Question: All the information is given but one can use an additional provincial financial report online for guidelines as well to assist in deliberation. After a

All the information is given but one can use an additional provincial financial report online for guidelines as well to assist in deliberation.

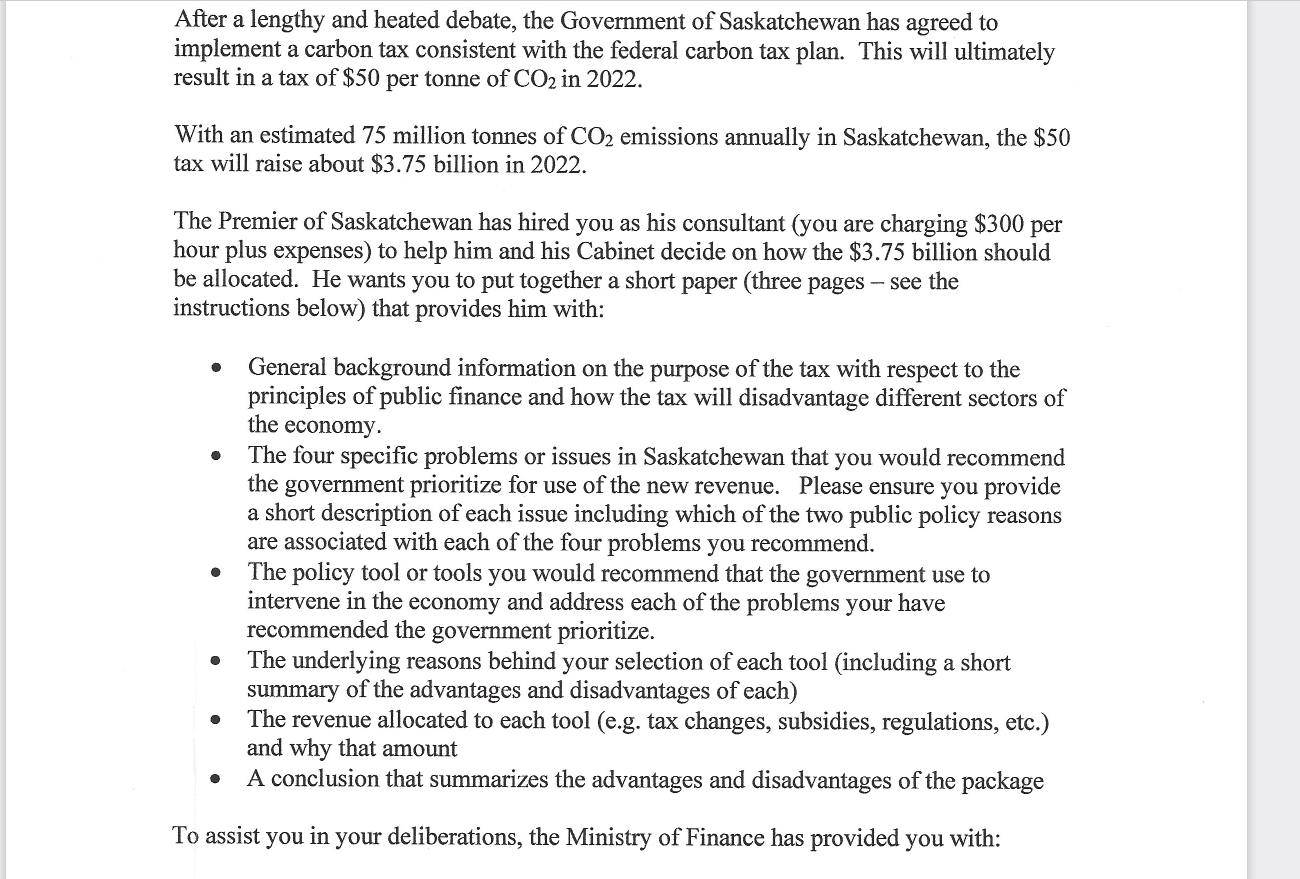

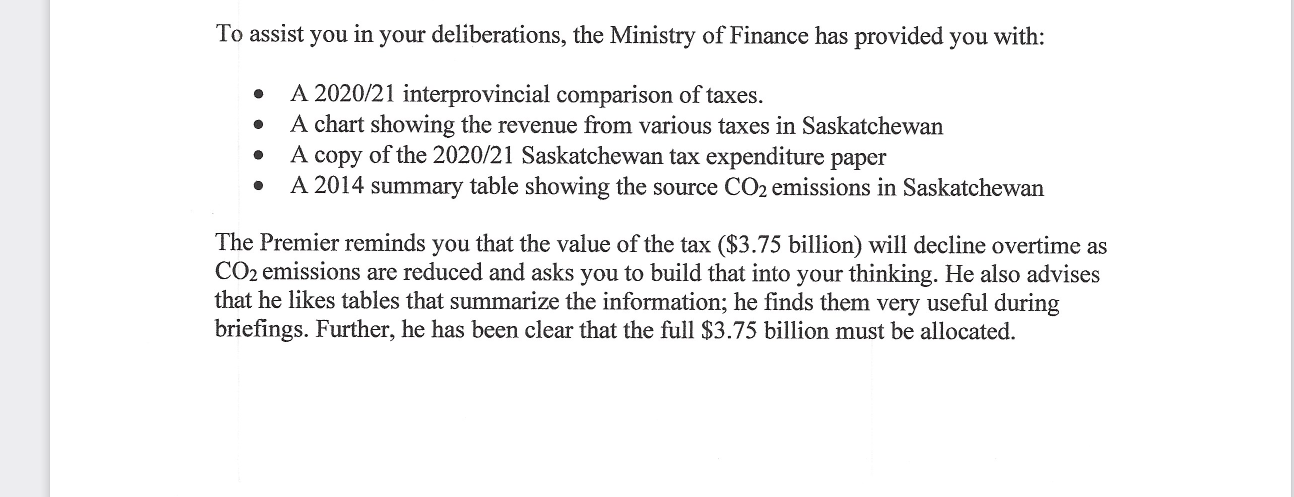

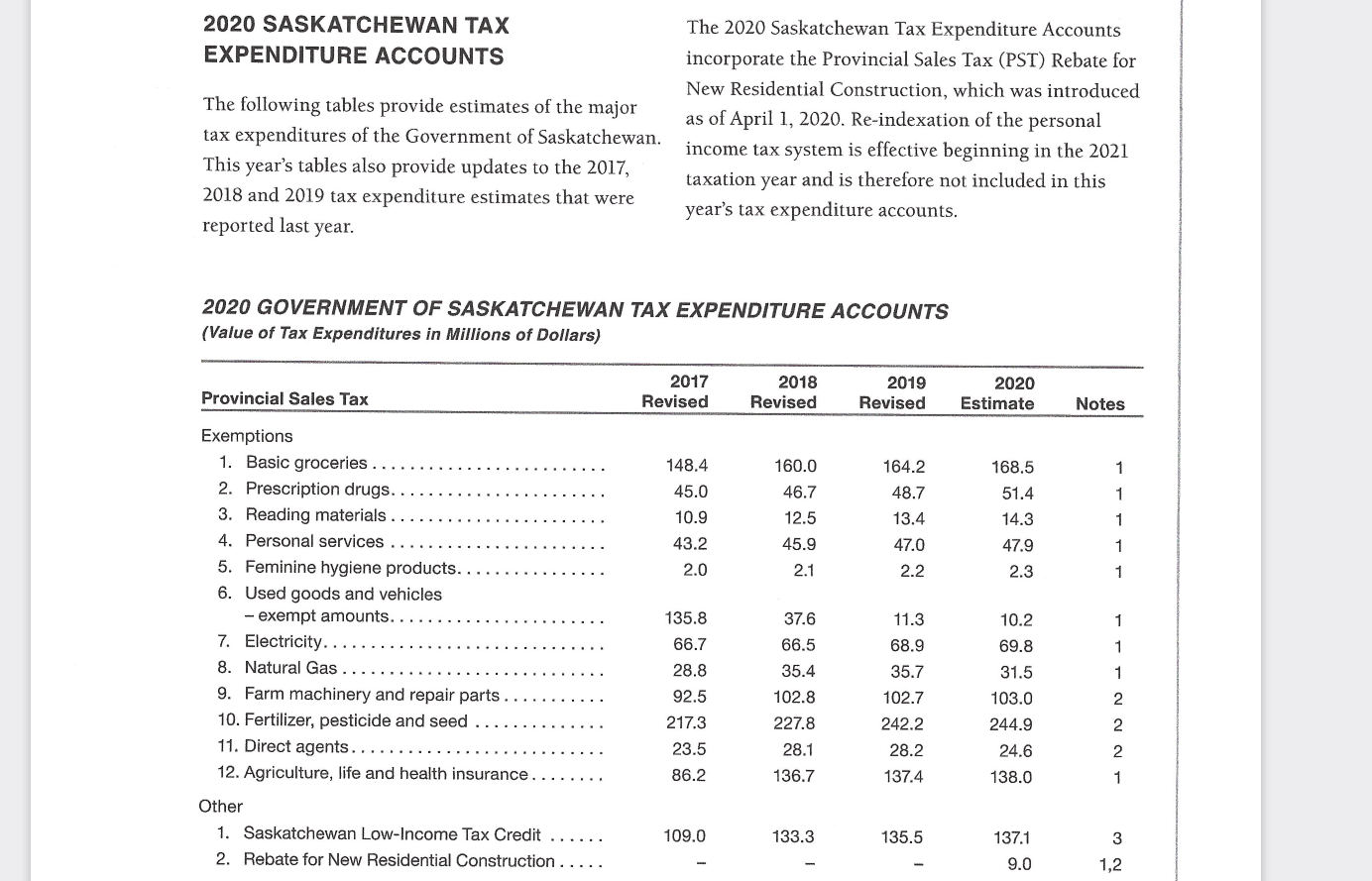

After a lengthy and heated debate, the Government of Saskatchewan has agreed to implement a carbon tax consistent with the federal carbon tax plan. This will ultimately result in a tax of $50 per tonne of CO2 in 2022. With an estimated 75 million tonnes of CO2 emissions annually in Saskatchewan, the $50 tax will raise about $3.75 billion in 2022. The Premier of Saskatchewan has hired you as his consultant (you are charging $300 per hour plus expenses) to help him and his Cabinet decide on how the $3.75 billion should be allocated. He wants you to put together a short paper (three pages - see the instructions below) that provides him with: General background information on the purpose of the tax with respect to the principles of public finance and how the tax will disadvantage different sectors of the economy. The four specific problems or issues in Saskatchewan that you would recommend the government prioritize for use of the new revenue. Please ensure you provide a short description of each issue including which of the two public policy reasons are associated with each of the four problems you recommend. The policy tool or tools you would recommend that the government use to intervene in the economy and address each of the problems your have recommended the government prioritize. The underlying reasons behind your selection of each tool (including a short summary of the advantages and disadvantages of each) The revenue allocated to each tool (e.g. tax changes, subsidies, regulations, etc.) and why that amount A conclusion that summarizes the advantages and disadvantages of the package . To assist you in your