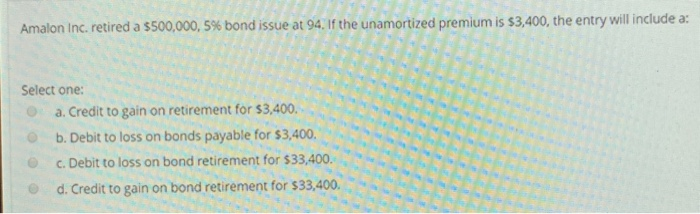

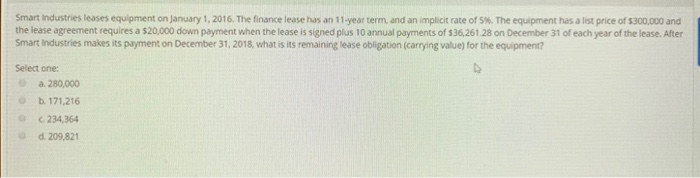

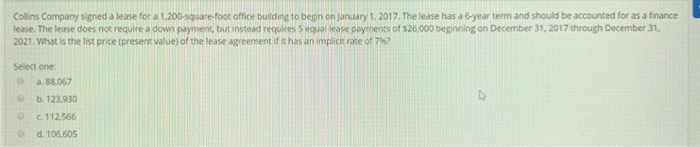

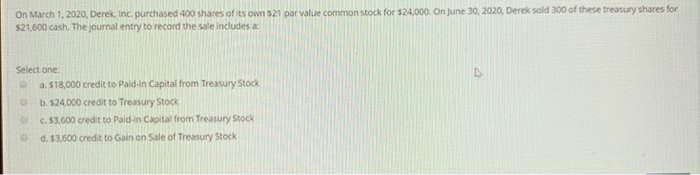

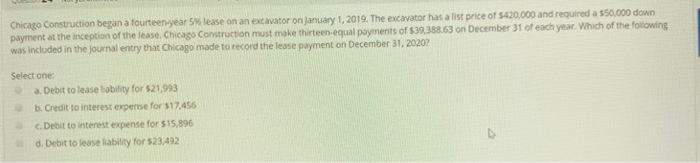

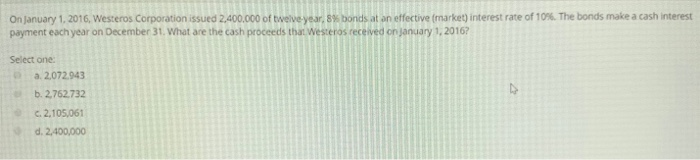

Amalon Inc. retired a $500,000, 5% bond issue at 94. If the unamortized premium is $3,400, the entry will include a: S A Select one: a. Credit to gain on retirement for $3,400. b. Debit to loss on bonds payable for $3,400. c. Debit to loss on bond retirement for $33,400. d. Credit to gain on bond retirement for $33,400. Smart Industries teases equipment on January 1, 2016. The finance lease has an 11-year term and an implicit rate of 5%. The equipment has a list price of 5300,000 and the lease agreement requires a $20,000 down payment when the lease is signed plus 10 annual payments of $36,261.28 on December 31 of each year of the lease. After Smart Industries makes its payment on December 31, 2018, what is its remaining lease obligation (carrying value) for the equipment? Select one: a. 280,000 b. 171,216 c234 364 d. 209.821 Collins Company signed a lease for a 1,200-square foot office building to begin on January 1, 2017. The lease has a 6-year term and should be accounted for as a finance lease. The lease does not require a down payment, but instead requires 5 equal lease payments of $26.000 beginning on December 31, 2017 through December 31 2021. What is the list price (present value of the lease agreement if it has an implicit rate of 792 Select one a R067 5 122.930 C112.566 d. 106,605 On March 1, 2020, Derek, Inc. purchased 400 shares of its own $21 par value common stock for $24,000. On June 30, 2020, Derek sold 300 of these treasury shares for $21,600 cash. The journal entry to record the sale includes a Select one: 4.518,000 credit to Pald.in Capital from Treasury Stock b. 524,000 credit to Treasury Stock C. 53,600 credit to Paid-in Capital from Treasury Stock 0.53,600 credit to Gain on Sale of Treasury Stock Chicago Construction began a fourteen-year 5% lease on an excavator on January 1, 2019. The excavator has a list price of $420,000 and required a 550.000 down payment at the inception of the lease Chicago Construction must make thirteen-equal payments of $39,388,63 on December 31 of each year. Which of the following was included in the journal entry that Chicago made to record the lease payment on December 31, 2020? Select one: a. Debit to lease ability for $21.993 b. Credit to interest expense for 517,456 c. Debit to interest expense for $15,896 d. Debit to lease liability for $23,492 On January 1, 2016, Westeros Corporation issued 2,400,000 of twelve-year, 8% bonds at an effective market) interest rate of 10%. The bonds make a cash interest payment each year on December 31. What are the cash proceeds that Westeros received on January 1, 2016? Select one: a 2,072.943 b. 2.762.732 c.2,105,061 d. 2,400,000