) (This is a "sigmoid function which maps the difference between loan and discount rates of interest onto the bounded (0,1) interval. As the difference goes to infinity, the function approaches 0; as the difference goes to negative infinity, the function approaches 1). a) Assume the discount rate is 5% (.05). Calculate the ER/D ratio for values of the loan rate of interest of i) 6% ii) 7% iii) 8% iv) 9% v) 10% 3. The "cost" to banks of accidentally being caught short of reserves is equal to the rate charged by the Fed on discount loans. The higher a bank's excess reserves, the lower its likely need for borrowing. The benefit to a bank of keeping excess reserves small is that it eams interest on more loans. Thus, it makes sense to claim that the excess-reserves-to-deposits ratio depends on the difference between the loan rate of interest and the discount rate. Of course this ratio must lie in the (0,1) interval. Assume that the specific functional form is the following! ER 1 D 1+ exp 100 li,-) (This is a "sigmoid function which maps the difference between loan and discount rates of interest onto the bounded (0,1) interval. As the difference goes to infinity, the function approaches 0; as the difference goes to negative infinity, the function approaches 1). a) Assume the discount rate is 5% (.05). Calculate the ER/D ratio for values of the loan rate of interest of i) 6% ii) 7% iii) 8% iv) 9% v) 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started