deliberations, the Ministry of Finance has provided you with: To assist you in your deliberations, the Ministry of Finance has provided you with: . A 2020/21 interprovincial comparison of taxes. A chart showing the revenue from various taxes in Saskatchewan A copy of the 2020/21 Saskatchewan tax expenditure paper A 2014 summary table showing the source CO2 emissions in Saskatchewan . The Premier reminds you that the value of the tax ($3.75 billion) will decline overtime as CO2 emissions are reduced and asks you to build that into your thinking. He also advises that he likes tables that summarize the information; he finds them very useful during briefings. Further, he has been clear that the full $3.75 billion must be allocated. 2020 SASKATCHEWAN TAX EXPENDITURE ACCOUNTS The following tables provide estimates of the major tax expenditures of the Government of Saskatchewan. This year's tables also provide updates to the 2017, 2018 and 2019 tax expenditure estimates that were reported last year. The 2020 Saskatchewan Tax Expenditure Accounts incorporate the Provincial Sales Tax (PST) Rebate for New Residential Construction, which was introduced as of April 1, 2020. Re-indexation of the personal income tax system is effective beginning in the 2021 taxation year and is therefore not included in this year's tax expenditure accounts. 2020 GOVERNMENT OF SASKATCHEWAN TAX EXPENDITURE ACCOUNTS (Value of Tax Expenditures in Millions of Dollars) Provincial Sales Tax 2017 Revised 2018 Revised 2019 Revised 2020 Estimate Notes 1 148.4 45.0 1 160.0 46.7 12.5 45.9 2.1 164.2 48.7 13.4 47.0 10.9 168.5 51.4 14.3 47.9 2.3 1 43.2 1 2.0 2.2 1 Exemptions 1. Basic groceries 2. Prescription drugs. 3. Reading materials. 4. Personal services 5. Feminine hygiene products. 6. Used goods and vehicles -exempt amounts. 7. Electricity. 8. Natural Gas 9. Farm machinery and repair parts 10. Fertilizer, pesticide and seed 11. Direct agents.. 12. Agriculture, life and health insurance. Other 1. Saskatchewan Low-Income Tax Credit 2. Rebate for New Residential Construction ..... 