Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alr Spares is a wholesaler that stocks engine components and test equipment for the commercial aircraft industry. A new customer has placed an order for

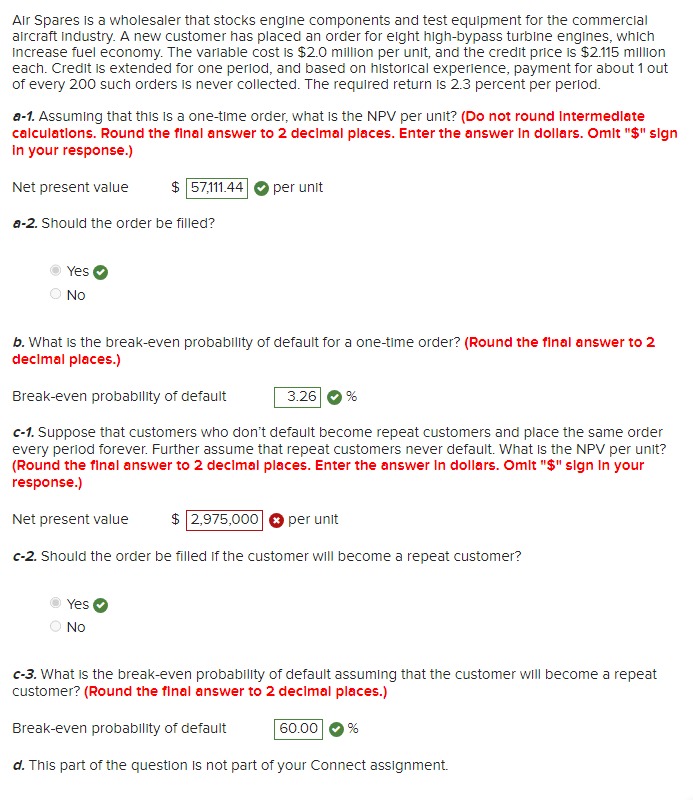

Alr Spares is a wholesaler that stocks engine components and test equipment for the commercial aircraft industry. A new customer has placed an order for eight high-bypass turbine engines, which increase fuel economy. The variable cost is $2.0 million per unit, and the credit price is $2.115 million each. Credit is extended for one perlod, and based on historical experience, payment for about 1 out of every 200 such orders is never collected. The required return is 2.3 percent per period. a-1. Assuming that this is a one-time order, what is the NPV per unit? (Do not round Intermedlate calculations. Round the final answer to 2 decimal places. Enter the answer In dollars. Omit "\$" sign In your response.) Net present value $ per unit a-2. Should the order be filled? Yes No b. What is the break-even probability of default for a one-time order? (Round the flinal answer to 2 decimal places.) Break-even probability of default % c-1. Suppose that customers who don't default become repeat customers and place the same order every period forever. Further assume that repeat customers never default. What is the NPV per unit? (Round the final answer to 2 decimal places. Enter the answer In dollars. Omlt "\$" sign In your response.) Net present value $ per unit c-2. Should the order be filled If the customer will become a repeat customer? Yes No c-3. What is the break-even probability of default assuming that the customer will become a repeat customer? (Round the final answer to 2 decimal places.) Break-even probability of default % d. This part of the question is not part of your Connect assignment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started