Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the owner of the President Theater. It is also your full time job, for which you draw a salary to live on.

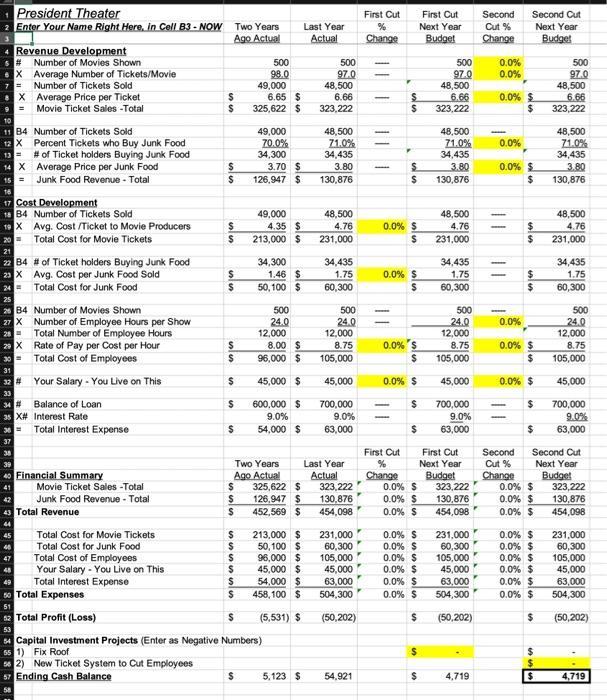

You are the owner of the President Theater. It is also your full time job, for which you draw a salary to live on. Two years ago, the President Theater had a small loss. Last year, facing a much larger loss, you went to the Bank and borrowed an additional $100,000. The Bank, however, has said that the current amount is the maximum that your business can borrow. The business now needs to put together a Business Plan or Budget for the coming year. If you run out of cash, you will go out of business, lose the theater, and your job. Good Luck. Prepare a completing the Yellow Areas on "Budget Questions and Answers" and on "Budget Financial Forecast" There are three parts to this assignment 1) Explain some of the Computations IN YOUR OWN WORDS. 2) First Cut Budget-Based on what you think will happen to your costs and 3) The Second Cut Budget are changes that you can make to stay in business and keep the Theater open for another year. 4) What You might Change in a Third Cut Budget Success will be a Positive Cash Balance at the End of the Final Budget. If you have Cash Left (and Explained Why), you win. 2 Follow the instructions IN ORDER on "Budget Questions and Answers" Only Only Only Enter in Yellow Colored Cells, Like B3 You may work together on this, however, every student should do their OWN file. President Theater 2 Enter Your Name Right Here, in Cell B3-NOW X 7 = Revenue Development # Number of Movies Shown X 9= 11 B4 Number of Tickets Sold 12 X Percent Tickets who Buy Junk Food 13= # of Ticket holders Buying Junk Food 14 X Average Price per Junk Food 15 = Junk Food Revenue - Total 17 Cost Development 18 B4 Number of Tickets Sold 19 X Avg. Cost /Ticket to Movie Producers 20 Total Cost for Movie Tickets 21 22 B4 # of Ticket holders Buying Junk Food 23 X Avg. Cost per Junk Food Sold 24 Total Cost for Junk Food 29 X 30 = Average Number of Tickets/Movie Number of Tickets Sold 25 26 B4 Number of Movies Shown 27 X Number of Employee Hours per Show 28 Total Number of Employee Hours 31 32 # Average Price per Ticket Movie Ticket Sales -Total 33 34 # 35 X# RE 45 46 47 36 = Total Interest Expense 37 Rate of Pay per Cost per Hour Total Cost of Employees Your Salary - You Live on This Balance of Loan Interest Rate Financial Summary Movie Ticket Sales -Total Junk Food Revenue - Total 43 Total Revenue Total Cost for Movie Tickets Total Cost for Junk Food Total Cost of Employees Your Salary - You Live on This Total Interest Expense 50 Total Expenses 51 52 Total Profit (Loss) Two Years Ago Actual $ $ $ $ $ 55 $ $ $ $ $ $ $ $ $ $ $ $ $ 500 98.0 49,000 $ 6.65 $ 325,622 $ 49,000 70.0% 34,300 3.70 $ 126,947 $ 49,000 4.35 $ 213,000 $ Two Years Ago Actual 34,300 1.46 $ 50,100 $ 500 24.0 12,000 8.00 $ 96,000 $ 45,000 $ 600,000 $ 9.0% 54,000 $ 53 54 Capital Investment Projects (Enter as Negative Numbers) 55 1) Fix Roof 56 2) New Ticket System to Cut Employees 57 Ending Cash Balance 58 325,622 $ 126,947 $ 452,569 $ 213,000 $ 50,100 $ 96,000 $ 45,000 $ 54,000 $ 458,100 $ (5,531) $ 5,123 S Last Year Actual 500 97.0 48,500 6.66 323,222 48,500 71.0% 34,435 3.80 130,876 48,500 4.76 231,000 34,435 1.75 60,300 500 24.0 12,000 8.75 105,000 45,000 700,000 9.0% 63,000 Last Year Actual 323,222 130,876 454,098 231,000 60,300 105,000 45,000 63,000 504,300 (50,202) 54,921 First Cut % Change - | | | F $ $ F First Cut % Change $ $ 0.0% $ $ 0.0% $ $ 0.0% S $ 0.0% $ $ $ 0.0% S 0.0% $ 0.0% $ 0.0% S 0.0% S 0.0% $ 0.0% $ 0.0% $ 0.0% $ $ $ First Cut Next Year Budget $ 500 97.0 48,500 6.66 323,222 48,500 71.0% 34,435 3.80 130,876 48,500 4.76 231,000 34,435 1.75 60,300 500 24.0 12,000 8.75 105,000 45,000 700,000 9.0% 63,000 First Cut Next Year Budget 323,222 130,876 454,098 231,000 60,300 105,000 45,000 63,000 504,300 (50,202) 4,719 Second Cut % Change 0.0% 0.0% 0.0% $ $ 0.0% F 0.0% $ $ - Second Cut Next Year Budget 0.0% - $ $ $ $ Second Cut% Change 0.0% $ $ 0.0% $ $ $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ 0.0% $ $ 500 97.0 $ 48,500 6.66 323,222 48,500 71.0% 34,435 3.80 130,876 48,500 4.76 231,000 Second Cut Next Year Budget 34,435 1.75 60,300 500 24.0 12,000 8.75 105,000 45,000 700,000 9.0% 63,000 323,222 130,876 454,098 231,000 60,300 105,000 45,000 63,000 504,300 (50,202) 4,719

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Computations The First Cut Budget is based on the current situation and what is expected to happen i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started