Answered step by step

Verified Expert Solution

Question

1 Approved Answer

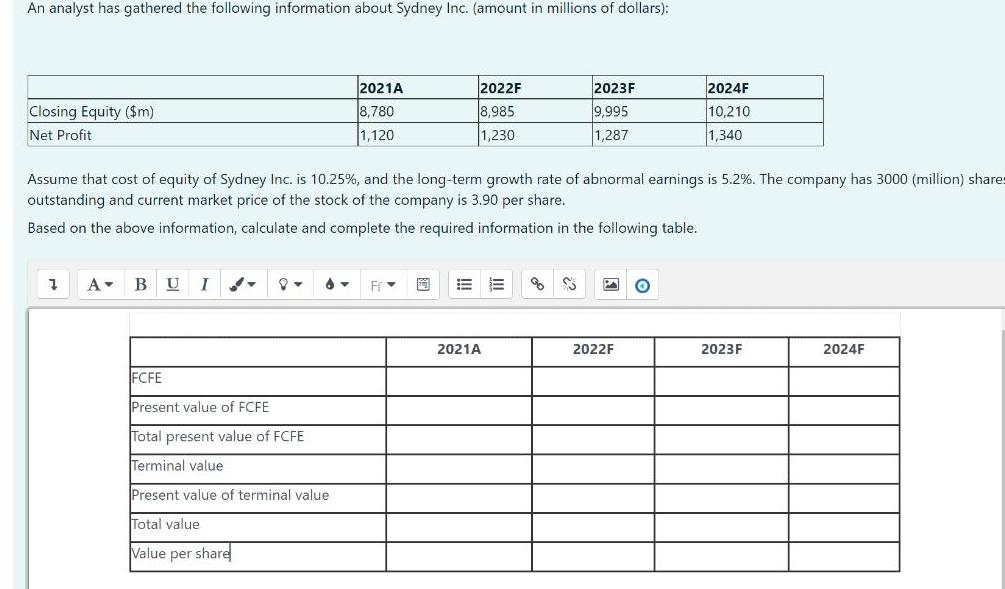

An analyst has gathered the following information about Sydney Inc. (amount in millions of dollars): Closing Equity ($m) Net Profit 1 A B U

An analyst has gathered the following information about Sydney Inc. (amount in millions of dollars): Closing Equity ($m) Net Profit 1 A B U I 2021A 8,780 1,120 FCFE Present value of FCFE Total present value of FCFE Terminal value Present value of terminal value Total value Value per share Assume that cost of equity of Sydney Inc. is 10.25%, and the long-term growth rate of abnormal earnings is 5.2%. The company has 3000 (million) shares outstanding and current market price of the stock of the company is 3.90 per share. Based on the above information, calculate and complete the required information in the following table. F 2022F 8,985 1,230 i 2021A 2023F 9,995 1,287 % 85 2022F 2024F 10,210 1,340 O 2023F 2024F

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANS W ER 2021 A 2022 F 20 23 F 2024 F FC FE 1 220 1 330 1 387 1 440 Present value of FC FE 1 102 1 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started