11.3 68.9 35.7 37.6 66.5 35.4 102.8 227.8 10.2 69.8 31.5 1 1 135.8 66.7 28.8 92.5 217.3 23.5 1 2 2 102.7 242.2 28.2 137.4 103.0 244.9 24.6 138.0 28.1 2 86.2 136.7 1 109.0 133.3 135.5 137.1 9.0 3 1,2 GOVERNMENT OF SASKATCHEWAN Schedule of Revenue For the Year Ended March 31 (Millions of Dollars) Budget 2019-20 Forecast 2018-19 Budget 2018-19 729.2 568.7 2,555.7 768.0 2,304.7 234.5 427.7 7,588.5 613.5 563.1 2,343.0 759.5 2,230.0 239.3 421.5 7,169.9 621.1 546.1 2,441.2 759.3 2,155.0 260.3 431.9 7,214.9 Own-Source Taxation Corporation income Fuel..... Individual income.. Property Provincial sales.. Tobacco Other... Total Taxation Non-Renewable Resources Crown land sales Oil and natural gas Potash Resource surcharge Other. Total Non-Renewable Resources Net Income from Government Business Enterprises Municipal Financing Corporation of Saskatchewan Saskatchewan Auto Fund....... Saskatchewan Gaming Corporation...... Saskatchewan Government Insurance Saskatchewan Liquor and Gaming Authority Saskatchewan Power Corporation. 63.9 46.6 691.1 618.6 385.0 85.5 1,826.8 57.5 693.0 501.6 383.3 70.2 1,705.6 700.1 308.0 317.3 92.8 1,482.1 1.0 66.9 21.8 59.1 477.9 255.2 0.9 16.3 21.6 49.8 487.2 208.7 0.8 118.0 23.0 60.7 481.4 176.7 After a lengthy and heated debate, the Government of Saskatchewan has agreed to implement a carbon tax consistent with the federal carbon tax plan. This will ultimately result in a tax of $50 per tonne of CO2 in 2022. With an estimated 75 million tonnes of CO2 emissions annually in Saskatchewan, the $50 tax will raise about $3.75 billion in 2022. The Premier of Saskatchewan has hired you as his consultant (you are charging $300 per hour plus expenses) to help him and his Cabinet decide on how the $3.75 billion should be allocated. He wants you to put together a short paper (three pages - see the instructions below) that provides him with: General background information on the purpose of the tax with respect to the principles of public finance and how the tax will disadvantage different sectors of the economy. The four specific problems