Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amber's employer, Lavender, Inc., has a 401( $99,000, and her marginal tax rate is 25% k) plan that permits salary deferral elections by its employees.

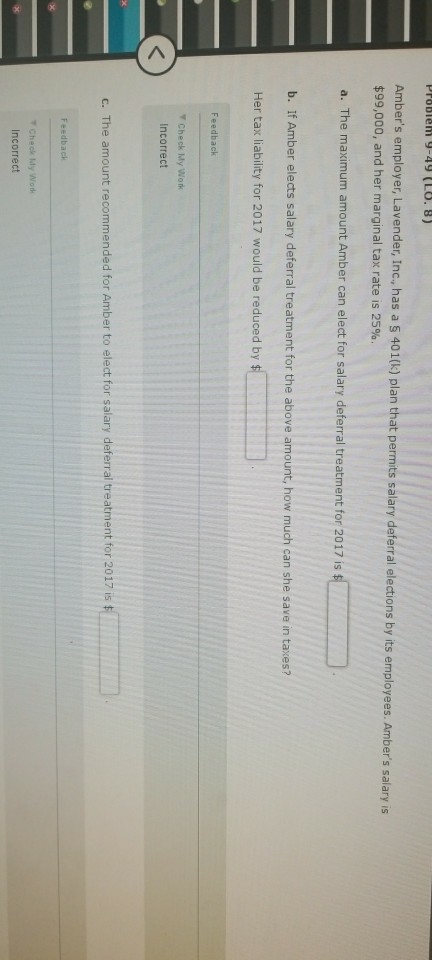

Amber's employer, Lavender, Inc., has a 401( $99,000, and her marginal tax rate is 25% k) plan that permits salary deferral elections by its employees. Amber's salary is a. The maximum amount Amber can elect for salary deferral treatment for 2017 is b. If Amber elects salary deferral treatment for the above amount, how much can she save in taxes? Her tax liability for 2017 would be reduced by Check My Work Incorrect c. The amount recommended for Amber to elect for salary deferral treatment for 2017 i5 Feedback Incorrect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started