or issues in Saskatchewan that you would recommend the government prioritize for use of the new revenue. Please ensure you provide a short description of each issue including which of the two public policy reasons are associated with each of the four problems you recommend. The policy tool or tools you would recommend that the government use to intervene in the economy and address each of the problems your have recommended the government prioritize. The underlying reasons behind your selection of each tool (including a short summary of the advantages and disadvantages of each) The revenue allocated to each tool (e.g. tax changes, subsidies, regulations, etc.) and why that amount A conclusion that summarizes the advantages and disadvantages of the package . To assist you in your deliberations, the Ministry of Finance has provided you with: To assist you in your deliberations, the Ministry of Finance has provided you with: . A 2020/21 interprovincial comparison of taxes. A chart showing the revenue from various taxes in Saskatchewan A copy of the 2020/21 Saskatchewan tax expenditure paper A 2014 summary table showing the source CO2 emissions in Saskatchewan . The Premier reminds you that the value of the tax ($3.75 billion) will decline overtime as CO2 emissions are reduced and asks you to build that into your thinking. He also advises that he likes tables that summarize the information; he finds them very useful during briefings. Further, he has been clear that the full $3.75 billion must be allocated. 2020 SASKATCHEWAN TAX EXPENDITURE ACCOUNTS The following tables provide estimates of the major tax expenditures of the Government of Saskatchewan. This year's tables also provide updates to the 2017, 2018 and 2019 tax expenditure estimates that were reported last year. The 2020 Saskatchewan Tax Expenditure Accounts incorporate the Provincial Sales Tax (PST) Rebate for New Residential Construction, which was introduced as of April 1, 2020. Re-indexation of the personal income tax system is effective beginning in the 2021 taxation year and is therefore not included in this year's tax expenditure accounts. 2020 GOVERNMENT OF SASKATCHEWAN TAX EXPENDITURE ACCOUNTS (Value of Tax Expenditures in Millions of Dollars) Provincial Sales Tax 2017 Revised 2018 Revised 2019 Revised 2020 Estimate Notes 1 148.4 45.0 1 160.0 46.7 12.5 45.9 2.1 164.2 48.7 13.4 47.0 10.9 168.5 51.4 14.3 47.9 2.3 1 43.2 1 2.0 2.2 1 Exemptions 1. Basic groceries 2. Prescription drugs. 3. Reading materials. 4. Personal services 5. Feminine hygiene products. 6. Used goods and vehicles -exempt amounts. 7. Electricity. 8. Natural Gas 9. Farm machinery and repair parts 10. Fertilizer, pesticide and seed 11. Direct agents.. 12. Agriculture, life and health insurance. Other 1. Saskatchewan Low-Income Tax Credit 2. Rebate for New Residential Construction ..... 11.3 68.9 35.7 37.6 66.5 35.4 102.8 227.8 10.2 69.8 31.5 1 1 135.8 66.7 28.8 92.5 217.3 23.5 1 2 2 102.7 242.2 28.2 137.4 103.0 244.9 24.6 138.0 28.1 2 86.2 136.7 1 109.0 133.3 135.5 137.1 9.0 3 1,2 GOVERNMENT OF SASKATCHEWAN Schedule of Revenue For the Year Ended March 31 (Millions of Dollars) Budget 2019-20 Forecast 2018-19 Budget 2018-19 729.2 568.7 2,555.7 768.0 2,304.7 234.5 427.7 7,588.5 613.5 563.1 2,343.0 759.5 2,230.0 239.3 421.5 7,169.9 621.1 546.1 2,441.2 759.3 2,155.0 260.3 431.9 7,214.9 Own-Source Taxation Corporation income Fuel..... Individual income.. Property Provincial sales.. Tobacco Other... Total Taxation Non-Renewable Resources Crown land sales Oil and natural gas Potash Resource surcharge Other. Total Non-Renewable Resources Net Income from Government Business Enterprises Municipal Financing Corporation of Saskatchewan Saskatchewan Auto Fund....... Saskatchewan Gaming Corporation...... Saskatchewan Government Insurance Saskatchewan Liquor and Gaming Authority Saskatchewan Power Corporation. 63.9 46.6 691.1 618.6 385.0 85.5 1,826.8 57.5 693.0 501.6 383.3 70.2 1,705.6 700.1 308.0 317.3 92.8 1,482.1 1.0 66.9 21.8 59.1 477.9 255.2 0.9 16.3 21.6 49.8 487.2 208.7 0.8 118.0 23.0 60.7 481.4 176.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts